Classmates.com 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

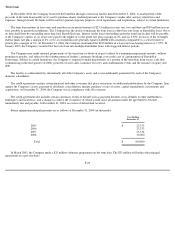

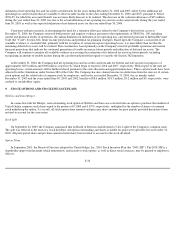

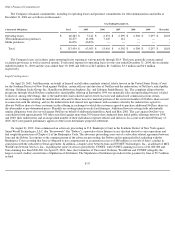

attributable to the expected utilization of net operating loss and tax credit carryforwards in the years ending December 31, 2004 and 2005, offset

by state income taxes. In September 2002, the State of California enacted legislation that suspends the utilization of net operating loss

carryforwards to offset current taxable income for a two-year period beginning in the year ended June 30, 2003. As a result, the Company

recorded a California state income tax provision for the period.

For the year ended June 30, 2003, the Company recorded a tax benefit of $1.8 million on pre-tax income of $26.0 million for an effective

tax rate benefit of 6.8%. The effective tax rate benefit differs from the statutory tax rate primarily due to the release of the valuation allowance

attributable to the actual utilization of net operating loss carryforwards, the benefit of which had not been previously recognized, as well as the

expected utilization of net operating loss and tax credit carryforwards in the period ended June 30, 2004, offset by state income taxes.

In the year ended June 30, 2002, the Company generated a pre-

tax loss of $47.8 million and, as a result, did not record a provision or benefit

for income taxes.

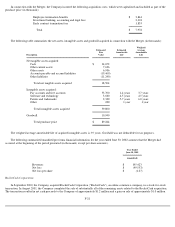

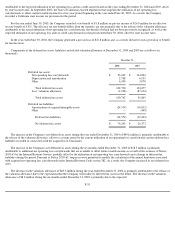

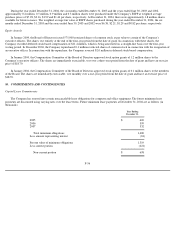

Components of the deferred tax assets, liabilities and related valuation allowance at December 31, 2004 and 2003 are as follows (in

thousands):

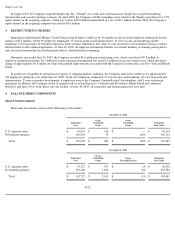

The increase in the Company's net deferred tax assets during the year ended December 31, 2004 of $49.8 million is primarily attributable to

the release of the valuation allowance, offset to a certain extent by the current utilization of net operating loss carryforwards and net deferred tax

liabilities recorded in connection with the acquisition of Classmates.

The increase in the Company's net deferred tax assets during the six months ended December 31, 2003 of $18.3 million is primarily

attributable to additional net operating loss carryforwards that are available to offset future taxable income as a result of the issuance of Notice

2003-65 by the Internal Revenue Service, partially offset by the utilization of net operating loss carryforwards and a change in deferred tax

liabilities during the period. Pursuant to Notice 2003-65, taxpayers were permitted to modify the calculation of the annual limitation associated

with acquired net operating loss carryforwards under Internal Revenue Code section 382. As a result, the Company increased its net deferred tax

asset.

The decrease in the valuation allowance of $85.3 million during the year ended December 31, 2004 is primarily attributable to the release of

the valuation allowance due to the expectation that the Company will realize its deferred tax assets in the future. The decrease in the valuation

allowance of $8.2 million during the six months ended December 31, 2003 is primarily due to the expected

F-31

December 31,

2004

2003

Deferred tax assets:

Net operating loss carryforwards

$

93,602

$

114,804

Depreciation and amortization

2,708

6,195

Other

6,390

3,078

Total deferred tax assets

102,700

124,077

Less: valuation allowance

(1,938

)

(87,212

)

Total deferred tax assets

100,762

36,865

Deferred tax liabilities:

Amortization of acquired intangible assets

(24,559

)

(10,052

)

Other

—

(

440

)

Deferred tax liabilities

(24,559

)

(10,492

)

Net deferred tax assets

$

76,203

$

26,373