CarMax 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2005

19

Revenue Recognition

We recognize revenue when the earnings process is complete,

generally either at the time of sale to a customer or upon

delivery to a customer. The majority of our revenue is

generated from the sale of used vehicles. We recognize vehicle

revenue when a sales contract has been executed and the

vehicle has been delivered, net of a reserve for returns under our

5-day or 250-mile, money-back guarantee. A reserve for vehicle

returns is recorded based on historical experience and trends.

We also sell extended service plans on behalf of unrelated

third parties to customers who purchase a vehicle. Because

these third parties are the primary obligors under these

programs, we recognize commission revenue on the extended

service plans at the time of the sale, net of a reserve for

estimated service plan returns. The estimated reserve for returns

is based on historical experience and trends.

The estimated reserves for returns could be affected if future

occurrences differ from historical averages.

Income Taxes

Estimates and judgments are used in the calculation of certain

tax liabilities and in the determination of the recoverability of

certain of the deferred tax assets. In the ordinary course of

business, many transactions occur for which the ultimate tax

outcome is uncertain at the time of the transactions. We adjust

our income tax provision in the period in which we determine

that it is probable that our actual results will differ from our

estimates. Tax law and rate changes are reflected in the income

tax provision in the period in which such changes are enacted.

We evaluate the need to record valuation allowances that

would reduce deferred tax assets to the amount that will more

likely than not be realized. When assessing the need for

valuation allowances, we consider future reversals of existing

temporary differences and future taxable income. We believe

that all of our recorded deferred tax assets as of February 28,

2005, will more likely than not be realized. However, if a change

in circumstances results in a change in our ability to realize our

deferred tax assets, our tax provision would increase in the

period when the change in circumstances occurs.

In addition, the calculation of our tax liabilities involves

dealing with uncertainties in the application of complex tax

regulations. We recognize potential liabilities for anticipated tax

audit issues in the U.S. and other tax jurisdictions based on our

estimate of whether, and the extent to which, additional taxes

will be due. If payments of these amounts ultimately prove to

be unnecessary, the reversal of the liabilities would result in tax

benefits being recognized in the period when we determine the

liabilities are no longer necessary. If our estimate of tax

liabilities proves to be less than the ultimate assessment, a further

charge to expense would result in the period of determination.

Information regarding income taxes is presented in Note 7

to the company’s consolidated financial statements.

Defined Benefit Retirement Plan

The plan obligations and related assets of our defined benefit

retirement plan are presented in Note 8 to the company’s

consolidated financial statements. Plan assets, which consist

primarily of marketable equity and debt instruments, are valued

using current market quotations. Plan obligations and the

annual pension expense are determined by independent

actuaries using a number of assumptions provided by the

company. Key assumptions used to measure the plan obligations

include the discount rate, the rate of salary increases, and the

estimated future return on plan assets. In determining the

discount rate, we use the current yield on high-quality, fixed-

income investments that have maturities corresponding to the

anticipated timing of the benefit payments. Salary increase

assumptions are based upon historical experience and

anticipated future board and management actions. Asset returns

are estimated based upon the anticipated average yield on the

plan assets. We do not believe that any significant changes in

assumptions used to measure the plan obligations are likely to

occur that would have a material impact on the company’s

financial position or results of operations.

RESULTS OF OPERATIONS

Certain prior year amounts have been reclassified to conform to

the current year’s presentation.

Net Sales and Operating Revenues

The components of net sales and operating revenues are

presented in Table 1.

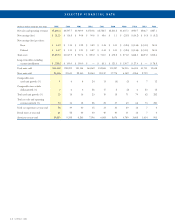

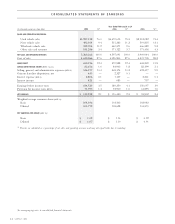

TABLE 1 — NET SALES AND OPERATING REVENUES

Years Ended February 28 or 29

(In millions) 2005 % 2004 % 2003 %

Used vehicle sales $3,997.2 76.0 $3,470.6 75.5 $2,912.1 73.4

New vehicle sales 492.1 9.4 515.4 11.2 519.8 13.1

Wholesale vehicle sales 589.7 11.2 440.6 9.6 366.6 9.2

Other sales and revenues:

Extended service plan revenues 84.6 1.6 77.1 1.7 68.1 1.7

Service department sales 82.3 1.6 69.1 1.5 58.6 1.5

Third-party finance fees, net 14.4 0.3 19.6 0.4 16.2 0.4

Appraisal purchase processing fees —— 5.3 0.1 28.5 0.7

Total other sales and revenues 181.3 3.4 171.1 3.7 171.4 4.3

Total net sales and operating revenues $5,260.3 100.0 $4,597.7 100.0 $3,969.9 100.0