CarMax 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2005

33

to new car inventory cost when achievement of volume

thresholds is determined to be probable.

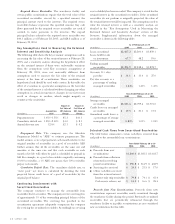

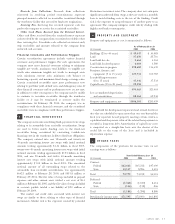

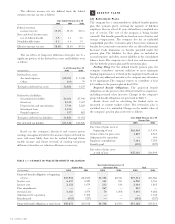

(G) Property and Equipment

Property and equipment is stated at cost less accumulated

depreciation and amortization. Depreciation and amortization

are calculated using the straight-line method over the assets’

estimated useful lives. Property held under capital lease is stated

at the lower of the present value of the minimum lease

payments at the inception of the lease or market value and is

amortized on a straight-line basis over the lease term or the

estimated useful life of the asset, whichever is shorter.

(H) Computer Software Costs

External direct costs of materials and services used in the

development of internal-use software and payroll and payroll-

related costs for employees directly involved in the development

of internal-use software are capitalized. Amounts capitalized are

amortized on a straight-line basis over a period of five years.

(I) Goodwill and Intangible Assets

The company reviews goodwill and intangible assets for

impairment annually or when circumstances indicate the

carrying amount may not be recoverable. As of February 28,

2005, and February 29, 2004, no impairment of goodwill or

intangible assets resulted from the annual impairment tests.

(J) Defined Benefit Plan Obligations

Defined benefit retirement plan obligations are included in

accrued expenses and other current liabilities on the company’s

consolidated balance sheets. The defined benefit retirement

plan obligations are determined by independent actuaries using

a number of assumptions provided by the company. Key

assumptions used in measuring the plan obligations include the

discount rate, the rate of salary increases, and the estimated

future return on plan assets.

(K) Insurance Liabilities

Insurance liabilities are included in accrued expenses and other

current liabilities on the company’s consolidated balance sheets.

The company uses a combination of insurance and self-insurance

for a number of risks including workers’ compensation, general

liability, and employee-related health care benefits, a portion of

which is paid by associates. Estimated insurance liabilities are

determined by considering historical claims experience,

demographic factors, and other actuarial assumptions.

(L) Impairment or Disposal of Long-Lived Assets

The company reviews long-lived assets for impairment when

circumstances indicate the carrying amount of an asset may not

be recoverable. Impairment is recognized when the sum of

undiscounted estimated future cash flows expected to result

from the use of the asset is less than the carrying value.

(M) Store Opening Expenses

Costs relating to store openings, including preopening costs, are

expensed as incurred.

(N) Income Taxes

Deferred income taxes reflect the impact of temporary

differences between the amounts of assets and liabilities

recognized for financial reporting purposes and the amounts

recognized for income tax purposes, measured by applying

currently enacted tax laws. A deferred tax asset is recognized if

it is more likely than not that a benefit will be realized. Tax law

and rate changes are reflected in the income tax provision in the

period in which such changes are enacted.

(O) Revenue Recognition

The company recognizes revenue when the earnings process is

complete, generally either at the time of sale to a customer or

upon delivery to a customer. As part of its customer service

strategy, the company guarantees the vehicles it sells with a 5-day

or 250-mile, money-back guarantee. If a customer returns the

vehicle purchased within the limits of the guarantee, the

company will refund the customer’s money. A reserve for returns

is recorded based on historical experience and trends.

The company sells extended service plans on behalf of

unrelated third parties. These service plans have terms of

coverage from 12 to 72 months. Because these third parties are

the primary obligors under these service plans, commission

revenue is recognized at the time of sale, net of a reserve for

estimated customer returns of the service plans. The reserve for

returns is based on historical experience and trends.

(P) Advertising Expenses

All advertising costs are expensed as incurred. Advertising expenses

are included in selling, general, and administrative expenses in

the accompanying consolidated statements of earnings.

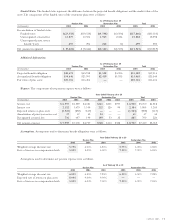

(Q) Net Earnings Per Share

Basic net earnings per share is computed by dividing net

earnings by the weighted average number of shares of common

stock outstanding. Diluted net earnings per share is computed

by dividing net earnings by the sum of the weighted average

number of shares of common stock outstanding and dilutive

potential common stock.

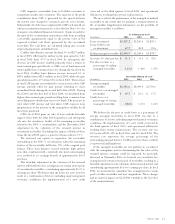

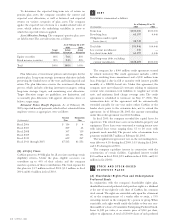

(R) Stock-Based Compensation

The company accounts for its stock-based compensation plans

under the recognition and measurement principles of

Accounting Principles Board (“APB”) Opinion No. 25,

“Accounting for Stock Issued to Employees,” and related

interpretations. Under this opinion and related interpretations,

compensation expense is recorded on the date of grant and

amortized over the period of service only if the market value of

the underlying stock on the grant date exceeds the exercise

price. No stock option-based employee compensation cost is

reflected in net earnings, as options granted under those plans

had exercise prices equal to the market value of the underlying

common stock on the date of grant. The following table

illustrates the effect on net earnings and net earnings per share

as if the fair-value-based method of accounting had been