CVS 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 CVS Corporation

Sales trends have moved in line with expectations. We expect

the numbers to climb with the introduction of the CVS brand

to these markets and the disruption of the store conversions

behind us. As noted at the time of purchase, the Sav-on and

Osco stores were operationally in better shape than the Eckerd

stores we acquired from J.C. Penney in 2004. Still, we are

executing against a significant opportunity to produce higher-quality

sales through improvements in merchandise assortment and

category focus. We will also leverage the CVS ExtraCare card to

encourage customer loyalty and increase sales and margins.

Looking at the former Eckerd stores acquired in 2004, same

store sales increased 14 percent in 2006. The front end rose

13 percent, with the pharmacy up 15 percent. This impressive

performance comes on top of the strong gains we posted in

2005. Although same store sales growth for these stores will

moderate going forward, they are still expected to outpace our

overall results for the foreseeable future.

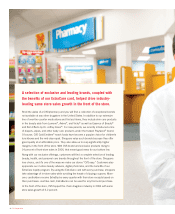

Even as CVS completed two major acquisitions in as many years,

organic square footage increased by 3.2 percent in 2006. We

opened 265 stores, including 147 new locations and 118 relo-

cations. Factoring in closings, we experienced net unit growth of

103 stores. We continued to expand in our newer, high-growth

markets, including those in Florida and Texas as well as Las

Vegas, Los Angeles, Chicago, Minneapolis, and Phoenix. All our

new stores in these markets are running at or above plan, with

both the front end and pharmacy performing well.

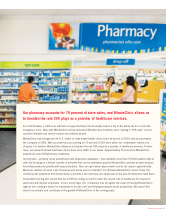

Benefiting from new opportunities in the pharmacy

CVS/pharmacy stores now fill 16 percent of all U.S. retail drug

prescriptions. The Medicare Part D prescription drug benefit

and generic drug launches are among the positive industry

factors contributing to our growth. Medicare Part D, rolled out

in January 2006, has led to increased utilization of prescription

drugs. Since enrolled seniors make the same co-payment

regardless of the pharmacy they choose, many are opting for

the convenience of the CVS/pharmacy located right in their

neighborhoods. Despite a competitor’s rollout of a $4 program

for selected generic drugs, we actually experienced a rise

in net prescription transfers in from leading mass merchant

retailers and continued to gain pharmacy share.

Use of generic drugs continues to climb, and they now account

for more than 60 percent of prescriptions filled. Although their

lower prices depress revenue growth, generics are more profit-

able and help fuel our margin gains. They also help reduce

overall healthcare costs for patients and payors.

Our PharmaCare pharmacy benefits management (PBM) and

specialty pharmacy business turned in an excellent performance

in 2006. Revenue rose 24.6 percent to $3.7 billion while

operating profit increased by 43 percent. Prescription Pathways®,

PharmaCare’s Medicare Part D joint venture with Universal

American Financial Corp., now administers prescription drug

benefits for 460,000 seniors and Medicare-eligible individuals.

That number places it among the nation’s top 10 prescription

drug plans for Medicare Part D beneficiaries.