CarMax 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CARMAX 2005

39

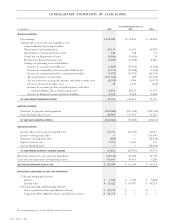

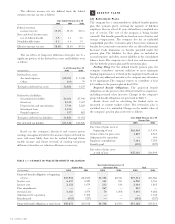

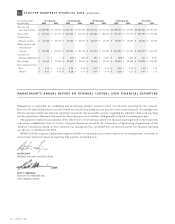

Funded Status. The funded status represents the difference between the projected benefit obligations and the market value of the

assets. The components of the funded status of the retirement plans were as follows:

As of February 28 or 29

Pension Plan Restoration Plan Total

(In thousands) 2005 2004 2005 2004 2005 2004

Reconciliation of funded status:

Funded status $(23,358) $(19,514) $(4,508) $(3,596) $(27,866) $(23,110)

Unrecognized actuarial loss 13,877 10,574 1,945 2,024 15,822 12,598

Unrecognized prior service

benefit/(cost) 257 294 242 (1) 499 293

Net amount recognized $ (9,224) $ (8,646) $(2,321) $(1,573) $(11,545) $(10,219)

Additional Information.

As of February 28 or 29

Pension Plan Restoration Plan Total

(In thousands) 2005 2004 2005 2004 2005 2004

Projected benefit obligation $48,674 $35,918 $4,508 $3,596 $53,182 $39,514

Accumulated benefit obligation $30,646 $21,991 $2,419 $1,553 $33,065 $23,544

Fair value of plan assets $25,316 $16,404 ——$25,316 $16,404

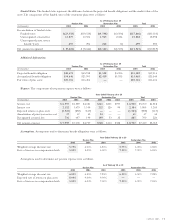

Expense. The components of net pension expense were as follows:

Years Ended February 28 or 29

Pension Plan Restoration Plan Total

(In thousands) 2005 2004 2003 2005 2004 2003 2005 2004 2003

Service cost $ 6,557 $5,529 $4,021 $343 $231 $197 $ 6,900 $5,760 $4,218

Interest cost 2,152 1,679 1,104 232 126 99 2,384 1,805 1,203

Expected return on plan assets (1,523) (892) (617) ——— (1,523) (892) (617)

Amortization of prior year service cost 37 37 35 24 —— 61 37 35

Recognized actuarial loss 736 647 194 149 53 32 885 700 226

Net pension expense $ 7,959 $7,000 $4,737 $748 $410 $328 $ 8,707 $7,410 $5,065

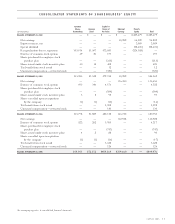

Assumptions. Assumptions used to determine benefit obligations were as follows:

Years Ended February 28 or 29

Pension Plan Restoration Plan

2005 2004 2003 2005 2004 2003

Weighted average discount rate 5.75% 6.00% 6.50% 5.75% 6.00% 6.50%

Rate of increase in compensation levels 5.00% 5.00% 6.00% 7.00% 7.00% 6.00%

Assumptions used to determine net pension expense were as follows:

As of February 28 or 29

Pension Plan Restoration Plan

2005 2004 2003 2005 2004 2003

Weighted average discount rate 6.00% 6.50% 7.25% 6.00% 6.50% 7.25%

Expected rate of return on plan assets 8.00% 9.00% 9.00% ———

Rate of increase in compensation levels 5.00% 6.00% 7.00% 7.00% 6.00% 7.00%