Classmates.com 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Web-hosting and domain name registration business of About Web Services, Inc. Our corporate headquarters are located in Woodland Hills,

California.

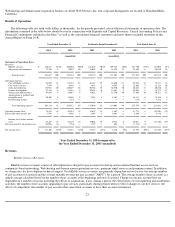

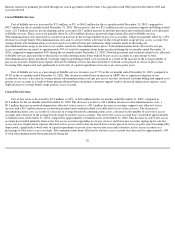

Results of Operations

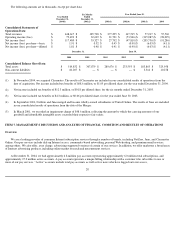

The following table sets forth (with dollars in thousands), for the periods presented, selected historical statements of operations data. The

information contained in the table below should be read in conjunction with Liquidity and Capital Resources, Critical Accounting Policies and

Financial Commitments included in this Item 7 as well as the consolidated financial statements and notes thereto included elsewhere in this

Annual Report on Form 10-K.

Year Ended December 31, 2004 compared to

the Year Ended December 31, 2003 (unaudited)

Revenues

Billable Services Revenues

Billable services revenues consist of subscription fees charged to pay accounts for dial-up and accelerated Internet access services,

community-based networking, Web-hosting and domain name registration services, premium email services and premium content. In addition,

we charge fees for live telephone technical support. Our billable services revenues are primarily dependent on two factors: the average number

of pay accounts for a period and the average monthly revenue per pay account ("ARPU") for a period. The average number of pay accounts is a

simple average calculated based on the number of pay accounts at the beginning and end of a period. Changes in our pay account base are

dependent on a number of factors including the effects of acquisitions, if any, during a period; the effectiveness of our marketing and distribution

activities; the number of free accounts upgrading to pay services, particularly during periods when we effect changes to our free services; the

effects of competition; the number of pay accounts that cancel their accounts or have their accounts terminated;

