CarMax 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

CARMAX 2005

Fiscal 2005 Highlights

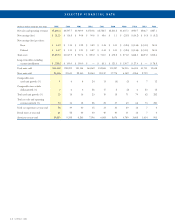

3Net sales and operating revenues increased 14% to $5.26 billion

in fiscal 2005 from $4.60 billion in fiscal 2004, while net

earnings decreased 3% to $112.9 million, or $1.07 per share,

from $116.5 million, or $1.10 per share.

3We opened nine used car superstores, including four standard-

sized stores in new markets and one standard-sized store and

four satellite stores in existing markets.

3Total used units increased 13%, primarily reflecting the

growth in the store base.

3Comparable store used units increased 1%.We experienced

widespread sales volatility and softness in the first half of the

year, caused, we believe, by a variety of external factors. Our

business rebounded in the second half of the year, as many of

these factors abated and we were able to convert stronger

customer traffic levels into renewed sales and earnings

growth. In addition, we benefited from the mid-year rollout

of a third-party finance provider focused on subprime-rated

customers, a segment that previously could not be financed

at CarMax.

3Our total gross profit margin was 12.4%, equal to the prior

year, and our gross profit dollars per unit climbed slightly to

$2,375 in fiscal 2005 from $2,323 in fiscal 2004.

3CAF income was $82.7 million, 3% below the prior year, as

the benefit of the growth in originations and managed

receivables was more than offset by the decline in the gain as

a percentage of loans sold (“gain spread”) to 3.8% in fiscal

2005 from 4.7% in fiscal 2004. The gain spread represents

the difference between average interest rates charged

customers and our cost of funds.

3Selling, general, and administrative expenses as a percent of

net sales and operating revenues (the “SG&A ratio”)

increased to 10.4% in fiscal 2005 from 10.2% in fiscal 2004,

reflecting the deleveraging effect of our first-half comparable

store sales declines and the growing proportion of our store

base that is comprised of stores not yet at base maturity.

Stores generally have higher SG&A ratios during their first

several years of operation.

3We completed sale-leaseback transactions covering seven

stores for total proceeds of $84.0 million.

3Net cash provided by operations decreased to $44.7 million

in fiscal 2005 from $148.5 million in fiscal 2004. The

decrease primarily resulted from a $110.5 million increase in

inventory in fiscal 2005, which included inventory for the

nine stores opened during the fiscal year, three stores opened

shortly after the end of the fiscal year, and inventory to

support expected comparable store sales growth. In fiscal

2004, inventory levels remained relatively unchanged from

those at the start of the year, despite opening nine stores

during the year, as we were able to successfully reduce excess

inventory that existed at the start of fiscal 2004. The excess

inventory resulted from the adverse impact of severe weather

on sales at the end of fiscal 2003.

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in

the company’s consolidated financial statements have been

prepared in accordance with accounting principles generally

accepted in the United States of America. Preparation of

financial statements requires management to make estimates

and assumptions affecting the reported amounts of assets,

liabilities, revenues, expenses, and the disclosures of contingent

assets and liabilities. We use our historical experience and other

relevant factors when developing our estimates and

assumptions. We continually evaluate these estimates and

assumptions. Note 2 to the company’s consolidated financial

statements includes a discussion of significant accounting

policies. The accounting policies discussed below are the ones

we consider critical to an understanding of the company’s

consolidated financial statements because their application

places the most significant demands on our judgment. Our

financial results might have been different if different

assumptions had been used or other conditions had prevailed.

Securitization Transactions

We use a securitization program to fund substantially all of the

automobile loan receivables originated by CAF. The

securitization transactions are accounted for as sales in

accordance with Statement of Financial Accounting Standards

(“SFAS”) No. 140, “Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities.” A gain,

recorded at the time of the securitization transaction, results

from recording a receivable equal to the present value of the

expected residual cash flows generated by the securitized

receivables. The fair value of our retained interest in

securitization transactions includes the present value of the

expected residual cash flows generated by the securitized

receivables, the restricted cash on deposit in various reserve

accounts, and an undivided ownership interest in the receivables

securitized through a warehouse facility and certain public

securitizations.

The present value of the expected residual cash flows

generated by the securitized receivables is determined by

estimating the future cash flows using management’s

assumptions of key factors, such as finance charge income,

default rates, prepayment rates, and discount rates appropriate

for the type of asset and risk. These assumptions are derived

from historical experience and projected economic trends.

Adjustments to one or more of these assumptions may have a

material impact on the fair value of the retained interest. The

fair value of the retained interest may also be affected by

external factors, such as changes in the behavior patterns of

customers, changes in the economy, and developments in the

interest rate markets. Note 2(C) to the company’s consolidated

financial statements includes a discussion of accounting policies

related to securitizations. Note 4 to the company’s consolidated

financial statements includes a discussion of securitizations and

provides a sensitivity analysis showing the hypothetical effect on

the retained interest if there were variations from the

assumptions used. In addition, see the “CarMax Auto Finance

Income” section of this MD&A for a discussion of the impact

of changing our assumptions.