CarMax 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2005

25

including rising gasoline prices, increasing interest rates,

wholesale vehicle prices rising somewhat faster than seasonal

norms, and the potential for unpredictable new car

manufacturer incentive behavior.

Fiscal 2006 Earnings Per Share. We currently expect fiscal

2006 earnings per share in the range of $1.20 to $1.30. We

expect CAF income to increase only slightly from the fiscal

2005 level, as projected continuing interest rate increases will

likely cause our cost of funds to once again rise more rapidly

than consumer rates. Consequently, we expect CAF’s gain

spread for fiscal 2006 to be slightly below the normalized range

of 3.5% to 4.5%.

Our earnings expectations also reflect the cost to roll out

marketwide advertising in Los Angeles for the first time as we

open our fifth L.A. store. Finally, we expect between $2 million

and $3 million in incremental costs related to separating our data

center operation from Circuit City—the last cost expected to

be added as a result of the separation. As a consequence of these

higher costs, we would expect to see modest SG&A leverage

only if we achieve the upper end of our expected comparable

store used unit growth range. We currently expect our effective

tax rate in fiscal 2006 to be approximately 38.4%.

We plan to adopt SFAS 123R, “Share-Based Payment,”

which modifies SFAS 123, “Accounting for Stock-Based

Compensation,” in fiscal 2007, beginning March 1, 2006. This

revised accounting standard requires that all stock-based

compensation, including grants of employee stock options, be

accounted for using a fair-value-based method and recorded

as a charge to earnings. The company is in the process of

determining the effect of adopting SFAS 123R.

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements

applicable to the company, see Note 14 to the company’s

consolidated financial statements.

FINANCIAL CONDITION

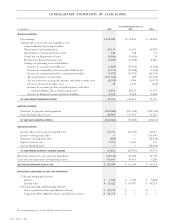

Operating Activities

We generated net cash from operating activities of $44.7 million

in fiscal 2005, $148.5 million in fiscal 2004, and $72.0 million in

fiscal 2003. The fiscal 2005 decline primarily resulted from an

increase in inventory, due to the addition of nine used car

superstores during the year, three stores opened shortly after the

end of the fiscal year, and inventory to support expected

comparable store used unit growth. The fiscal 2004

improvement primarily resulted from the increase in net

earnings and a slight decrease in inventory, despite having added

nine used car superstores during the year. The decrease in

inventory in fiscal 2004 reflected the combined effects of a

higher-than-normal inventory balance at the end of fiscal 2003

resulting from weather-impeded sales in February 2003 and the

disposal of four new car franchises during the fiscal year.

Investing Activities

Net cash used in investing activities was $141.1 million in fiscal

2005, $73.8 million in fiscal 2004, and $80.4 million in fiscal

2003. Capital expenditures were $230.1 million in fiscal 2005,

$181.3 million in fiscal 2004, and $122.0 million in fiscal 2003.

The increase in capital expenditures reflects the increase in our

store base associated with our growth plan. Additionally, a

portion of the capital spending in fiscal 2005 and fiscal 2004

was associated with the construction of new corporate offices in

Richmond, Va.

Capital expenditures are funded through sale-leaseback

transactions, short- and long-term debt, and internally generated

funds. Net proceeds from sales of assets totaled $89.0 million in

fiscal 2005, $107.5 million in fiscal 2004, and $41.6 million in

fiscal 2003. The majority of the sale proceeds relate to sale-

leaseback transactions. In fiscal 2005, we entered into sale-

leaseback transactions involving seven superstore properties

valued at approximately $84.0 million. In fiscal 2004, we entered

into sale-leaseback transactions involving nine superstore

properties valued at a total of $107.0 million. In fiscal 2003, we

entered into one sale-leaseback transaction involving three

superstore properties valued at approximately $37.6 million.

These transactions were structured with initial lease terms of

either 15 or 20 years with four, five-year renewal options. At

February 28, 2005, we owned six superstores currently in

operation, as well as land and construction-in-progress related to

several planned superstores. In addition, we have five superstores

that have been accounted for as capital leases.

In fiscal 2006, we anticipate gross capital expenditures of

approximately $250 million. Planned expenditures primarily

relate to new store construction, including furniture, fixtures,

and equipment; land purchases associated with future year store

openings; new corporate offices; and leasehold improvements to

existing properties. We expect to open nine used car superstores

during fiscal 2006.

Financing Activities

Net cash provided by financing activities was $63.8 million in

fiscal 2005. In fiscal 2004, net cash used in financing activities

was $47.6 million, compared with net cash provided of $39.8

million in fiscal 2003. In fiscal 2005, we increased short-term

debt by $60.8 million primarily to fund increased inventory. In

fiscal 2004, we used cash generated from operations to reduce

total outstanding debt by $51.6 million. In fiscal 2003, we

increased total outstanding debt by $67.6 million and paid a

one-time dividend of $28.4 million to Circuit City in

conjunction with the separation transaction.

The aggregate principal amount of automobile loan

receivables funded through securitizations, which are discussed in

Notes 3 and 4 to the company’s consolidated financial statements,

totaled $2.43 billion at February 28, 2005, $2.20 billion at

February 29, 2004, and $1.86 billion at February 28, 2003.

During fiscal 2005, we completed two public automobile loan

securitizations totaling $1.15 billion. At February 28, 2005, the

warehouse facility limit was $825.0 million and unused

warehouse capacity totaled $162.5 million. The warehouse

facility matures in June 2005. Note 2(C) and Note 4 to the

company’s consolidated financial statements include a discussion

of the warehouse facility. We anticipate that we will be able to

renew, expand, or enter into new securitization arrangements to

meet the future needs of the automobile finance operation.