Classmates.com 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

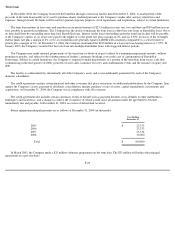

The Company has reclassified certain Auction Rate securities from cash and cash equivalents to short-term investments. Auction Rate

securities are variable rate bonds tied to short-term interest rates with maturities on the face of the securities in excess of 90 days. Auction Rate

securities have interest rate resets through a modified Dutch auction, at predetermined short-term intervals, usually every 7, 28 or 35 days. They

are traded at par and the interest paid during a given period is based upon the interest rate determined during the prior auction. Although these

securities are issued and rated as long-term bonds, they are priced and traded as short-term instruments due to the liquidity provided through the

interest rate reset. The Company has historically classified these instruments as cash and cash equivalents if the period between interest rate

resets was 90 days or less. Based on the Company's re-evaluation of the maturity dates associated with the underlying bonds, the Company has

reclassified its Auction Rate securities, previously classified as cash equivalents, as short-term investments on its consolidated balance sheet at

December 31, 2003. In addition, certain amounts were reclassified in the consolidated statements of cash flows for the six months ended

December 31, 2003 and the years ended June 30, 2003 and 2002.

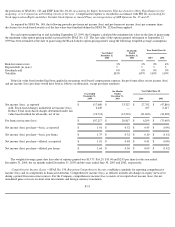

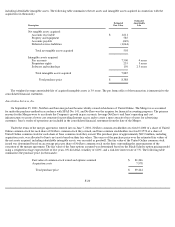

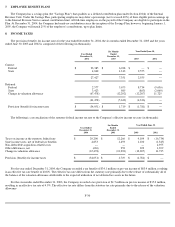

Short-term investments, prior to the reclassification, consisted of the following (in thousands):

Gross unrealized gains and losses are presented net of tax in accumulated other comprehensive income (loss) on the consolidated balance

sheets. The Company recognized $0.1 million of realized gains from the sale of short-term investments in the year ended December 31, 2004.

The Company had no material realized gains or losses from the sale of short-term investments in the six months ended December 31, 2003 and

the years ended June 30, 2003 and 2002.

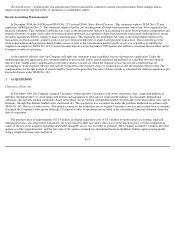

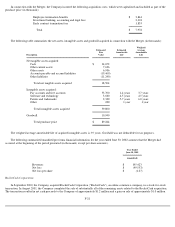

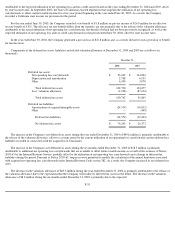

Maturities of short-term investments were as follows (in thousands):

F-23

December 31, 2003

(prior to reclass)

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

U.S. corporate notes

$

39,321

$

917

$

(5

)

$

40,233

Government agencies

91,083

1,183

(10

)

92,256

Total

$

130,404

$

2,100

$

(15

)

$

132,489

December 31, 2004

Amortized Cost

Estimated Fair

Value

Maturing within 1 year

$

29,159

$

29,158

Maturing between 1 year and 4 years

62,854

62,832

Maturing after 4 years

84,292

84,291

Total

$

176,305

$

176,281

December 31, 2003

December 31, 2003

(prior to reclass)

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

Maturing within 1 year

$

41,581

$

41,861

$

41,581

$

41,861

Maturing between 1 year and 4 years

88,823

90,628

88,823

90,628

Maturing after 4 years

62,323

62,326

—

—

Total

$

192,727

$

194,815

$

130,404

$

132,489