Classmates.com 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

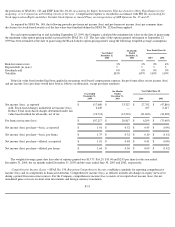

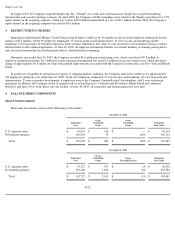

including identifiable intangible assets. The following table summarizes the net assets and intangible assets acquired in connection with the

acquisition (in thousands):

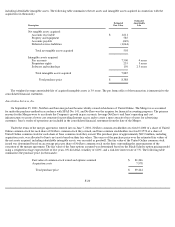

The weighted average amortizable life of acquired intangible assets is 3.9 years. The pro forma effect of the transaction is immaterial to the

consolidated financial statements.

Juno Online Services, Inc.

On September 25, 2001, NetZero and Juno merged and became wholly-owned subsidiaries of United Online. The Merger was accounted

for under the purchase method in accordance with SFAS No. 141, and NetZero was the acquirer for financial accounting purposes. The primary

reasons for the Merger were to accelerate the Company's growth in pay accounts, leverage NetZero's and Juno's operating and cost

infrastructures to create a lower cost structure for providing Internet access and to create a more attractive base of users for advertising

customers. Juno's results of operations are included in the consolidated financial statements from the date of the Merger.

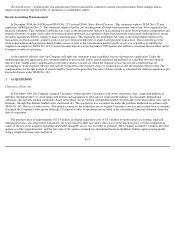

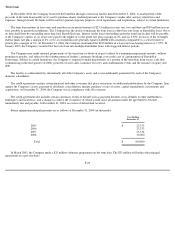

Under the terms of the merger agreement, entered into on June 7, 2001, NetZero common stockholders received 0.2000 of a share of United

Online common stock for each share of NetZero common stock they owned, and Juno common stockholders received 0.3570 of a share of

United Online common stock for each share of Juno common stock they owned. The purchase price of approximately $89.2 million, including

acquisition costs, was allocated to Juno's net assets based on their fair values. The excess of the purchase price over the estimated fair values of

the net assets acquired, including identifiable intangible assets, was recorded as goodwill. The fair value of the United Online common stock

issued was determined based on an average price per share of NetZero common stock on the dates surrounding the announcement of the

execution of the merger agreement. The fair value of the Juno options assumed was determined based on the Black-

Scholes option pricing model

using a weighted average expected life of five years, 0% dividend, volatility of 120%, and a risk-free interest rate of 5%. The following table

summarizes the purchase price (in thousands):

F-20

Description

Estimated

Fair Value

Estimated

Amortizable

Life

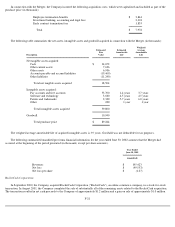

Net tangible assets acquired:

Accounts receivable

$

1,611

Property and equipment

585

Accounts payable

(649

)

Deferred service liabilities

(1,044

)

Total net tangible assets acquired

503

Intangible assets acquired:

Pay accounts

7,500

4 years

Proprietary rights

235

3 years

Software and technology

150

2.5 years

Total intangible assets acquired

7,885

Total purchase price

$

8,388

Fair value of common stock issued and options assumed

$

81,266

Acquisition costs

7,978

Total purchase price

$

89,244