Classmates.com 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2004, two customers comprised approximately 18% and 14% of the consolidated accounts receivable balance. At

December 31, 2003, three customers comprised approximately 25%, 16% and 10% of the consolidated accounts receivable balance. For the year

ended December 31, 2004, the six months ended December 31, 2003 and the years ended June 30, 2003 and 2002, the Company did not have

any individual customers that comprised more than 10% of total revenues.

At December 31, 2004 and 2003, the majority of the Company's cash and cash equivalents was maintained primarily with four major

financial institutions in the United States. Deposits with these institutions generally exceed the amount of insurance provided on such deposits.

The Company's business depends substantially on the capacity, affordability, reliability and security of third-party telecommunications and

data service providers. Only a small number of providers offer the network services the Company requires, and the majority of its

telecommunications services is currently purchased from a limited number of vendors. A number of the Company's historical vendors have

ceased operations or ceased offering the services that the Company requires, causing the need to switch vendors. In addition, several vendors

have experienced significant financial difficulties and filed for and emerged from bankruptcy. To the extent vendors experience future

difficulties, they may be unable to perform satisfactorily or to continue to offer their services. Any material disruption of these services could

have a material adverse effect on the Company's financial position, results of operations and cash flows.

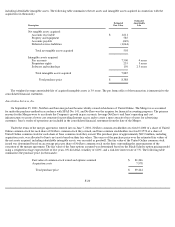

Long-Lived Assets—

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation is computed using the

straight-line method over the estimated useful lives of the assets, which is generally two to three years for computer software and equipment and

three to seven years for furniture, fixtures and office equipment. Leasehold improvements are amortized over the shorter of the lease term or the

estimated useful lives. Upon the sale or retirement of property or equipment, the cost and related accumulated depreciation or amortization is

removed from the Company's financial statements with the resulting gain or loss reflected in the Company's results of operations. Repairs and

maintenance expenses are expensed as incurred.

Definite-lived identifiable intangible assets are amortized over their estimated useful lives, ranging from one to ten years. The Company's

intangible assets were acquired primarily in connection with business combinations (see Note 2).

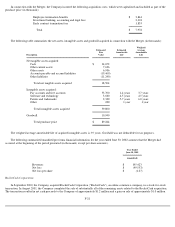

The Company assesses the impairment of long-lived assets, which include property and equipment and intangible assets, whenever events

or changes in circumstances indicate that such assets might be impaired and the carrying value may not be recoverable in accordance with SFAS

No. 144,

Accounting for the Impairment or Disposal of Long-Lived Assets . Events and circumstances that may indicate that an asset is impaired

include significant decreases in the market value of an asset, significant underperformance relative to expected historical or projected future

results of operations, a change in the extent or manner in which an asset is used, significant declines in the Company's stock price for a sustained

period, shifts in technology, loss of key management or personnel, changes in the Company's operating model or strategy and competitive forces.

If events and circumstances indicate that the carrying amount of an asset may not be recoverable and the expected undiscounted future cash

flows attributable to the asset are less than the carrying amount of the asset, an impairment loss equal to the excess of the asset's carrying value

over its fair value is recorded. Fair value is determined based on the present value of estimated expected future cash flows using a discount rate

commensurate with the risk involved, quoted market prices or appraised values, depending on the nature of the assets.

Goodwill— The Company adopted SFAS No. 142, Goodwill and Other Intangible Assets

, on July 1, 2002. Under SFAS No. 142, goodwill

is not amortized, but is tested for impairment at a reporting unit level on an annual basis and between annual tests if an event occurs or

circumstances change that

F-11