Classmates.com 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

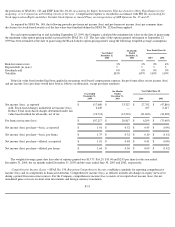

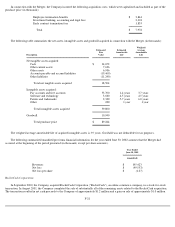

five years, 0% dividend, volatility of 99%, and a risk-free interest rate of 3%. The following table summarizes the purchase price (in thousands):

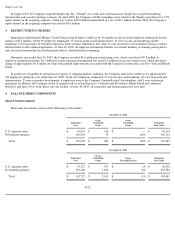

The following table summarizes the net liabilities assumed and goodwill and intangible assets acquired in connection with the acquisition of

Classmates (in thousands):

The weighted average amortizable life of acquired definite-lived intangible assets is 7.2 years. The goodwill is not deductible for tax

purposes.

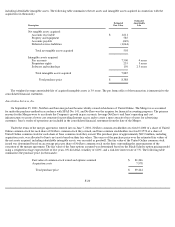

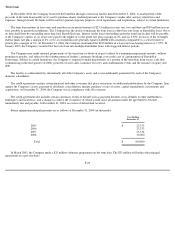

The following summarized unaudited pro forma financial information assumes that the acquisition of Classmates had occurred at the

beginning of each of the periods presented (in thousands, except per share amounts).

F-18

Cash

$

125,453

Fair value of options assumed

4,325

Intrinsic value of unvested options

(1,445

)

Acquisition costs

3,065

Total purchase price

$

131,398

Description

Estimated

Fair Value

Estimated

Amortizable

Life

Net liabilities assumed:

Cash

$

30,350

Accounts receivable

3,397

Property and equipment

9,700

Other assets

2,384

Accounts payable and accrued liabilities

(6,713

)

Deferred revenue

(23,757

)

Deferred income taxes

(15,897

)

Capital leases

(1,485

)

Other long

-

term liabilities

(286

)

Total net liabilities assumed

(2,307

)

Intangible assets acquired:

Trademark and trade name

13,800

10 years

Advertising contracts and related relationships

7,200

3.5 years

Pay accounts

21,700

4 years

Free accounts

21,500

10 years

Other intangibles

536

7 years

Total intangible assets acquired

64,736

Goodwill

68,969

Total purchase price

$

131,398

Year Ended

December 31,

2004

2003

Revenues

$

513,300

$

417,642

Net income

$

111,882

$

51,189

Net income per share

—

basic

$

1.82

$

0.81

Net income per share

—

diluted

$

1.70

$

0.74