Classmates.com 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

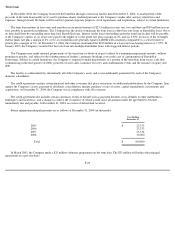

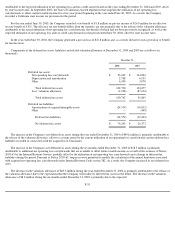

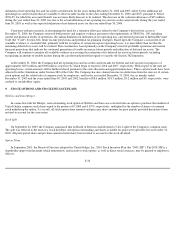

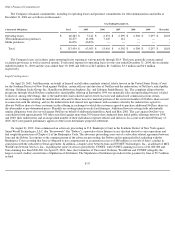

utilization of net operating loss and tax credit carryforwards for the years ending December 31, 2004 and 2005, offset by the additional net

operating loss carryforwards that are available to offset taxable income in the years ending December 31, 2006 and 2007, pursuant to Notice

2003-65, for which the associated benefit was not more likely than not to be realized. The decrease in the valuation allowance of $15 million

during the year ended June 30, 2003 was due to the actual utilization of net operating loss and tax credit carryforwards during the year ended

June 30, 2003 as well as the expected utilization of net deferred assets for the year ended June 30, 2004.

Consistent with prior periods, in determining the need for a valuation allowance related to the Company's deferred tax assets at

December 31, 2004, the Company reviewed both positive and negative evidence pursuant to the requirements of SFAS No. 109, including

current and historical results of operations, the annual limitation on utilization of net operating loss carryforwards pursuant to Internal Revenue

Code (the "Code") Section 382, future income projections and potential tax-planning strategies. Based upon the Company's assessment of all

available evidence, it concluded that, primarily with the exception of certain foreign net operating losses, it is more likely than not that the

remaining deferred tax assets will be realized. This conclusion is based primarily on the Company's trend of profitable operations and current

financial projections that indicate the continued generation of taxable income in future periods and utilization of deferred tax assets. The

Company will continue to monitor all available evidence in assessing the realization of its deferred tax assets in future periods, including

recognizing an amount of taxable income during the carryforward period that equals or exceeds the Section 382 limitation.

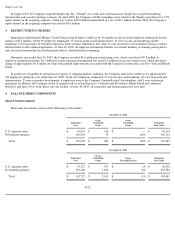

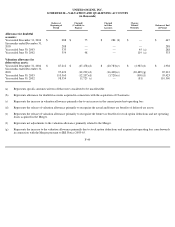

At December 31, 2004, the Company had net operating loss and tax credit carryforwards for federal and state income tax purposes of

approximately $235 million and $300 million, respectively, which begin to expire in 2018 and 2007, respectively. With respect to the state net

operating losses, certain amounts will be further reduced pursuant to the state allocation and apportionment laws. These carryforwards have been

adjusted to reflect limitations under Section 382 of the Code. The Company has also claimed income tax deductions from the exercise of certain

stock options and the related sale of common stock by employees, and for the year ended December 31, 2004, the six months ended

December 31, 2003 and the years ended June 30, 2003 and 2002, benefits of $8.6 million, $18.3 million, $5.2 million and $0, respectively, were

credited to stockholders' equity.

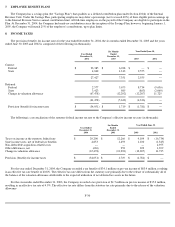

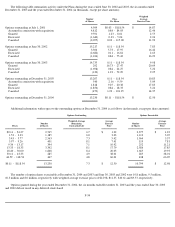

9. STOCK OPTIONS AND STOCK ISSUANCE PLANS

NetZero and Juno Merger

In connection with the Merger, each outstanding stock option of NetZero and Juno was converted into an option to purchase that number of

United Online common stock shares equal to the product of 0.2000 and 0.3570, respectively, multiplied by the number of shares of common

stock underlying the option. As a result, all stock option share amounts and price per share amounts for prior periods provided herein have been

restated to account for the conversion.

Stock Split

On September 24, 2003, the Company announced that its Board of Directors had declared a 3-for-2 split of the Company's common stock.

The split was effected in the form of a stock dividend. All options outstanding and shares available for grant were split effective on October 31,

2003. All prior period share and per share amounts herein have been restated to account for the stock dividend.

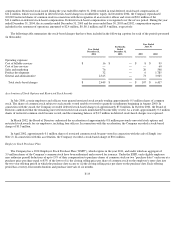

Option Plans

In September 2001, the Board of Directors adopted the United Online, Inc. 2001 Stock Incentive Plan (the "2001 SIP"). The 2001 SIP is a

shareholder-

approved plan under which nonstatutory and incentive stock options, as well as direct stock issuances, may be granted to employees,

officers,

F-32