Classmates.com 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reclassifications —Certain prior year amounts have been reclassified to conform to current year presentation. These changes had no

impact on previously reported results of operations or stockholders' equity.

Recent Accounting Pronouncement

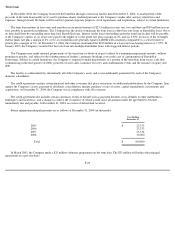

In December 2004, the FASB issued SFAS No. 123 (revised 2004), Share-Based Payment . This statement replaces SFAS No. 123 and

supersedes APB Opinion No. 25. This statement requires that the cost resulting from all share-based payment transactions be recognized in the

financial statements. This statement establishes fair value as the measurement objective in accounting for share-

based payment arrangements and

requires all entities to apply a fair-value-based measurement method in accounting for share-based payment transactions with employees except

for equity instruments held by employee share ownership plans. This statement also establishes fair value as the measurement objective for

transactions in which an entity acquires goods or services from nonemployees in share-based payment transactions. This statement uses the

terms compensation and payment in their broadest senses to refer to the consideration paid for goods or services, regardless of whether the

supplier is an employee. SFAS No. 123 (revised) becomes effective in the September 2005 quarter and will have a material adverse effect on the

Company's results of operations.

At the required effective date, the Company will apply this statement using a modified version of prospective application. Under the

modified prospective application, this statement applies to new awards and to awards modified, repurchased, or cancelled after the required

effective date. Additionally, compensation cost for the portion of awards for which the requisite service has not been rendered that are

outstanding as of the required effective date will be recognized as the requisite service is rendered on or after the required effective date. The

compensation cost for that portion of awards shall be based on the grant-

date fair value of those awards as calculated for either recognition or pro

forma disclosures under SFAS No. 123.

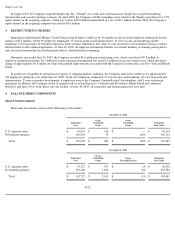

2. ACQUISITIONS

Classmates Online, Inc.

In November 2004, the Company acquired Classmates, which operates Classmates.com (www.classmates.com), connecting millions of

members throughout the U.S. and Canada with friends and acquaintances from school, work and the military. Its Classmates International

subsidiary also operates leading community-

based networking sites in Sweden, through Klassträffen Sweden AB (www.klasstraffen.com), and in

Germany, through StayFriends GmbH (www.stayfriends.de). The acquisition was accounted for under the purchase method in accordance with

SFAS No. 141, Business Combinations

. The primary reason for the acquisition was to acquire Classmates' services and account base to continue

to expand the Company's subscription offerings. Classmates' results of operations are included in the consolidated financial statements from the

date of acquisition.

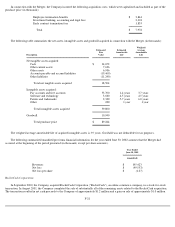

The purchase price of approximately $131.4 million, including acquisition costs of $3.1 million for professional, accounting, legal and

administrative fees, was allocated to Classmates' net assets based on their fair values. The excess of the purchase price over the estimated fair

values of the net assets acquired, including identifiable intangible assets, was recorded as goodwill. The Company assumed 0.5 million unvested

options as of the acquisition date, and the fair value of the options assumed was determined based on the Black-Scholes option pricing model

using a weighted average expected life of

F-17