Classmates.com 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

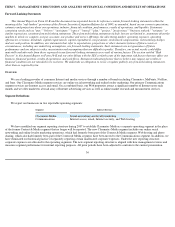

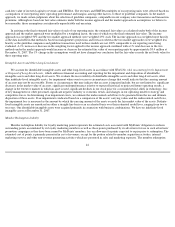

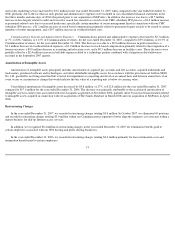

The following table sets forth, for the periods presented, a reconciliation of the changes in the member redemption liability (in thousands):

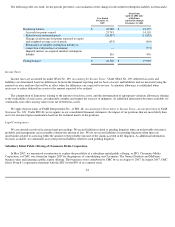

Income Taxes

Income taxes are accounted for under SFAS No. 109, Accounting for Income Taxes . Under SFAS No. 109, deferred tax assets and

liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the

enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when

necessary to reduce deferred tax assets to the amount expected to be realized.

The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating

to the realizability of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, we

continually assess the carrying value of our net deferred tax assets.

We apply the provisions of FASB Interpretation No., or FIN, 48, Accounting for Uncertainty in Income Taxes—an interpretation of FASB

Statement No. 109 . Under FIN 48, we recognize, in our consolidated financial statements, the impact of tax positions that are more likely than

not to be sustained upon examination based on the technical merits of the positions.

Legal Contingencies

We are currently involved in certain legal proceedings. We record liabilities related to pending litigation when an unfavorable outcome is

probable and management can reasonably estimate the amount of loss. We do not record liabilities for pending litigation when there are

uncertainties related to assessing either the amount or the probable outcome of the claims asserted in the litigation. As additional information

becomes available, we continually assess the potential liability related to such pending litigation.

Subsidiary Initial Public Offering of Classmates Media Corporation

In May 2007, we announced our intention to explore the possibility of a subsidiary initial public offering, or IPO. Classmates Media

Corporation, or CMC, was formed in August 2007 for the purposes of consolidating our Classmates, The Names Database and MyPoints

business units and initiating a public equity offering. The businesses were contributed to CMC by us on August 9, 2007. In August 2007, CMC

filed a Form S-1 registration statement with the SEC for the IPO of its common stock.

44

Year Ended

December 31,

2007

Period from

April 10, 2006 (date

of MyPoints

acquisition) through

December 31, 2006

Beginning balance

$

19,989

$

18,497

Accruals for points earned

23,745

14,103

Reduction for redeemed points

(18,857

)

(11,892

)

Changes in allowance for points expected to expire

and weighted

-

average cost of points

(633

)

(404

)

Revaluation of member redemption liability in

connection with purchase accounting

—

(

771

)

Imputed interest on acquired member redemption

liability

316

456

Ending balance

$

24,560

$

19,989