CarMax 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

CARMAX 2005

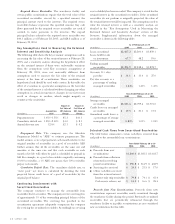

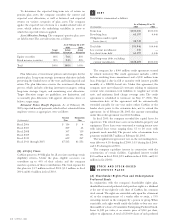

SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)

(In thousands except First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

per share data) 2005 2004 2005 2004 2005 2004 2005 2004 2005 2004

Net sales and

operating revenues $1,324,990 $1,172,835 $1,323,507 $1,236,457 $1,215,711 $1,071,534 $1,396,054 $1,116,865 $5,260,262 $4,597,691

Gross profit $ 167,230 $ 147,771 $ 163,200 $ 163,105 $ 145,446 $ 126,242 $ 174,320 $ 133,770 $ 650,196 $ 570,888

CarMax Auto

Finance income $ 21,816 $ 25,748 $ 20,744 $ 22,677 $ 20,439 $ 17,649 $ 19,657 $ 18,889 $ 82,656 $ 84,963

Selling, general, and

administrative

expenses $ 130,688 $ 115,553 $ 134,726 $ 120,714 $ 137,170 $ 114,282 $ 143,993 $ 117,825 $ 546,577 $ 468,374

Gain (loss) on

franchise dispositions $—$—$ (11) $ (460) $ 692 $ 1,207 $ (48) $ 1,580 $ 633 $ 2,327

Net earnings $ 35,330 $ 35,260 $ 29,859 $ 39,610 $ 18,045 $ 19,053 $ 29,694 $ 22,526 $ 112,928 $ 116,450

Net earnings per share:

Basic $ 0.34 $ 0.34 $ 0.29 $ 0.38 $ 0.17 $ 0.18 $ 0.28 $ 0.22 $ 1.09 $ 1.13

Diluted $ 0.33 $ 0.34 $ 0.28 $ 0.37 $ 0.17 $ 0.18 $ 0.28 $ 0.21 $ 1.07 $ 1.10

17

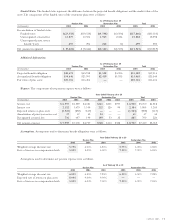

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the company.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Accordingly, even

effective internal control over financial reporting can provide only reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework

and criteria established in Internal Control—Integrated Framework, issued by the Committee of Sponsoring Organizations of the

Treadway Commission. Based on this evaluation, our management has concluded that our internal control over financial reporting

was effective as of February 28, 2005.

KPMG LLP, the company’s independent registered public accounting firm, has issued a report on our management’s assessment of

our internal control over financial reporting. This report is included herein.

AUSTIN LIGON

PRESIDENT AND CHIEF EXECUTIVE OFFICER

KEITH D. BROWNING

EXECUTIVE VICE PRESIDENT AND

CHIEF FINANCIAL OFFICER

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING