Classmates.com 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

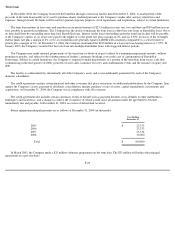

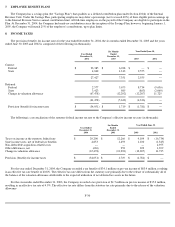

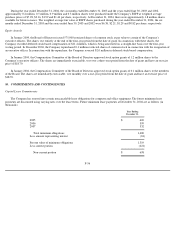

7. EMPLOYEE BENEFIT PLANS

The Company has a savings plan (the "Savings Plan") that qualifies as a defined contribution plan under Section 401(k) of the Internal

Revenue Code. Under the Savings Plan, participating employees may defer a percentage (not to exceed 40%) of their eligible pretax earnings up

to the Internal Revenue Service annual contribution limit. All full-

time employees on the payroll of the Company are eligible to participate in the

Plan. At December 31, 2004, the Company had made no contributions since the inception of the Savings Plan; however, beginning January 1,

2005, the Company will match 25% of the employee's contributions, up to plan limits.

8. INCOME TAXES

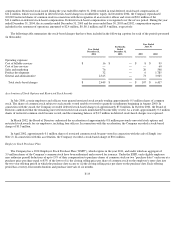

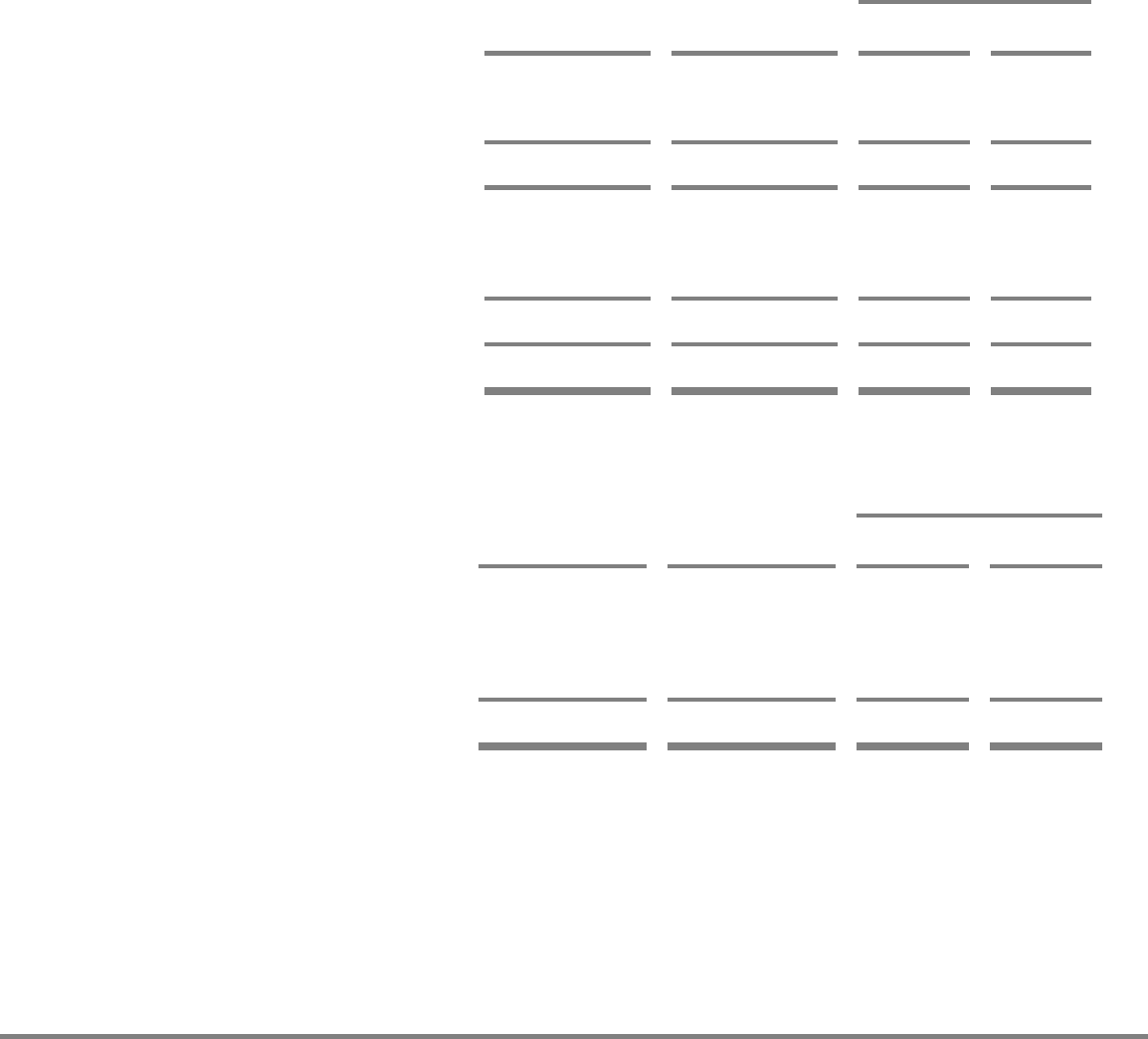

The provision (benefit) for income taxes for the year ended December 31, 2004, the six months ended December 31, 2003 and the years

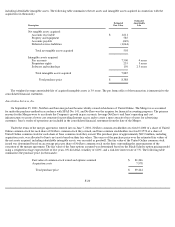

ended June 30, 2003 and 2002 is comprised of the following (in thousands):

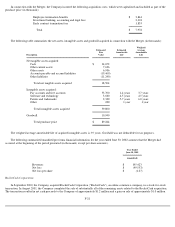

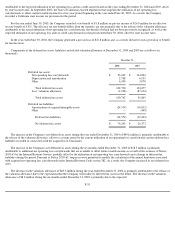

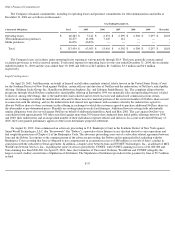

The following is a reconciliation of the statutory federal income tax rate to the Company's effective income tax rate (in thousands):

For the year ended December 31, 2004, the Company recorded a tax benefit of $34.1 million on pre-tax income of $83.4 million, resulting

