Classmates.com 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cost of Free Services —With respect to Internet access services, cost of free services includes direct costs incurred in providing certain

technical and customer support services to free access accounts as well as costs that have been allocated to free services based on the aggregate

hourly usage of free access accounts as a percentage of total hours used by the Company's active access accounts. Allocated costs consist

primarily of telecommunications and data center costs, personnel and overhead-related costs associated with operating the Company's network

and data centers, and depreciation of network computers and equipment. The Company allocates costs associated with Web hosting between pay

services and free services based on estimated bandwidth used by free Web-hosting accounts. Costs associated with the Company's community-

based networking services are allocated based on the number of Web site visits by free accounts relative to the total number of visits.

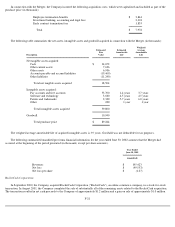

Sales and Marketing —Sales and marketing expenses include advertising and promotion expenses, fees paid to distribution partners to

acquire new pay and free accounts, personnel-

related expenses for sales and marketing personnel and telemarketing costs incurred to acquire pay

accounts, retain pay accounts and up-sell pay accounts to additional services, such as the Company's accelerated dial-up services. The Company

has expended significant amounts on sales and marketing, including national branding campaigns comprised of television, Internet,

sponsorships, radio, print and outdoor advertising and on retail and other performance-based distribution relationships. Marketing and

advertising costs to promote the Company's products and services are expensed in the period incurred. Advertising and promotion expenses

include media, agency and promotion expenses. Media production costs are expensed the first time the advertisement is run. Media and agency

costs are expensed over the period the advertising runs. Advertising and promotion expense for the year ended December 31, 2004, the six

months ended December 31, 2003 and the years ended June 30, 2003 and 2002 was $147.1 million, $57.6 million, $67.7 million and

$25.4 million, respectively. At December 31, 2004 and 2003, $4.3 million and $3.5 million, respectively, of prepaid advertising and promotion

expense was included in other current assets.

Product Development Costs —The Company capitalizes certain costs incurred for the development of software. Product development

expenses include expenses for the maintenance of existing software and the development of new or improved software and technology, including

personnel-related expenses for the software engineering department and the costs associated with operating the Company's facility in India.

Costs incurred by the Company to manage, monitor and operate the Company's services are generally expensed as incurred, except for certain

costs relating to the acquisition and development of internal-use software that are capitalized and depreciated over their estimated useful lives,

generally three years or less.

General and Administrative —General and administrative expenses include personnel-related expenses for executive, finance, legal,

human resources and internal customer support personnel. In addition, general and administrative expenses include fees for professional, legal,

accounting and financial services, non-income taxes, insurance, and occupancy and other overhead-related costs, as well as the expenses

incurred and credits received as a result of certain legal settlements.

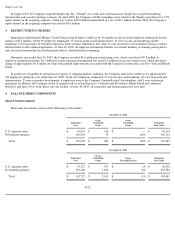

Stock-Based Compensation —The Company accounts for stock-based employee compensation arrangements in accordance with the

provisions of Accounting Principles Board ("APB") Opinion No. 25, Accounting for Stock Issued to Employees

, Financial Accounting Standards

Board ("FASB") Interpretation No. ("FIN") 44, Accounting for Certain Transactions Involving Stock Compensation , and Emerging Issues Task

Force ("EITF") Issue No. 00-23, Issues Related to the Accounting for Stock Compensation under APB Opinion No. 25 and FIN No. 44 and

complies with the disclosure provisions of SFAS No. 123, Accounting for Stock-Based Compensation and SFAS No. 148, Accounting for Stock-

Based Compensation

—Transition and Disclosure, an amendment of FASB Statement No. 123 . Under APB Opinion No. 25, employee stock-

based compensation expense is recognized over the vesting period based on the difference, if any, on the date of grant, between the fair value of

the Company's stock and the exercise price. The Company accounts for stock issued to non-employees in accordance with

F-14