Classmates.com 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

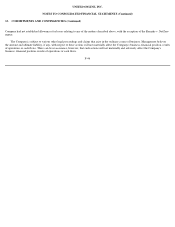

7. INCOME TAXES

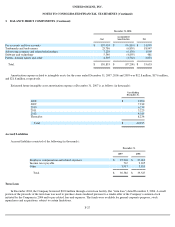

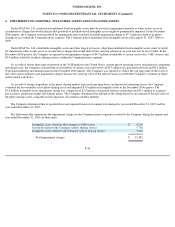

The provision for income taxes for the years ended December 31, 2007, 2006 and 2005 is comprised of the following (in thousands):

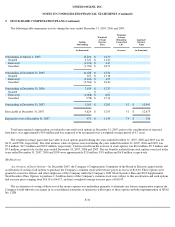

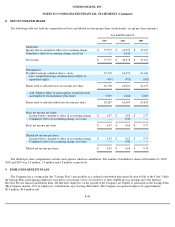

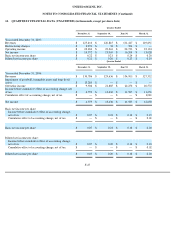

The following is a reconciliation of the statutory federal income tax rate to the Company's effective income tax rate (in thousands):

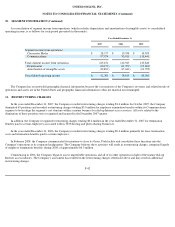

For the year ended December 31, 2007, the Company recorded a tax provision of $40.9 million on pre-tax income of $98.7 million,

resulting in an effective tax rate of 41.5%. The effective tax rate differs from the statutory federal income tax rate primarily due to (1) state

income taxes, net of federal benefit; (2) compensation, including stock-based compensation, that is limited under Section 162(m) of the Internal

Revenue Code (the "Code"); (3) foreign losses, the benefit of which is not currently recognizable due to uncertainty regarding realization; (4) the

re-measurement of certain deferred tax assets in New York; (5) employee stock purchase plan compensation, the benefit of which is not

currently recognized under SFAS No. 123R but which is recognized upon a disqualified disposition; and (6) the benefit of federal tax exempt

interest income.

For the year ended December 31, 2006, the Company recorded a tax provision of $36.3 million on pre-tax income of $77.5 million,

resulting in an effective tax rate of 46.8%. The effective tax rate differs from the statutory federal income tax rate primarily due to (1) state

income taxes, net of federal benefit; (2) compensation, including stock-based compensation, that is limited under Section 162(m) of the Code;

(3) foreign losses, the benefit of which is not currently recognizable due to uncertainty

F-37

Year Ended December 31,

2007

2006

2005

Current:

Federal

$

27,278

$

33,433

$

33,043

State

6,389

6,469

5,625

33,667

39,902

38,668

Deferred:

Federal

6,070

(6,404

)

(2,339

)

State

803

2,795

3,916

Foreign

375

—

—

7,248

(3,609

)

1,577

Provision for income taxes

$

40,915

$

36,293

$

40,245

Year Ended December 31,

2007

2006

2005

Taxes on income at the statutory federal income tax rate of

35%

$

34,541

$

27,133

$

30,580

State income taxes, net of federal tax benefits

4,660

3,858

4,454

Re

-

measurement of deferred tax assets

(331

)

2,265

2,473

Other differences, net

(501

)

(427

)

6

Increase in valuation allowance

2,546

3,464

2,732

Provision for income taxes

$

40,915

$

36,293

$

40,245