CarMax 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

CARMAX 2005

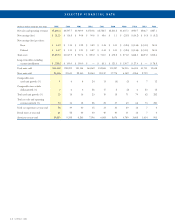

Retail vehicle sales changes were as follows:

Years Ended February 28 or 29

2005 2004 2003

Vehicle units:

Used vehicles 13 % 18 % 16 %

New vehicles (5)% (3)% (7)%

Total 11 % 16 % 13 %

Vehicle dollars:

Used vehicles 15 % 19 % 17 %

New vehicles (5)% (1)% (7)%

Total 13 % 16 % 12 %

Comparable store used unit sales growth is one of the key

drivers of our profitability. A CarMax store is included in

comparable store sales in the store’s fourteenth full month of

operation. Comparable store retail sales changes were as follows:

Years Ended February 28 or 29

2005 2004 2003

Vehicle units:

Used vehicles 1% 6 % 8 %

New vehicles 8% (1)% (3)%

Total 1% 5 % 6 %

Vehicle dollars:

Used vehicles 3% 7 % 8 %

New vehicles 8% 1 % (3)%

Total 3% 6 % 6 %

Used Vehicle Sales. The increases in used vehicle sales of 15%

in fiscal 2005 and 19% in fiscal 2004 primarily reflect the

opening of used car superstores not yet in our comparable store

base. We opened five used car superstores in fiscal 2003, nine in

fiscal 2004, and nine in fiscal 2005. During the first half of fiscal

2005, we experienced widespread volatility and softness in our

used car business during the peak spring and summer selling

season. We believe the soft market environment was the result of

economic and other factors such as high gas prices; the intense

competition and unpredictable incentive behavior among new

car manufacturers; higher wholesale vehicle prices resulting, in

part, from fewer off-lease vehicles; and severe weather in the

southeastern United States. In the second half of fiscal 2005,

used vehicle sales growth increased as many of the factors that

appeared to cause the first half weakness abated. We experienced

the strongest sales growth of the fiscal year in the fourth quarter,

reinforcing our belief that the softness experienced during the

first half of the year was due to external factors and was not

indicative of issues related to the execution of our consumer

offer, nor to the pressures of geographic expansion.

Following a nine-month test in selected stores, in August

2004 we added DRIVE Financial Services to our group of

third-party lenders. DRIVE provides subprime financing.

DRIVE-financed sales added approximately 3% to our total

used unit sales in fiscal 2005. We believe these were

incremental sales that we previously would not have been able

to finance. DRIVE-financed sales were highest in our fourth

fiscal quarter, coinciding with the income tax-refund season.

The fiscal 2004 used vehicle sales increase was due to the

growth in comparable store used unit sales that resulted from

strong sales execution and marketing programs, as well as the

return to historical levels of nonprime approval rates by third-

party lenders following the lower approval rates experienced

in the fourth quarter of fiscal 2003.

New Vehicle Sales. New vehicle sales were generally in line

with industry performance for the core brands we represent—

Chevrolet, DaimlerChrysler, Nissan, and Toyota. Declines in

total new car sales and units are due primarily to the disposition

of five new car franchises in fiscal 2005, four in fiscal 2004, and

one in fiscal 2003.

Wholesale Vehicle Sales. Our operating strategy is to build

customer satisfaction by offering high-quality vehicles. Fewer

than half of the vehicles acquired from consumers through the

appraisal purchase process meet our standards for

reconditioning and subsequent retail sale. Those vehicles that

do not meet our standards are sold at our on-site wholesale

auctions. Total wholesale vehicle units sold at these auctions

were 155,393 in fiscal 2005; 127,168 in fiscal 2004; and 104,593

in fiscal 2003.

In fiscal 2005, the increase in wholesale vehicle sales as a

percentage of total net sales and operating revenues was due in

large part to enhancements to the processes that our sales

consultants use to deliver appraisals to customers and our

systems support for buyers.We believe that these enhancements

have contributed to the continuing increase in our rate of

appraisal purchases completed per appraisal offers made.

Additionally, higher average wholesale prices added to the

wholesale vehicle sales increases. In fiscal 2004, the growth in

wholesale vehicle sales reflected in part an increase in wholesale

appraisal traffic resulting from increased consumer response to

our vehicle appraisal offer.

Other Sales and Revenues. Other sales and revenues include

extended service plan revenues, service department sales, third-

party finance fees, and, through the second quarter of fiscal

2004, appraisal purchase processing fees collected from

customers on the purchase of their vehicles.

During the second quarter of fiscal 2004, the appraisal

purchase processing fees were replaced with an alternative

method for recovering the costs of our appraisal and wholesale

operations. Under the revised appraisal cost recovery (“ACR”)

method, instead of charging the customer the appraisal purchase

processing fee, we adjust the price of our purchase offer to allow

for full recovery of our costs, thereby reducing the acquisition