Classmates.com 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

Business Combinations— All of the Company's acquisitions have been accounted for as purchase business combinations. Under the

purchase method of accounting, the costs, including transaction costs, are allocated to the underlying net assets acquired, based on their

respective estimated fair values. The excess of the purchase price over the estimated fair values of the net assets acquired is recorded as

goodwill.

The judgments made in determining the estimated fair value and expected useful lives assigned to each class of assets and liabilities

acquired can significantly impact net income. Consequently, to the extent an indefinite-lived, definite-lived or a longer-lived asset is ascribed

greater value under the purchase method than a shorter-lived asset, there may be less amortization recorded in a given period. Definite-lived

identifiable intangible assets are amortized on either a straight-line basis or an accelerated basis. The Company determines the appropriate

amortization method by performing an analysis of expected cash flows over the estimated useful lives of the assets and matches the amortization

expense to the expected cash flows from those assets.

Determining the fair value of certain assets and liabilities acquired is subjective in nature and often involves the use of significant estimates

and assumptions. Two areas, in particular, that require significant judgment are estimating the fair value and related useful lives of identifiable

intangible assets. To assist in this process, the Company may obtain appraisals from valuation specialists for certain intangible assets. While

there are a number of different methods used in estimating the fair value of acquired intangible assets, there are two approaches primarily used:

the discounted cash flow and market comparison approaches. Some of the more significant estimates and assumptions inherent in the two

approaches include: projected future cash flows (including timing); discount rate reflecting the risk inherent in the future cash flows; terminal

growth rate; subscriber churn; terminal value; determination of appropriate market comparables; and the determination of whether a premium or

a discount should be applied to market comparables. Most of the above assumptions are made based on available historical and market

information.

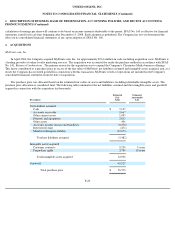

Member Redemption Liability— Member redemption liability for loyalty marketing points represents the estimated costs associated with

MyPoints' obligation to redeem outstanding points accumulated by its loyalty marketing members as well as those points purchased by its

advertisers for use in such advertisers' promotion campaigns as they have been earned by MyPoints' members, less an allowance for points

expected to expire prior to redemption. The estimated cost of points is primarily presented in cost of revenues, except for the portion related to

member acquisition activities, internal marketing surveys and other non-

revenue generating activities which are presented in sales and marketing

expenses. The member redemption liability is recognized when members earn points and is reduced when members redeem accumulated points

upon reaching required redemption thresholds or when points are expired prior to redemption.

MyPoints members may redeem points for third-party gift cards and other rewards. Members earn points when they respond to direct

marketing offers delivered by MyPoints, purchase goods or services from advertisers, engage in certain promotional campaigns of advertisers or

engage in other specified activities.

The member redemption liability is estimated based upon the weighted-average cost and number of points that may be redeemed in the

future. On a monthly basis, the weighted-average cost of points is calculated by taking the total cost of items fulfilled divided by total points

redeemed. The discounts and points needed to redeem vary by merchant and award denomination. MyPoints purchases gift cards and other

awards from merchants at a discount and sets redemption levels for its members. MyPoints

F-12