22

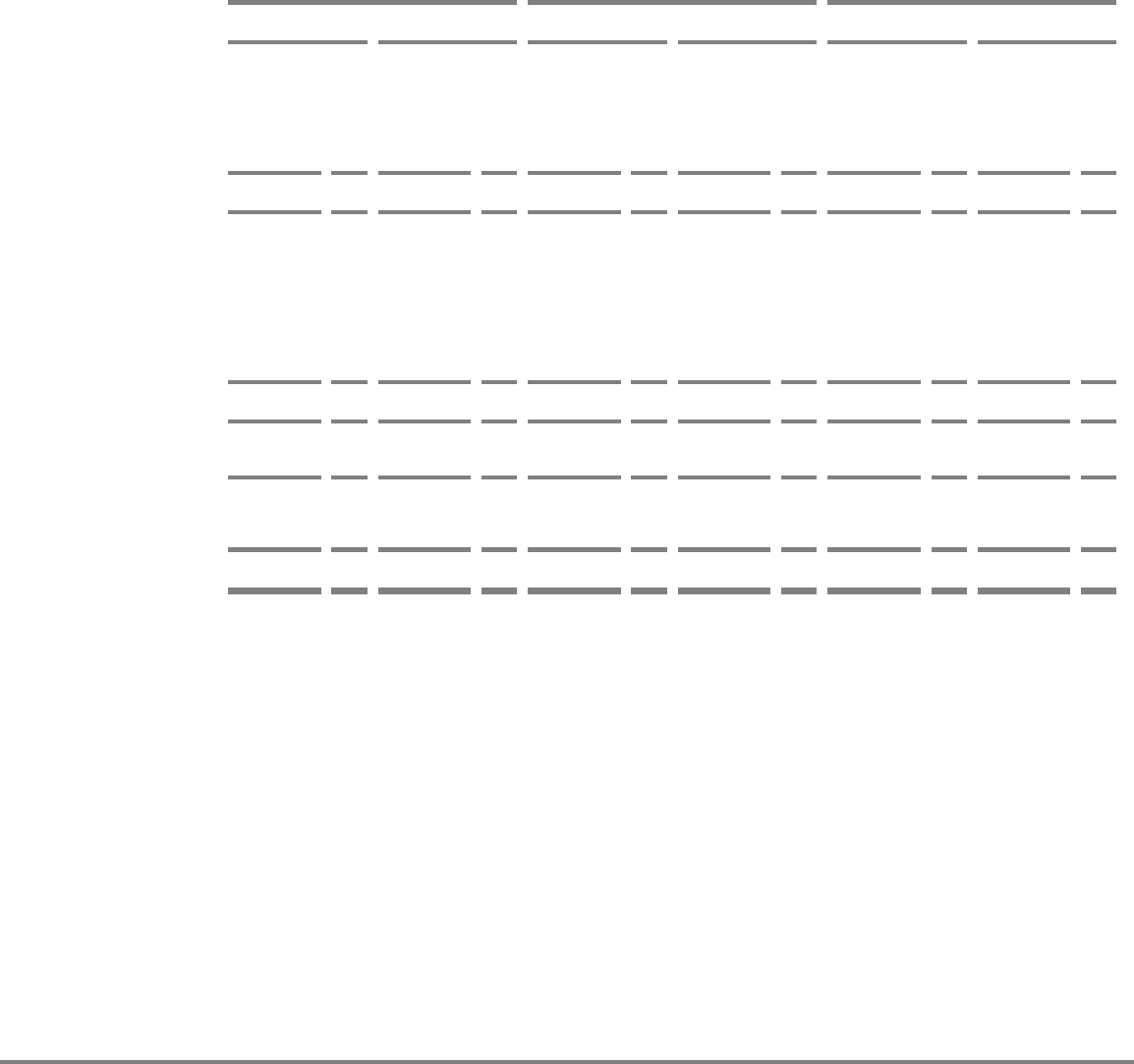

Year Ended December 31,

Six Months Ended December 31,

Year Ended June 30,

2004

2003

2003

2002

2003

2002

(unaudited)

(unaudited)

Statements of Operations Data:

Revenues:

Billable services

$

410,821

92

%

$

306,086

90

%

$

167,639

90

%

$

109,343

88

%

$

247,790

89

%

$

141,005

84

%

Advertising and commerce

37,796

8

33,079

10

18,099

10

14,525

12

29,505

11

26,510

16

Total revenues

448,617

100

339,165

100

185,738

100

123,868

100

277,295

100

167,515

100

Operating expenses:

Cost of billable services

94,999

21

92,785

27

46,182

25

42,690

34

89,293

32

74,227

44

Cost of free services

7,393

2

9,659

3

3,953

2

6,897

6

12,603

5

33,129

20

Sales and marketing

178,981

40

120,619

36

70,526

38

36,530

30

86,623

31

40,220

24

Product development

27,454

6

21,881

6

10,488

6

11,661

9

23,054

8

24,779

15

General and administrative

39,894

9

29,087

9

14,022

7

12,740

10

27,805

10

30,722

18

Amortization of goodwill and

intangible assets

20,403

5

15,856

5

7,928

4

8,483

7

16,411

6

14,156

8

Restructuring charges

—

—

(

215

)

—

—

—

—

—

(

215

)

—

4,228

3

Total operating expenses

369,124

82

289,672

85

153,099

82

119,001

96

255,574

92

221,461

132

Operating income (loss)

79,493

18

49,493

15

32,639

18

4,867

4

21,721

8

(53,946

)

(32

)

Interest and other income, net

3,936

1

4,636

1

2,407

1

2,061

2

4,290

1

6,136

3

Income (loss) before income

taxes

83,429

19

54,129

16

35,046

19

6,928

6

26,011

9

(47,810

)

(29

)

Provision (benefit) for income taxes

(34,051

)

(8

)

(754

)

—

1,719

1

692

1

(1,781

)

(1

)

—

—

Net income (loss)

$

117,480

26

%

$

54,883

16

%

$

33,327

18

%

$

6,236

5

%

$

27,792

10

%

$

(47,810

)

(29

)%