Classmates.com 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of

any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or

that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company's internal control over financial reporting at December 31, 2004. In making this

assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") in

Internal Control

—Integrated Framework . Based on that assessment under those criteria, management has determined that, at December 31,

2004, the Company's internal control over financial reporting was effective.

Management has excluded Classmates Online, Inc. and its subsidiaries from its assessment of internal control over financial reporting as of

December 31, 2004 because it was acquired by the Company in a purchase business combination in November 2004. Classmates Online, Inc. is

a wholly-

owned subsidiary of the Company whose total assets and total revenues represent 31% and 2%, respectively, of the related consolidated

financial statement amounts as of and for the year ended December 31, 2004.

Management's assessment of the effectiveness of the Company's internal control over financial reporting at December 31, 2004 has been

audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which appears herein.

ITEM 9B. OTHER INFORMATION

None.

PART III

ITEMS 10, 11, 12, 13 and 14

The information required by Items 10, 11, 12, 13 and 14 is hereby incorporated by reference to our definitive proxy statement relating to

our 2005 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of our fiscal

year.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

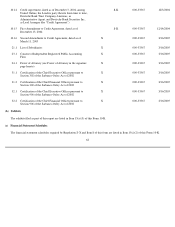

(a) The following documents are filed as part of this report:

1. Consolidated Financial Statements:

2. Financial Statement Schedule:

All other schedules have been omitted because the information required to be set forth therein is not applicable, not required or is shown in

the consolidated financial statements or notes thereto.

60

Page

Report of Independent Registered Public Accounting Firm

F

-

2

Consolidated Balance Sheets

F

-

4

Consolidated Statements of Operations

F

-

5

Consolidated Statements of Comprehensive Income (Loss)

F

-

6

Consolidated Statements of Stockholders' Equity

F

-

7

Consolidated Statements of Cash Flows

F

-

8

Notes to Consolidated Financial Statements

F

-

9

Page

Schedule II

—

Valuation and Qualifying Accounts

F

-

40