CarMax 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

CARMAX 2005

Selling, General, and Administrative Expenses

The SG&A ratio was 10.4% in fiscal 2005, 10.2% in fiscal 2004,

and 9.9% in fiscal 2003. As anticipated, the fiscal 2005, 2004,

and 2003 SG&A ratios were adversely affected by the

continuation of our store growth plan. During these three

years, newer stores comprised an increasing percentage of our

store base. New stores typically experience higher SG&A ratios

during their first several years of operation. Additionally, the

increase in the fiscal 2005 SG&A ratio reflects the deleveraging

impact of lower comparable store unit sales experienced during

the first half of the fiscal year.

The increases in the fiscal 2005, fiscal 2004, and fiscal 2003

SG&A ratios also reflect the expected higher level of operating

expenses associated with being a standalone company following

the October 1, 2002, separation from Circuit City. We estimate

standalone costs were approximately $3.0 million to $4.0

million higher in fiscal 2005 than in fiscal 2004, and

approximately $13.5 million higher in fiscal 2004 than in fiscal

2003. A majority of these costs related to employee benefits and

insurance. The SG&A ratio for fiscal 2003 also included costs of

$7.8 million associated with the separation of CarMax from

Circuit City. Excluding these costs, the SG&A ratio would have

been 9.7% in fiscal 2003.

Accounting for Leases

In February 2005, the Securities and Exchange Commission

(“SEC”) issued an open letter addressing issues regarding

public companies’ accounting for leases and leasing activities.

Of specific concern to the SEC were the appropriate

accounting for the amortization of leasehold improvements,

periods of free or reduced rents (“rent holidays”), and

incentives provided by a lessor related to leasehold

improvements. CarMax has reviewed its accounting for leases

with regard to the SEC’s specific concerns and compliance

with generally accepted accounting principles. As a result of

our review, in the fourth quarter of fiscal 2005, we recognized

cumulative expenses of $1.5 million before tax, or $0.01 per

share, and recorded capital lease obligations and property and

equipment of approximately $17.3 million. The impact on

our consolidated financial statements for fiscal 2005 and prior

fiscal years was immaterial.

Income Taxes

The effective income tax rate was 38.8% in fiscal year 2005,

38.5% in fiscal 2004, and 39.5% in fiscal 2003. The fiscal 2005

increase resulted from geographic expansion into states with

higher income tax rates, including having a larger percentage of

stores located in unitary tax states. The higher fiscal 2003

effective tax rate included the impact of non-tax-deductible

costs associated with the October 1, 2002, separation from

Circuit City.

OPERATIONS OUTLOOK

Changes in Store Base

During the fiscal year ending February 28, 2006, we plan to

expand our used car superstore base by approximately 16%,

opening nine used car superstores. Planned entries into new

mid-sized markets include Jacksonville, Fla.;Wichita, Kans.; Salt

Lake City, Utah; and Virginia Beach, Va. Satellite superstore

additions are planned for Miami, Fla.; Kansas City, Mo.; and

Nashville, Tenn. In early fiscal 2006, we added a standard

superstore and a satellite superstore in the Los Angeles market.

Fiscal 2006 Expectations

The fiscal 2006 expectations discussed below are based on

historical and current trends in our business and should be read

in conjunction with the “Cautionary Information About

Forward-Looking Statements” section of this MD&A.

Fiscal 2006 Comparable Store Used Unit Growth. Assuming

continuing healthy sales performance, we expect fiscal 2006

comparable store used unit growth in the range of 5% to 9%.

We expect that the growth will be stronger in the first half of

the fiscal year due to the relatively low level of comparable store

used unit sales performance in the first half of fiscal 2005. Some

of the economic and market factors that may have affected our

sales in the first half of fiscal 2005 are still present in the market,

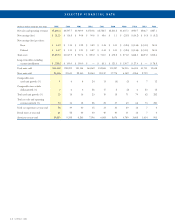

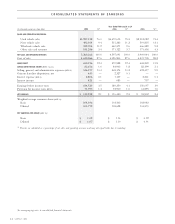

SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)

(In thousands First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

except per share data) 2005 2004 2005 2004 2005 2004 2005 2004 2005 2004

Net sales and

operating revenues $1,324,990 $1,172,835 $1,323,507 $1,236,457 $1,215,711 $1,071,534 $1,396,054 $1,116,865 $5,260,262 $4,597,691

Gross profit $ 167,230 $ 147,771 $ 163,200 $ 163,105 $ 145,446 $ 126,242 $ 174,320 $ 133,770 $ 650,196 $ 570,888

CarMax Auto

Finance income $ 21,816 $ 25,748 $ 20,744 $ 22,677 $ 20,439 $ 17,649 $ 19,657 $ 18,889 $ 82,656 $ 84,963

Selling, general,

and administrative

expenses $ 130,688 $ 115,553 $ 134,726 $ 120,714 $ 137,170 $ 114,282 $ 143,993 $ 117,825 $ 546,577 $ 468,374

Gain (loss) on

franchise dispositions $—$—$ (11) $ (460) $ 692 $ 1,207 $ (48) $ 1,580 $ 633 $ 2,327

Net earnings $ 35,330 $ 35,260 $ 29,859 $ 39,610 $ 18,045 $ 19,053 $ 29,694 $ 22,526 $ 112,928 $ 116,450

Net earnings per share:

Basic $ 0.34 $ 0.34 $ 0.29 $ 0.38 $ 0.17 $ 0.18 $ 0.28 $ 0.22 $ 1.09 $ 1.13

Diluted $ 0.33 $ 0.34 $ 0.28 $ 0.37 $ 0.17 $ 0.18 $ 0.28 $ 0.21 $ 1.07 $ 1.10