in an effective tax rate benefit of 40.8%. The effective tax rate differs from the statutory rate primarily due to the release of substantially all of

the balance of the valuation allowance attributable to the expected utilization of net deferred tax assets in the future.

For the six months ended December 31, 2003, the Company recorded a tax provision of $1.7 million on pre-tax income of $35.0 million,

resulting in an effective tax rate of 4.9%. The effective tax rate differs from the statutory tax rate primarily due to the release of the valuation

allowance

F-30

Six Months

Ended

December 31,

2003

Year Ended June 30,

Year Ended

December 31,

2004

2003

2002

Current:

Federal

$

23,385

$

6,038

$

—

$

—

State

4,042

1,313

2,555

—

27,427

7,351

2,555

—

Deferred:

Federal

2,577

5,675

8,734

(9,656

)

State

3,423

985

(863

)

(2,069

)

Change in valuation allowance

(67,478

)

(12,292

)

(12,207

)

11,725

(61,478

)

(5,632

)

(4,336

)

—

Provision (benefit) for income taxes

$

(34,051

)

$

1,719

$

(1,781

)

$

—

Six Months

Ended

December 31,

2003

Year Ended June 30,

Year Ended

December 31,

2004

2003

2002

Taxes on income at the statutory federal rate

$

29,200

$

12,266

$

9,104

$

(16,734

)

State income taxes, net of federal tax benefits

4,853

1,493

1,100

(1,345

)

Non

-

deductible acquisition

-

related costs

—

—

—

4,955

Other differences, net

(626

)

252

222

1,399

Change in valuation allowance

(67,478

)

(12,292

)

(12,207

)

11,725

Provision (benefit) for income taxes

$

(34,051

)

$

1,719

$

(1,781

)

$

—