Classmates.com 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

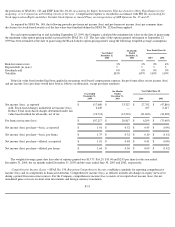

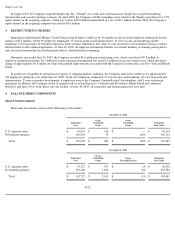

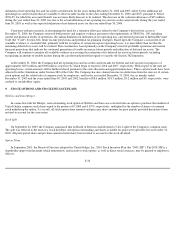

Amortization expense for the year ended December 31, 2004, the six months ended December 31, 2003 and the years ended June 30, 2003

and 2002 was $20.4 million, $7.9 million, $16.4 million and $14.2 million, respectively.

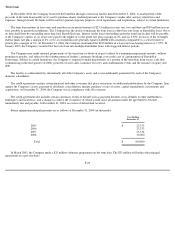

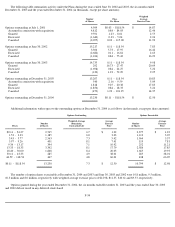

Estimated future amortization expense at December 31, 2004 is as follows (in thousands):

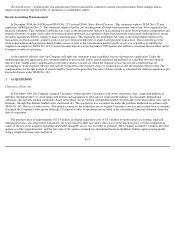

In January 2005, the Company purchased an intangible asset for $6.0 million. The amount will be amortized over the expected useful life of

the asset, which has yet to be determined.

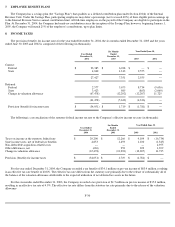

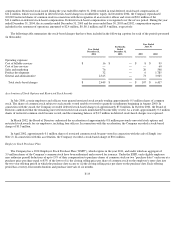

Accrued Liabilities

Accrued liabilities consist of the following (in thousands):

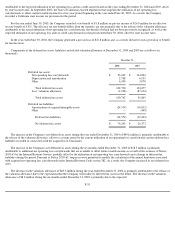

Line of Credit

In December 2003, United Online obtained a one-year $25 million unsecured revolving line of credit from a bank that was to expire in

December 2004. This facility was available for general corporate purposes and the interest rates on borrowings were based on current market

rates. The line of credit contained covenants pertaining to the maintenance of a minimum quick ratio, minimum cash balances with the lender

and minimum profitability levels. The line of credit provided additional working capital to support the Company's growth and overall business

strategy.

In November 2004, the Company borrowed $10.3 million from the line of credit and repaid the amount on the same business day. No

interest expense was incurred related to the borrowing. The line of credit was canceled in December 2004 in connection with the signing of the

term loan agreement under which the Company borrowed $100 million.

F-25

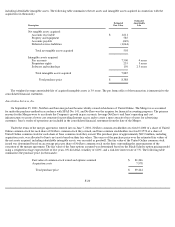

Software and technology

3,750

(1,870

)

1,880

Trademarks and trade names

2,806

(1,152

)

1,654

Patents, trademarks and other

1,833

(1,390

)

443

Total

$

69,589

$

(38,862

)

$

30,727

Year Ending

December 31,

2005

$

20,169

2006

14,040

2007

8,525

2008

5,511

2009

4,694

Thereafter

17,619

Total

$

70,558

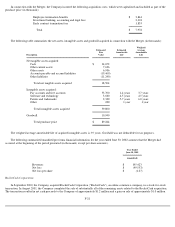

December 31,

2004

2003

Employee compensation and related expenses

$

11,564

$

8,205

Settlement costs

4,281

4,281

Other

2,475

1,542

Total

$

18,320

$

14,028