CVS 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 37

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

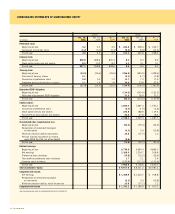

Diluted earnings per common share is computed by dividing: (i) net

earnings, after accounting for the difference between the dividends

on the ESOP preference stock and common stock and after making

adjustments for the incentive compensation plans, by (ii) Basic Shares

plus the additional shares that would be issued assuming that all dilutive

stock awards are exercised and the ESOP preference stock is converted

into common stock. Options to purchase 4.7 million, 6.9 million and

9.4 million shares of common stock were outstanding as of December 30,

2006, December 31, 2005 and January 1, 2005, respectively, but were

not included in the calculation of diluted earnings per share because

the options’ exercise prices were greater than the average market price

of the common shares and, therefore, the effect would be antidilutive.

New Accounting Pronouncements

The Company adopted, SFAS No. 123(R), “Share-Based Payment,”

effective January 1, 2006. This statement established standards for

the accounting for transactions in which an entity exchanges its equity

instruments for goods or services. The statement focused primarily on

accounting for transactions in which an entity obtains employee services

in share-based payment transactions. The adoption of this statement

resulted in a $42.7 million reduction in net earnings for 2006. Please

see Note 7 to the Company’s consolidated financial statements for

additional information regarding stock-based compensation.

The Company adopted FASB Staff Position (“FSP”) No. FAS 13-1,

“Accounting for Rental Costs Incurred during a Construction Period,”

effective January 1, 2006. The FSP addresses the accounting for

rental costs associated with operating leases that are incurred during a

construction period and requires rental costs associated with ground or

building operating leases that are incurred during a construction period

to be recognized as rental expense over the life of the lease. The adoption

of this statement did not have a material impact on the Company’s

consolidated results of operations, financial position or cash flows.

The Company adopted the Securities and Exchange Commission (SEC)

Staff Accounting Bulletin (“SAB”) No. 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current

Year Financial Statements,” effective November 15, 2006. SAB No. 108

requires misstatements to be quantified based on their impact on each

of the financial statements and related disclosures. The adoption of this

statement resulted in a $24.7 million increase in net earnings for 2006.

The Company adopted SFAS No. 158, “Employer’s Accounting for Defined

Benefit Pension and Other Postretirement Plans – an amendment of FASB

Statements No. 87, 88, 106, and 132(R),” effective December 15, 2006.

SFAS No. 158 requires an employer to recognize in its statement of

financial position an asset for a plan’s overfunded status or a liability for

a plan’s underfunded status, measure a plan’s assets and its obligations

that determine its funded status as of the end of the employer’s fiscal

year, and recognize changes in the funded status of a defined benefit

postretirement plan in the year in which the changes occur. Those changes

will be reported in comprehensive income and in a separate component

of shareholder’s equity. The adoption of this statement did not have a

material impact on the Company’s consolidated results of operations,

financial position or cash flows.

In July 2006, the Financial Accounting Standards Board (“FASB”) issued

FASB Interpretation (“FIN”) No. 48, “Accounting for Uncertainty in

Income Taxes – an interpretation of FASB Statement No. 109.” FIN No. 48

clarifies the accounting and disclosure for uncertain tax positions, which

relate to the uncertainty about how certain tax positions taken or expected

to be taken on a tax return should be reflected in the financial statements

before they are finally resolved with the taxing authorities. FIN No. 48 is

effective for fiscal years beginning after December 15, 2006. Although the

Company is still analyzing the impact of FIN No. 48, it does not believe

the adoption will have a material impact on its consolidated results of

operations and financial position.

In September 2006, the FASB issued SFAS No. 157, “Fair Value

Measurement.” SFAS No. 157 defines fair value, establishes a framework

for measuring fair value in generally accepted accounting principles and

expands disclosures regarding fair value measurements. SFAS No. 157 is

effective for fiscal years beginning after November 15, 2007 and interim

periods within those fiscal years. The Company is currently evaluating

the impact that SFAS No. 157 may have on its consolidated results of

operations and financial position.

2 ACQUISITION

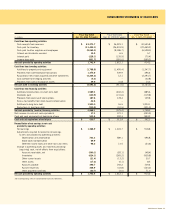

On June 2, 2006, CVS acquired certain assets and assumed certain

liabilities from Albertson’s, Inc. (“Albertsons”) for $4.0 billion. The

Company believes that this acquisition is consistent with its long-term

strategy of expanding its retail drugstore business in high-growth markets.

The assets acquired and the liabilities assumed included approximately

700 standalone drugstores and a distribution center (collectively

the “Standalone Drug Business”). CVS financed the acquisition of the

Standalone Drug Business by issuing commercial paper and borrowing

$1.0 billion from a bridge loan facility. During the third quarter of 2006,

CVS repaid a portion of the commercial paper used to finance the

acquisition with the proceeds received from the issuance of $800 million

of 5.75% unsecured senior notes due August 15, 2011 and $700 million of

6.125% unsecured senior notes due August 15, 2016. During the

fourth quarter of 2006, CVS sold a substantial portion of the acquired

real estate through a sale-leaseback transaction, the proceeds of which

were used in retiring the bridge loan facility. The results of the operations

of the Standalone Drug Business from June 2, 2006 through December 30,

2006, have been included in CVS’ consolidated statements of operations

for the period ended December 30, 2006.