CVS 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

18 CVS Corporation

On December 20, 2006, the initial waiting period under the Hart-Scott-

Rodino Act for the CVS/Caremark merger, expired without a request for

additional information from the U.S. Federal Trade Commission.

On January 7, 2007, Caremark issued a press release announcing that

its board of directors, after thorough consideration and consultation with

its legal and financial advisers, had determined that the Express Scripts

proposal did not constitute, and was not reasonably likely to lead to, a

superior proposal under the terms of the merger agreement with CVS.

Caremark further announced that its board of directors had unanimously

concluded that pursuing discussions with Express Scripts was not in the

best financial or strategic interests of Caremark and its shareholders.

On January 16, 2007, CVS and Caremark announced that Caremark

shareholders would receive a special one-time cash dividend of $2 per share

upon or promptly after closing of the transaction. In addition, CVS and

Caremark agreed that as promptly as practicable after the closing of the

merger, an accelerated share repurchase transaction will be executed,

whereby 150 million of the outstanding shares of the combined entity

will be retired. On January 19, 2007, the Registration Statement on Form

S-4 relating to the proposed merger was declared effective by the Securities

and Exchange Commission (the “SEC”). In addition, a special meeting

of Caremark shareholders to approve the merger was scheduled for

February 20, 2007 and a special meeting of CVS shareholders to be

held for the same purpose was scheduled for February 23, 2007.

On February 13, 2007, CVS and Caremark announced that the special

one-time cash dividend payable to Caremark shareholders upon or promptly

after closing of the transaction would be increased to $6 per share.

Caremark also announced that on February 12, 2007 its board of directors

had declared the $6 special cash dividend payable upon or promptly

after closing of the merger to Caremark shareholders of record on the

date immediately preceding the closing date of the merger. In connection

with its declaration of such dividend, the Caremark board also unanimously

reaffirmed its recommendation that Caremark shareholders vote “for”

the merger with CVS at the Caremark special meeting of shareholders.

On February 13, 2007, the Court of Chancery of the State of Delaware

determined that, to permit additional time for dissemination to Caremark

shareholders of certain newly filed information, the Caremark special

meeting of shareholders to approve the merger must be postponed to a

date not earlier than March 9, 2007. On February 23, 2007, the Court

of Chancery of the State of Delaware further delayed the Caremark

shareholder vote until twenty days after Caremark makes supplemental

disclosures regarding Caremark shareholders’ right to seek appraisal

and the structure of fees to be paid by Caremark to its financial advisors.

The supplemental disclosures were mailed to Caremark shareholders on

February 24, 2007, at which time Caremark announced that its special

meeting of shareholders to approve the merger had been adjourned

to March 16, 2007. On February 23, 2007, CVS announced that

The following discussion should be read in conjunction with our audited

consolidated financial statements and our Cautionary Statement Concerning

Forward-Looking Statements that are presented in this Annual Report.

OUR BUSINESS

Our Company is a leader in the retail drugstore industry in the United

States. We sell prescription drugs and a wide assortment of general

merchandise, including over-the-counter drugs, beauty products and

cosmetics, film and photofinishing services, seasonal merchandise,

greeting cards and convenience foods through our CVS/pharmacy® retail

stores and online through CVS.com®. We also provide healthcare services

through our 146 MinuteClinic healthcare clinics, located in 18 states,

of which 129 are located within CVS retail drugstores. In addition,

we provide pharmacy benefit management, mail order services and

specialty pharmacy services through PharmaCare Management Services

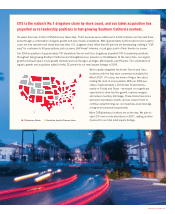

(“PharmaCare”) and PharmaCare Pharmacy® stores. As of December 30,

2006, we operated 6,202 retail and specialty pharmacy stores in 43 states

and the District of Columbia.

PROPOSED CAREMARK MERGER

On November 1, 2006, we entered into a definitive agreement and plan

of merger with Caremark Rx, Inc., (“Caremark”). The agreement is

structured as a merger of equals under which Caremark shareholders will

receive 1.670 shares of common stock, par value $0.01 per share, of

CVS for each share of common stock of Caremark, par value $0.001 per

share, issued and outstanding immediately prior to the effective time of

the merger. The closing of the transaction, which is expected to occur

during the first quarter of 2007, is subject to approval by the shareholders

of both CVS and Caremark, as well as customary regulatory approvals,

including review under the Hart-Scott-Rodino Act. Accordingly, there

can be no assurance the merger will be completed.

Caremark is a leading pharmacy benefits manager in the United States.

Caremark’s operations involve the design and administration of programs

aimed at reducing the costs and improving the safety, effectiveness and

convenience of prescription drug use. Caremark operates a national retail

pharmacy network with over 60,000 participating pharmacies (including

CVS/pharmacy stores), 7 mail service pharmacies, 21 specialty mail

service pharmacies and the industry’s only repackaging plant regulated

by the Food & Drug Administration. Through its Accordant® disease

management offering, Caremark also provides disease management

programs for 27 conditions. Twenty-one of these programs are accredited

by the National Committee for Quality Assurance.

On December 18, 2006, Caremark received an unsolicited offer from a

competing pharmacy benefits manager, Express Scripts, Inc. (“Express

Scripts”) pursuant to which Express Scripts offered to acquire all of the

outstanding shares of Caremark for $29.25 in cash and 0.426 shares of

Express Scripts common stock for each share of Caremark common stock.