CarMax 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2005

31

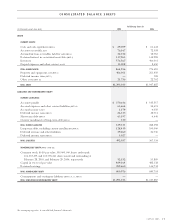

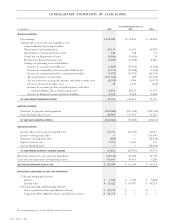

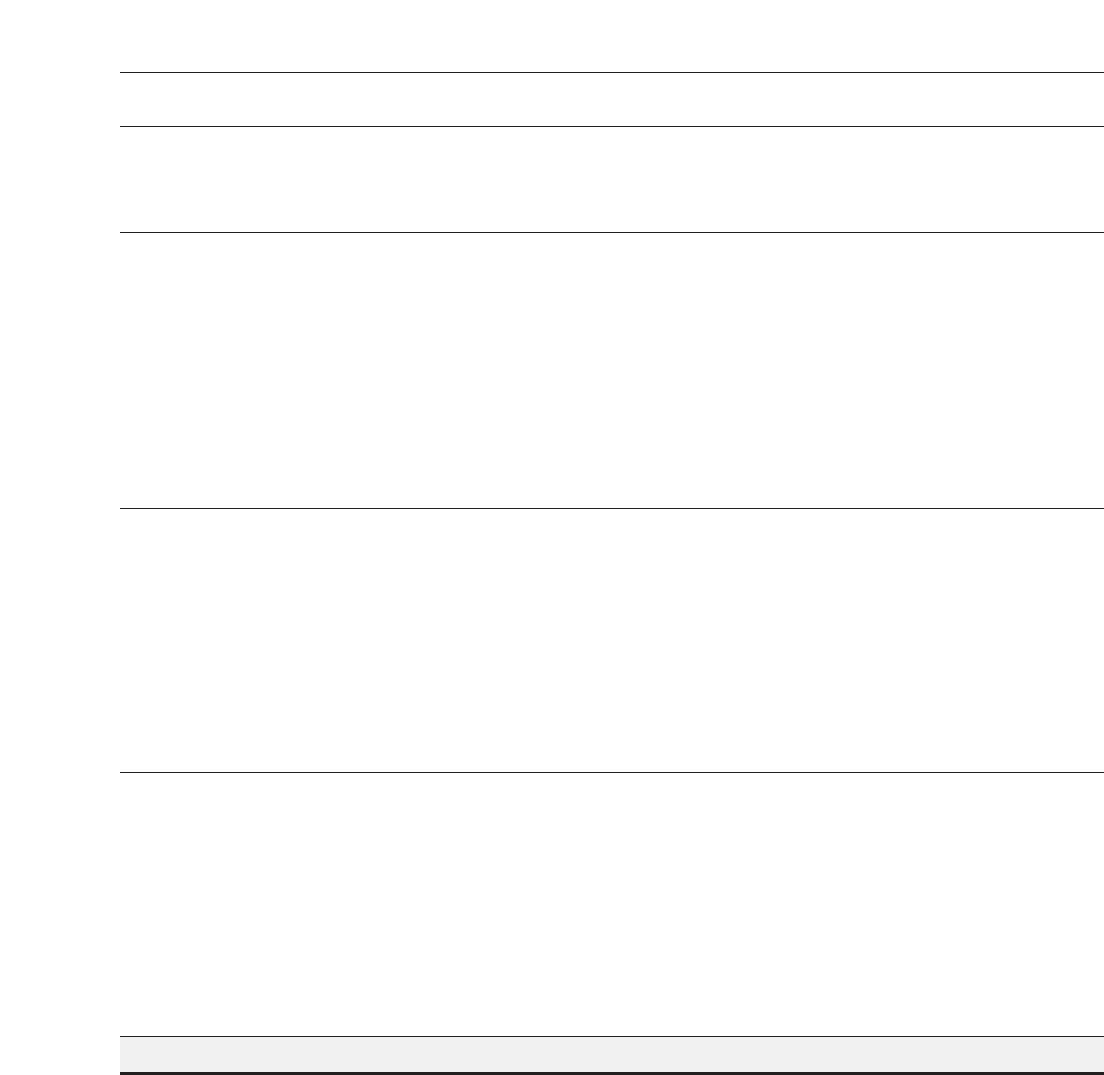

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Common Capital in

Shares Common Excess of Retained Parent’s

(In thousands)

Outstanding Stock Par Value Earnings Equity Total

BALANCE AT FEBRUARY 28, 2002

— $ — $ — $ — $ 485,479 $ 485,479

Net earnings — — — 30,282 64,520 94,802

Equity issuances, net — — — — 2,589 2,589

Special dividend — — — — (28,400) (28,400)

Recapitalization due to separation 103,014 51,507 472,681 — (524,188) —

Exercise of common stock options 39 20 177 — — 197

Shares purchased for employee stock

purchase plan — — (213) — — (213)

Shares issued under stock incentive plans 30 15 408 — — 423

Tax benefit from stock issued — — 12 — — 12

Unearned compensation—restricted stock — — (320) — — (320)

BALANCE AT FEBRUARY 28, 2003

103,083 51,542 472,745 30,282 — 554,569

Net earnings — — — 116,450 — 116,450

Exercise of common stock options 693 346 4,176 — — 4,522

Shares purchased for employee stock

purchase plan — — (599) — — (599)

Shares issued under stock incentive plans 3 2 95 — — 97

Shares cancelled upon reacquisition

by the company (1) (1) (13) — — (14)

Tax benefit from stock issued — — 5,598 — — 5,598

Unearned compensation—restricted stock — — 130 — — 130

BALANCE AT FEBRUARY 29, 2004

103,778 51,889 482,132 146,732 — 680,753

Net earnings — — — 112,928 — 112,928

Exercise of common stock options 522 262 3,955 — — 4,217

Shares purchased for employee stock

purchase plan — — (747) — — (747)

Shares issued under stock incentive plans 4 2 88 — — 90

Shares cancelled upon reacquisition

by the company (1) (1) (16) — — (17)

Tax benefit from stock issued — — 3,628 — — 3,628

Unearned compensation—restricted stock — — 124 — — 124

BALANCE AT FEBRUARY 28, 2005

104,303 $52,152 $489,164 $259,660 $ — $800,976

See accompanying notes to consolidated financial statements.