Classmates.com 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

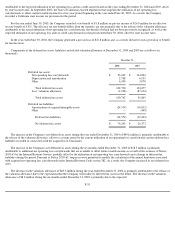

compensation. Restricted stock issued during the year ended December 31, 2004 resulted in total deferred stock-based compensation of

$11.4 million, which was included in deferred stock-based charges in stockholders' equity. In December 2004, the Company repurchased

100,000 restricted shares of common stock in connection with the resignation of an executive officer and reversed $2.0 million of the

$11.4 million in deferred stock-based compensation. Deferred stock-based compensation is recognized over the service period. During the year

ended December 31, 2004, the six months ended December 31, 2003 and the years ended June 30, 2003 and 2002, compensation expense

included in the statement of operations amounted to $2.4 million, $0, $0.1 million and $3.4 million, respectively.

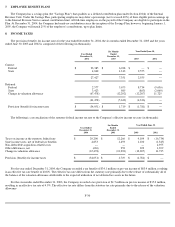

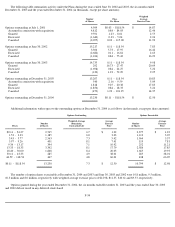

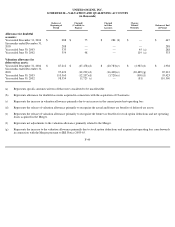

The following table summarizes the stock-based charges that have been included in the following captions for each of the periods presented

(in thousands):

Acceleration of Stock Options and Restricted Stock Awards

In July 2000, certain employees and officers were granted restricted stock awards totaling approximately 0.5 million shares of common

stock. The shares of common stock subject to such awards vested ratably over twelve quarterly installments beginning in August 2000. In

connection with the award, the Company recorded deferred stock-based charges of approximately $7.8 million. In October 2001, the Board of

Directors authorized that the remaining unvested restricted stock awards immediately become fully vested. As a result, approximately 0.3 million

shares of restricted common stock became vested, and the remaining balance of $1.5 million in deferred stock-based charges was expensed.

In March 2002, the Board of Directors authorized the acceleration of approximately 0.8 million previously unvested stock options and

restricted stock awards for six employees, including four officers. In connection with this acceleration, the Company recorded a stock-based

charge of $1.3 million.

In April 2002, approximately 0.1 million shares of restricted common stock became vested in connection with the sale of Simpli (see

Note 2). In connection with this acceleration, the Company recorded a stock

-based charge of $0.6 million.

Employee Stock Purchase Plan

The Company has a 2001 Employee Stock Purchase Plan ("ESPP"), which expires in the year 2011, and under which an aggregate of

3.9 million shares of the Company's common stock have been authorized and reserved for issuance. Under the ESPP, each eligible employee

may authorize payroll deductions of up to 15% of their compensation to purchase shares of common stock on two "purchase dates" each year at a

purchase price per share equal to 85% of the lower of (i) the closing selling price per share of common stock on the employee's entry date into

the two-year offering period in which the purchase date occurs or (ii) the closing selling price per share on the purchase date. Each offering

period has a twenty-four month duration and purchase intervals of six months.

F-35

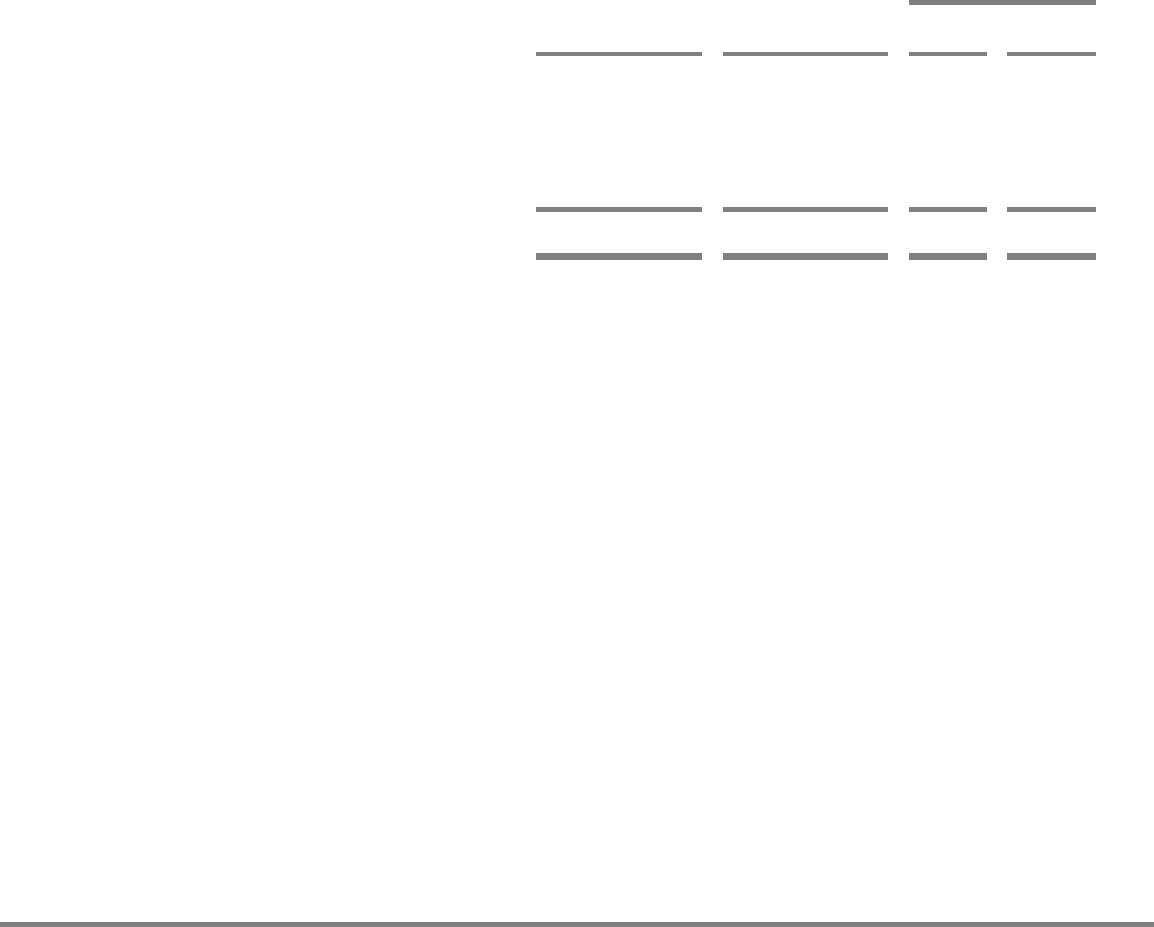

Year Ended

June 30,

Six Months

Ended

December 31,

2003

Year Ended

December 31,

2004

2003

2002

Operating expenses:

Cost of billable services

$

16

$

—

$

8

$

99

Cost of free services

—

—

—

60

Sales and marketing

76

—

20

548

Product development

32

—

6

1,785

General and administrative

2,325

—

73

3,925

Total stock

-

based charges

$

2,449

$

—

$

107

$

6,417