Classmates.com 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

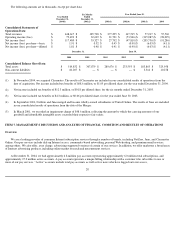

Product Development

Product development expenses include expenses for the maintenance of existing software and technology and the development of new or

improved software and technology, including personnel-related expenses for the software engineering department and the costs associated with

operating our facility in India. Costs incurred by us to manage, monitor and operate our services are generally expensed as incurred, except for

certain costs relating to the acquisition and development of internal-use software, which are capitalized and depreciated over their estimated

useful lives, generally three years or less.

Product development expenses increased by $5.6 million, or 25%, to $27.5 million for the year ended December 31, 2004, compared to

$21.9 million for the year ended December 31, 2003. The increase was primarily the result of a $6.4 million increase in personnel-related

expenses as a result of increased headcount and compensation costs, including increased costs associated with our acquisitions of our Web-

hosting and community-

based networking businesses, partially offset by a $0.8 million decrease in depreciation. Depreciation expense decreased

as a result of assets placed in service in prior years becoming fully depreciated and lower levels of capital expenditures in recent years versus

prior years. We anticipate that we will increase our product development expenses, both in dollar terms and as a percent of revenues, in 2005.

Additionally, product development expenses could increase further as a percentage of revenues in 2005 as a result of increased compensation

expense recognized in connection with the adoption of SFAS No. 123 (revised) commencing no later than the September 2005 quarter.

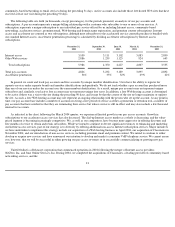

General and Administrative

General and administrative expenses include personnel-related expenses for executive, finance, legal, human resources and internal

customer support personnel. In addition, general and administrative expenses include fees for professional legal, accounting and financial

services, office relocation costs, non-income taxes, insurance, and occupancy and other overhead-related costs, as well as the expenses incurred

and credits received as a result of certain legal settlements.

General and administrative expenses increased by $10.8 million, or 37%, to $39.9 million for the year ended December 31, 2004, compared

to $29.1 million for the year ended December 31, 2003. The increase was the result of $3.3 million in lease termination fees and accelerated

depreciation expenses in connection with the relocation of our corporate offices; a $3.2 million increase in professional and consulting fees

primarily related to our Sarbanes-Oxley Section 404 compliance efforts, the due diligence process associated with a potential acquisition that

was terminated and increased legal fees; a $2.3 million increase in stock-based compensation primarily related to restricted stock issued to

certain of our executive officers in January 2004; a $2.3 million increase in overhead-related costs and a $1.4 million increase in personnel-

related expenses as a result of higher compensation costs, including increased costs associated with our acquisitions of our Web-hosting and

community-based networking businesses. These increases were partially offset by a $1.7 million decrease in legal settlement costs. General and

administrative expenses could increase as a percentage of revenues in 2005 as a result of increased compensation expense recognized in

connection with the adoption of SFAS No. 123 (revised) commencing no later than the September 2005 quarter.

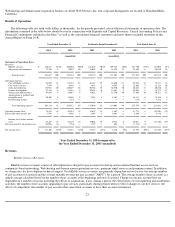

Amortization of Intangible Assets

Amortization of intangible assets includes amortization of acquired pay accounts and free accounts, acquired trademarks and trade names,

purchased technologies and other identifiable intangible assets. At December 31, 2004, we had approximately $70.6 million in net identifiable

intangible assets resulting primarily from the acquisition of Classmates, the acquisition of the Internet access assets of BlueLight and the

acquisition of the Web-hosting assets of About, Inc. At December 31, 2004, we had

27