CarMax 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

CARMAX 2005

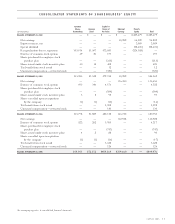

applied to all outstanding stock awards in each reported period

as follows:

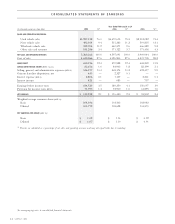

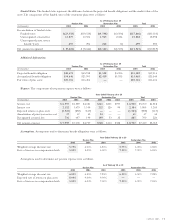

Years Ended February 28 or 29

(In thousands except per share data) 2005 2004 2003

Net earnings, as reported $112,928 $116,450 $94,802

Total additional stock-based

compensation expenses

determined under the

fair-value-based method

for all awards, net of

related tax effects 11,501 6,759 4,391

Pro forma net earnings $101,427 $109,691 $90,411

Earnings per share:

Basic, as reported $ 1.09 $ 1.13 $ 0.92

Basic, pro forma $ 0.97 $ 1.06 $ 0.88

Diluted, as reported $ 1.07 $ 1.10 $ 0.91

Diluted, pro forma $ 0.97 $ 1.04 $ 0.86

The pro forma effect on fiscal 2005 and prior fiscal years

may not be representative of the pro forma effects on net

earnings and earnings per share for future years.

For the purpose of computing the pro forma amounts

indicated above, the fair value of each option on the date of

grant was estimated using the Black-Scholes option-pricing

model. The weighted average assumptions used in the model

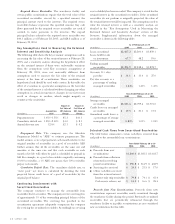

were as follows:

Years Ended February 28 or 29

2005 2004 2003

Expected dividend yield ———

Expected stock volatility 73% 78% 76%

Risk-free interest rates 3% 3% 4%

Expected lives (in years) 555

Using these assumptions in the Black-Scholes model, the

weighted average fair value of options granted was $18 per

share in fiscal 2005, $9 per share in fiscal 2004, and $17 per share

in fiscal 2003.

(S) Derivative Financial Instruments

In connection with securitization activities through the

warehouse facility, the company enters into interest rate swap

agreements to manage exposure to interest rates and to more

closely match funding costs to the use of funding. The company

recognizes the interest rate swaps as either assets or liabilities on

the consolidated balance sheets at fair value with changes in fair

value included in earnings as a component of CarMax Auto

Finance income.

(T) Risks and Uncertainties

CarMax retails used and new vehicles. The diversity of the

company’s customers and suppliers reduces the risk that a severe

impact will occur in the near term as a result of changes in its

customer base, competition, or sources of supply. However,

management cannot assure that unanticipated events will not

have a negative impact on the company.

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires management to make estimates and

assumptions that affect the reported amounts of assets, liabilities,

revenues and expenses, and the disclosure of contingent assets

and liabilities. Actual results could differ from those estimates.

(U) Reclassifications

Certain prior year amounts have been reclassified to conform to

the current year’s presentation.

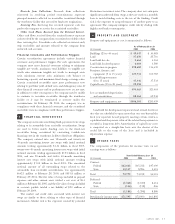

CARMAX AUTO FINANCE INCOME

The company’s finance operation, CAF, originates prime-rated

financing for qualified customers at competitive market rates of

interest.Throughout each month, the company sells substantially

all of the loans originated by CAF in securitization transactions as

discussed in Note 4. The majority of the contribution from CAF

is generated by the spread between the interest rate charged to

the customer and the company’s cost of funds. A gain,recorded at

the time of the securitization transaction, results from recording a

receivable approximately equal to the present value of the

expected residual cash flows generated by the securitized

receivables. The cash flows are calculated taking into account

expected prepayment and default rates.

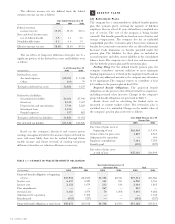

CarMax Auto Finance income was as follows:

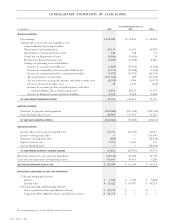

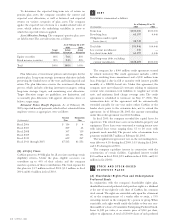

Years Ended February 28 or 29

(In millions) 2005 2004 2003

Gains on sales of loans $58.3 $65.1 $68.2

Other CAF income:

Servicing fee income 24.7 21.8 17.3

Interest income 19.0 16.0 11.5

Total other CAF income 43.7 37.8 28.8

Direct CAF expenses:

CAF payroll and

fringe benefit expense 9.0 8.2 7.0

Other direct CAF expenses 10.3 9.7 7.6

Total direct CAF expenses 19.3 17.9 14.6

CarMax Auto Finance income $82.7 $85.0 $82.4

CarMax Auto Finance income does not include any

allocation of indirect costs or income. The company presents

this information on a direct basis to avoid making arbitrary

decisions regarding the indirect benefit or costs that could be

attributed to CAF. Examples of indirect costs not included are

retail store expenses, retail financing commissions, and

corporate expenses such as human resources, administrative

services, marketing, information systems, accounting, legal,

treasury, and executive payroll.

3