Classmates.com 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

changes in our marketing and related distribution channels; changes in our marketing expenditures; the effects of seasonality; and the impact of

new types of pay services. ARPU is calculated by dividing billable services revenues for a period by the average number of pay accounts for that

period. ARPU may fluctuate from period to period as a result of a variety of factors including changes in the mix of pay subscriptions and their

related pricing plans; the use of promotions, such as one or more free months of service, and discounted pricing plans to obtain or retain

subscribers; increases or decreases in the price of our services; the number of services subscribed to by each pay account; pricing and success of

new pay services and the penetration of these types of services as a percentage of total pay accounts; and the timing of pay accounts being added

or removed during a period.

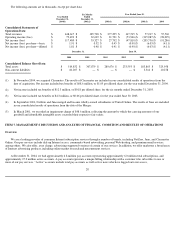

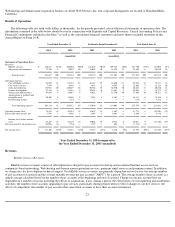

Billable services revenues increased by $104.7 million, or 34%, to $410.8 million for the year ended December 31, 2004, compared to

$306.1 million for the year ended December 31, 2003. The increase was due to an increase in the number of Internet access accounts,

particularly those accounts subscribing to our accelerator services, and an increase in our average number of pay accounts, offset partially by a

decrease in our ARPU.

Our average number of pay accounts was approximately 3,859,000 for the year ended December 31, 2004, compared to approximately

2,534,000 for the year ended December 31, 2003. The increase in our average number of pay accounts resulted from a number of factors

including our acquisition of Classmates in November 2004, from which we acquired approximately 1,452,000 pay accounts and which increased

our average number of pay accounts by 726,000; increased spending on marketing and promotion of our pay services, particularly our

accelerator services; the introduction of new pay services, particularly our premium email services; an expansion of our online and offline

distribution channels; our Web-hosting acquisition in April 2004; and a significant number of our free accounts upgrading to our pay services.

However, we experienced limited growth in the June 2004 and September 2004 quarters in pay access accounts and, for the first time since we

began offering pay access services, experienced a decline in pay access accounts in the December 2004 quarter. We believe the recent decline in

pay access accounts is primarily attributable to increased competition, which is likely to continue to adversely impact our ability to grow our pay

access accounts going forward. While the number of pay access accounts may grow in the March 2005 quarter due, in part, to historically

positive seasonality, we cannot assure you that either our total pay account base or our pay access accounts will grow or will not continue to

decrease in future periods, including the March 2005 quarter. Excluding the pay accounts from the Classmates acquisition, our growth in pay

accounts during the December 2004 quarter was 142,000. The magnitude of this growth was primarily attributable to an increase in premium

email accounts resulting from an email consolidation program which resulted in a number of our free accounts upgrading to pay accounts. We

currently anticipate that our increase in pay accounts during the March 2005 quarter will be lower than the increase we experienced during the

December 2004 quarter and that we will not experience comparable growth in premium email accounts in future periods.

ARPU was $8.87 for the year ended December 31, 2004, compared to $10.07 for the year ended December 31, 2003. ARPU for the

December 2004 quarter was $8.98, a decrease from $10.60 in the September 2004 quarter. These decreases in ARPU were due primarily to the

timing of the addition of 1,452,000 pay accounts from our acquisition of Classmates in November 2004, and due to the lower ARPU of the

Classmates pay service. Additionally, these decreases were due to an increase in the percentage of pay accounts with a lower ARPU, particularly

our premium email services; a decrease in the percentage of total pay accounts comprised of our accelerator services which generates a

significantly higher average ARPU; an increase in the number of free months of service offered for initial trial periods and retention programs;

and an increase in the number of accounts signing up for promotional pricing plans. In addition, we have experienced slower growth in the

number of accelerator subscriptions in each quarter since the March 2004 quarter. Recently, AOL's Netscape brand began offering a similar

accelerator service as part of its standard $9.95 value-priced offering. Increased

23