Classmates.com 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(commencing in the first quarter of 2006), proceeds of asset sales, insurance recovery and condemnation events and the issuance of equity and

debt.

The facility is collateralized by substantially all of our assets and is unconditionally guaranteed by each of our domestic subsidiaries.

The credit agreement contains certain financial and other covenants that place restrictions on additional indebtedness by us, liens against

our assets, payment of dividends, consolidation, merger, purchase or sale of assets, capital expenditures, investments and acquisitions. At

December 31, 2004, we were in compliance with all covenants.

The credit agreement also includes certain customary events of default such as payment defaults, cross-defaults to other indebtedness,

bankruptcy and insolvency, and a change in control, the occurrence of which would cause all amounts under the agreement to become

immediately due and payable. At December 31, 2004, no events of default had occurred.

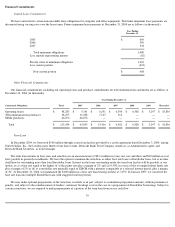

Future minimum principal payments are as follows at December 31, 2004 (in thousands):

In March 2005, we made a $25 million voluntary prepayment on the term loan. The $25 million will reduce the principal repayments on a

pro rata basis.

Critical Accounting Policies and Estimates

General

Our discussion and analysis of our financial condition and results of operations is based upon our audited and unaudited consolidated

financial statements, which have been prepared in accordance with generally accepted accounting principles ("GAAP") including those for

interim financial information and with the instructions for Form 10-K and Article 10 of Regulation S-X issued by the Securities and Exchange

Commission ("SEC"). The preparation of financial statements in accordance with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities and the reported amounts of revenues

and expenses. Actual results could differ from those estimates. The results of operations for interim or transition periods are not necessarily

indicative of the operating results for a full year.

The following is a discussion of the accounting policies and related estimates that we believe are most critical to understanding our

consolidated financial statements, financial position and results of operations and which require complex management judgments, uncertainties

and/or estimates.

Revenue Recognition

We apply the provisions of SEC Staff Accounting Bulletin ("SAB") No. 104, Revenue Recognition in Financial Statements , which

provides guidance on the recognition, presentation and disclosure of revenue in financial statements filed with the SEC. SAB No. 104 outlines

the basic criteria that must be met to recognize revenue and provides guidance for disclosure related to revenue recognition policies. In general,

we recognize revenue related to our billable services and advertising products when (i) persuasive evidence of an arrangement exists,

(ii) delivery has occurred or services have been rendered, (iii) the fee is fixed or determinable and (iv) collectibility is reasonably assured.

40

Year Ending

December 31,

2005

$

23,333

2006

23,333

2007

23,334

2008

30,000

Total

$

100,000