Classmates.com 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

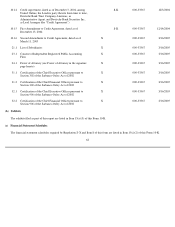

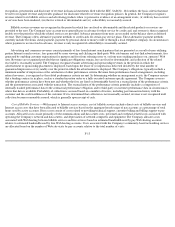

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

The accompanying notes are an integral part of these consolidated financial statements.

F-5

Year Ended June 30,

Year Ended

December 31,

2004

Six Months Ended

December 31,

2003

2003

2002

Revenues:

Billable services

$

410,821

$

167,639

$

247,790

$

141,005

Advertising and commerce

37,796

18,099

29,505

26,510

Total revenues

448,617

185,738

277,295

167,515

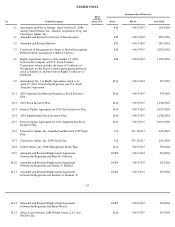

Operating expenses:

Cost of billable services (including stock

-

based charges,

see Note 9)

94,999

46,182

89,293

74,227

Cost of free services (including stock-based charges, see

Note 9)

7,393

3,953

12,603

33,129

Sales and marketing (including stock-based charges, see

Note 9)

178,981

70,526

86,623

40,220

Product development (including stock

-

based charges, see

Note 9)

27,454

10,488

23,054

24,779

General and administrative (including stock-

based charges,

see Note 9)

39,894

14,022

27,805

30,722

Amortization of intangible assets

20,403

7,928

16,411

14,156

Restructuring charges

—

—

(

215

)

4,228

Total operating expenses

369,124

153,099

255,574

221,461

Operating income (loss)

79,493

32,639

21,721

(53,946

)

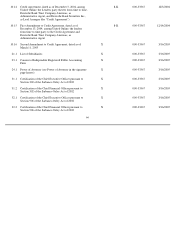

Interest and other income, net

3,936

2,407

4,290

6,136

Income (loss) before income taxes

83,429

35,046

26,011

(47,810

)

Provision (benefit) for income taxes

(34,051

)

1,719

(1,781

)

—

Net income (loss)

$

117,480

$

33,327

$

27,792

$

(47,810

)

Net income (loss) per share

—

basic

$

1.91

$

0.52

$

0.45

$

(0.90

)

Net income (loss) per share

—

diluted

$

1.81

$

0.48

$

0.41

$

(0.90

)

Shares used to calculate basic net income (loss) per share

61,404

64,163

61,688

53,309

Shares used to calculate diluted net income (loss) per share

65,012

69,504

67,074

53,309