Classmates.com 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

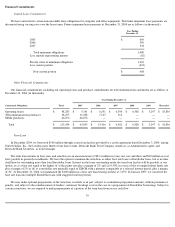

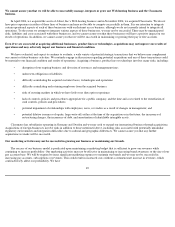

Financial Commitments

Capital Lease Commitments

We have entered into certain noncancelable lease obligations for computer and office equipment. The future minimum lease payments are

discounted using varying rates over the lease terms. Future minimum lease payments at December 31, 2004 are as follows (in thousands):

Other Financial Commitments

Our financial commitments, including our operating leases and purchase commitments for telecommunications and media are as follows at

December 31, 2004 (in thousands):

Term Loan

In December 2004, we borrowed $100 million through a term loan facility provided by a credit agreement dated December 3, 2004, among

United Online, Inc., the Lenders party thereto from time to time, Deutsche Bank Trust Company Americas, as Administrative agent, and

Deutsche Bank Securities, as Lead Arranger.

The term loan matures in four years and amortizes in an annual amount of $23.3 million in years one, two and three and $30 million in year

four, payable in quarterly installments. We have the option to maintain the term loan as either base rate loans or Eurodollar loans, but at no time

shall there be outstanding more than four Eurodollar loans. Interest on the loans outstanding under the term loan facility will be payable, at our

option, at (a) a base rate equal to the higher of (i) the prime rate plus a margin of 2% and (ii) 0.50% in excess of the overnight federal funds rate

plus a margin of 2% or (b) at a eurodollar rate generally equal to LIBOR with a maturity comparable to a selected interest period, plus a margin

of 3%. At December 31, 2004, we maintained the $100 million in a base rate loan bearing interest at 7.25%. In January 2005, we converted the

base rate loan into multiple Eurodollar loans with staggered interest periods.

We may make optional prepayments of the term loan, in whole or in part (subject to a minimum prepayment amount), without premium or

penalty, and subject to the reimbursement of lenders' customary breakage costs in the case of a prepayment of Eurodollar borrowings. Subject to

certain restrictions, we are required to make prepayments of a portion of the term loan from excess cash flow

39

Year Ending

December 31,

2005

$

669

2006

399

2007

332

Total minimum obligations

1,400

Less amount representing interest

(81

)

Present value of minimum obligations

1,319

Less current portion

(621

)

Non

-

current portion

$

698

Year Ending December 31,

Contractual Obligations

Total

2005

2006

2007

2008

2009

Thereafter

Operating leases

$

48,283

$

5,141

$

6,291

$

6,390

$

6,308

$

5,297

$

18,856

Telecommunications purchases

18,275

11,038

7,125

112

—

—

—

Media purchases

46,876

46,876

—

—

—

—

—

Total

$

113,434

$

63,055

$

13,416

$

6,502

$

6,308

$

5,297

$

18,856