Classmates.com 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

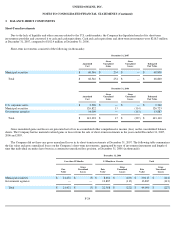

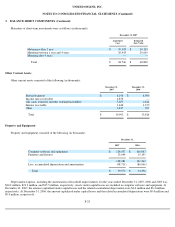

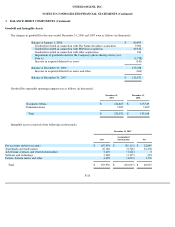

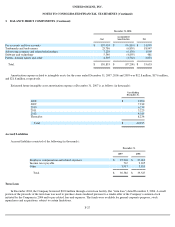

3. BALANCE SHEET COMPONENTS (Continued)

In January 2006, the Company paid, in full, the outstanding balance on the term loan of $54.2 million. Effective upon payment of the

outstanding balance, the term loan terminated and was of no further force or effect. During the quarter ended March 31, 2006, the Company

accelerated and recognized, in the consolidated statements of operations, $1.5 million in deferred financing costs in connection with the early

repayment of the term loan.

4. STOCKHOLDERS' EQUITY

Stockholders' Rights Plan

On November 15, 2001, the Board of Directors declared a dividend of one preferred share purchase right for each outstanding share of the

Company's common stock. The dividend was paid on November 26, 2001 to the stockholders of record at the close of business on that date.

Each right entitles the registered holder to purchase from the Company one unit consisting of one one-

thousandth of a share of its Series A junior

participating preferred stock at a price of $25 per unit. On April 29, 2003, the Board of Directors voted to amend the purchase price per unit from

$25 to $140. The rights generally will be exercisable only if a person or group acquires beneficial ownership of 15% or more of the Company's

common stock or announces a tender or exchange offer which would result in a person or group owning 15% or more of the Company's common

stock. The Company generally will be entitled to redeem the rights at $0.0007 per right at any time until 10 days after a public announcement

that a 15% position in the Company's common stock has been acquired or that a tender or exchange offer which would result in a person or

group owning 15% or more of the Company's common stock has commenced. The rights expire on November 26, 2011.

Preferred Stock

The Company has 5.0 million shares of preferred stock authorized with a par value of $0.0001, of which 300,000 shares are designated as

Series A junior participating preferred stock. At December 31, 2007 and 2006, the Company had no preferred shares issued or outstanding.

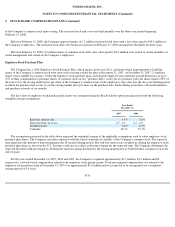

Common Stock Subject to Repurchase Rights

At December 31, 2007 and 2006, there were 350,000 and 475,000 shares of common stock, respectively, that were subject to repurchase

related to unvested shares under restricted stock agreements. The 350,000 restricted shares outstanding at December 31, 2007 vested entirely at

the end of a four-year vesting period in January 2008, at which time approximately 142,000 shares were withheld and employee withholding

taxes of $1.5 million were paid.

Common Stock Repurchases

The Company's Board of Directors authorized a common stock repurchase program (the "program") that allows the Company to repurchase

shares of its common stock through open market or privately negotiated transactions based on prevailing market conditions and other factors

through December 31, 2007. At December 31, 2007, the Company had repurchased $139.2 million of its common stock under the program,

leaving $60.8 million remaining under the program.

Shares withheld upon vesting of restricted stock units to pay applicable employee withholding taxes are considered common stock

repurchases, but are not counted as purchases against the program.

F-28