CarMax 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

CARMAX 2005

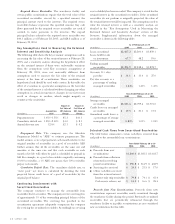

To determine the expected long-term rate of return on

pension plan assets, the company considers the current and

expected asset allocations, as well as historical and expected

returns on various categories of plan assets. The company

applies the expected rate of return to a market-related value of

assets, which reduces the underlying variability in assets to

which the expected return is applied.

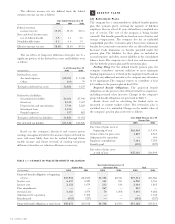

Asset Allocation Strategy. The company’s pension plan assets

are held in trust.The asset allocation was as follows:

As of February 28 or 29

2005 2004

Target Actual Actual

Allocation Allocation Allocation

Equity securities 80% 76% 80%

Fixed income securities 20% 24% 20%

Total 100% 100% 100%

Plan fiduciaries set investment policies and strategies for the

pension plan. Long-term strategic investment objectives include

preserving the funded status of the trust and balancing risk and

return. The plan fiduciaries oversee the investment allocation

process, which includes selecting investment managers, setting

long-term strategic targets, and monitoring asset allocations.

Target allocation ranges are guidelines, not limitations, and

occasionally plan fiduciaries will approve allocations above or

below a target range.

Estimated Future Benefit Payments. As of February 28,

2005, expected benefit payments, which reflect estimated future

employee service, as appropriate, were as follows:

Pension Restoration

(In thousands) Plan Plan

Fiscal 2006 $ 136 $ 4

Fiscal 2007 209 65

Fiscal 2008 307 119

Fiscal 2009 433 193

Fiscal 2010 609 237

Fiscal 2011 through 2015 $7,535 $1,553

(B) 401(k) Plans

CarMax sponsors a 401(k) plan for all associates meeting certain

eligibility criteria. Under the plan, eligible associates can

contribute up to 40% of their salaries, and the company

matches a portion of those contributions. The total expense for

this plan was $1.7 million in fiscal 2005, $1.1 million in fiscal

2004, and $1.0 million in fiscal 2003.

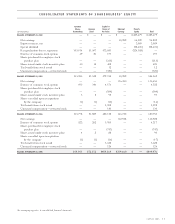

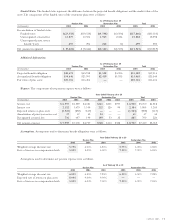

DEBT

Total debt is summarized as follows:

As of February 28 or 29

(In thousands) 2005 2004

Term loan $100,000 $100,000

Revolving loan 65,197 4,446

Obligations under capital

leases [Note 12] 28,749 —

Total debt 193,946 104,446

Less current installments 330 —

Less short-term debt 65,197 4,446

Total long-term debt, excluding

current installments $128,419 $100,000

The company has a $300 million credit agreement secured

by vehicle inventory. The credit agreement includes a $200

million revolving loan commitment and a $100 million term

loan. Principal is due in full at maturity with interest payable

monthly at a LIBOR-based rate. Under this agreement, the

company must meet financial covenants relating to minimum

current ratio, maximum total liabilities to tangible net worth

ratio, and minimum fixed charge coverage ratio. The credit

agreement is scheduled to terminate on May 17, 2006. The

termination date of the agreement will be automatically

extended annually for one year unless either CarMax or the

lender elects, prior to the extension date, not to extend the

agreement. As of February 28, 2005, the amount outstanding

under this credit agreement was $165.2 million.

In fiscal 2005, the company recorded five capital leases for

superstores. The related lease assets are included in property and

equipment. These leases were structured at varying interest rates

with initial lease terms ranging from 15 to 20 years with

payments made monthly. The present value of minimum lease

payments totaled $28.7 million at February 28, 2005.

The weighted average interest rate on the outstanding short-

term debt was 4.3% during fiscal 2005, 3.5% during fiscal 2004,

and 3.2% during fiscal 2003.

The company capitalizes interest in connection with the

construction of certain facilities. Capitalized interest totaled

$3.5 million in fiscal 2005, $2.5 million in fiscal 2004, and $1.0

million in fiscal 2003.

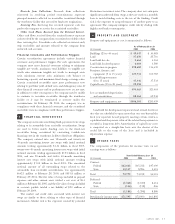

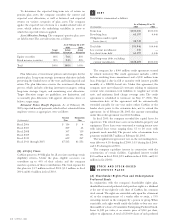

STOCK AND STOCK-BASED

INCENTIVE PLANS

(A) Shareholder Rights Plan and Undesignated

Preferred Stock

In conjunction with the company’s shareholder rights plan,

shareholders received preferred stock purchase rights as a dividend

at the rate of one right for each share of CarMax, Inc. common

stock owned. The rights are exercisable only upon the attainment

of, or the commencement of a tender offer to attain, a 15%

ownership interest in the company by a person or group. When

exercisable, each right would entitle the holder to buy one one-

thousandth of a share of Cumulative Participating Preferred Stock,

Series A, $20 par value, at an exercise price of $140 per share,

subject to adjustment. A total of 120,000 shares of such preferred

9

10