CVS 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 3

Gaining share in the front end and broadening

our healthcare offerings

In the front of the store, our continued focus on the health,

personal care, and beauty categories drove industry-leading

same store sales growth. The average front-end transaction

grew to approximately $11 in 2006. Moreover, the ExtraCare

loyalty program continued to increase in popularity with card

use exceeding 63 percent of front-end sales.

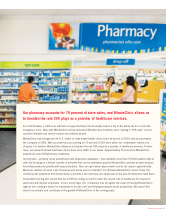

Our acquisition of MinuteClinic, completed in September,

allows CVS to provide customers with convenient, cost-effective,

and high-quality care for common family ailments right in our

stores. The high level of patient satisfaction received to date

has solidified our belief that this is the right concept for con-

sumers, payors, and providers. We made the decision to buy

MinuteClinic, already a strategic partner, because we wanted

control of its brand as well as personnel decisions, hours of

operation, and expansion rate. Most importantly, we saw an

opportunity to benefit from additional revenues and profits.

Since the acquisition, we have almost doubled the number of

MinuteClinics from 83 to 155 across 19 states. Furthermore,

we plan to open approximately 300 MinuteClinics in 2007

with well over 2,500 CVS/pharmacy stores slated to have

MinuteClinics over the long term.

Creating a company that serves payors and

consumers more efficiently

As this report goes to press, we are also close to a shareholder

vote on our proposed merger of equals with Caremark Rx, Inc.

If successful, the resulting entity, CVS/Caremark Corporation,

will combine our unmatched retail footprint and PharmaCare

subsidiary with Caremark’s leading PBM business. Together,

we will create the nation’s premier pharmacy services provider,

broadening our respective healthcare missions and positioning

ourselves to drive many of the changes that will reshape our

industry in the coming years.

Shareholders of both companies have yet to vote on the

merger, but we are optimistic about the outcome. Regardless,

CVS/pharmacy and PharmaCare have proven how powerful

a combined retail/PBM model can be. We will aggressively

leverage these twin strengths in the future, because they will

allow us to pursue new opportunities and help improve the

delivery of healthcare in the United States. Consumers want

convenience, choice, and to get more for their healthcare dollar.

Employers and health plans want to give plan members access

to a full range of integrated pharmacy services, promote better

health outcomes, and control costs at the same time.

Managing the significant costs of specialty pharmacy care

remains a critical area of concern for employers and other plan

sponsors. We are well-positioned to address this issue through

end-to-end participation – from plan design to delivery of

value-added pharmacy services via face-to-face interaction

with customers. We can accomplish this on a broader platform

through our proposed merger with Caremark or through accel-

erated organic growth of our retail/PBM model. We will carefully

evaluate all our opportunities to ensure that we help drive the

changes necessary to improve our industry.