CVS 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 CVS Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Stock-Based Compensation

On January 1, 2006, the Company adopted SFAS No. 123(R),

“Share-Based Payment,” using the modified prospective transition method.

Under this method, compensation expense is recognized for options

granted on or after January 1, 2006, as well as any unvested options on

the date of adoption. As allowed under the modified prospective transition

method, prior period financial statements have not been restated. Prior to

January 1, 2006, the Company accounted for its stock-based compensation

plans under the recognition and measurement principles of Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued

to Employees,” and related interpretations. As such, no stock-based

employee compensation costs were reflected in net earnings for options

granted under those plans since they had an exercise price equal to the

fair market value of the underlying common stock on the date of grant.

See Note 7 for further information on stock-based compensation.

Income Taxes

The Company provides for federal and state income taxes currently

payable, as well as for those deferred because of timing differences

between reported income and expenses for financial statement purposes

versus tax purposes. Federal and state incentive tax credits are recorded

as a reduction of income taxes. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to differences

between the carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes. Deferred tax

assets and liabilities are measured using the enacted tax rates expected

to apply to taxable income in the years in which those temporary differences

are expected to be recoverable or settled. The effect of a change in tax

rates is recognized as income or expense in the period of the change.

Earnings per Common Share

Basic earnings per common share is computed by dividing: (i) net

earnings, after deducting the after-tax Employee Stock Ownership Plan

(“ESOP”) preference dividends, by (ii) the weighted average number of

common shares outstanding during the year (the “Basic Shares”).

When computing diluted earnings per common share, the Company assumes

that the ESOP preference stock is converted into common stock and all

dilutive stock awards are exercised. After the assumed ESOP preference

stock conversion, the ESOP Trust would hold common stock rather than

ESOP preference stock and would receive common stock dividends

($0.1550 per share in 2006, $0.1450 per share in 2005 and $0.1325 per

share in 2004) rather than ESOP preference stock dividends (currently

$3.90 per share). Since the ESOP Trust uses the dividends it receives to

service its debt, the Company would have to increase its contribution to the

ESOP Trust to compensate it for the lower dividends. This additional

contribution would reduce the Company’s net earnings, which in turn,

would reduce the amounts that would be accrued under the Company’s

incentive compensation plans.

provided. Funds that are directly linked to advertising commitments are

recognized as a reduction of advertising expense in the selling, general

and administrative expenses line when the related advertising commitment

is satisfied. Any such allowances received in excess of the actual cost

incurred also reduce the carrying cost of inventory. The total value of

any upfront payments received from vendors that are linked to purchase

commitments is initially deferred. The deferred amounts are then amortized

to reduce cost of goods sold over the life of the contract based upon

purchase volume. The total value of any upfront payments received from

vendors that are not linked to purchase commitments is also initially

deferred. The deferred amounts are then amortized to reduce cost of

goods sold on a straight-line basis over the life of the related contract.

The total amortization of these upfront payments was not material to

the accompanying consolidated financial statements.

Store Opening and Closing Costs

New store opening costs, other than capital expenditures, are charged

directly to expense when incurred. When the Company closes a store, the

present value of estimated unrecoverable costs, including the remaining

lease obligation less estimated sublease income and the book value of

abandoned property and equipment, are charged to expense. The long-term

portion of the lease obligations associated with store closings was

$418.0 million, $406.3 million, and $507.1 million in 2006, 2005

and 2004, respectively.

Advertising Costs

Advertising costs are expensed when the related advertising takes place.

Advertising costs, net of vendor funding, which is included in selling,

general and administrative expenses, were $265.3 million in 2006,

$206.6 million in 2005 and $205.7 million in 2004.

Interest Expense, Net

Interest expense was $231.7 million, $117.0 million and

$64.0 million, and interest income was $15.9 million, $6.5 million

and $5.7 million in 2006, 2005 and 2004, respectively. Capitalized

interest totaled $20.7 million in 2006, $12.7 million in 2005 and

$10.4 million in 2004.

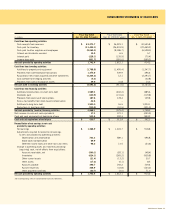

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss consists of a minimum pension

liability, unrealized losses on derivatives and adjustment to initially

apply SFAS No. 158. Due to the application of SFAS No. 158 in 2006,

there was no minimum pension liability recorded as of December 30,

2006. In accordance with SFAS No. 158, the amount included in

accumulated other comprehensive income related to the Company’s

pension and postretirement plans was $87.4 million pre-tax ($55.4 million

after-tax) as of December 30, 2006. The minimum pension liability

totaled $117.0 million pre-tax ($73.4 million after-tax) as of December 31,

2005. The unrealized loss on derivatives totaled $27.2 million pre-tax

($17.2 million after-tax) and $26.7 million pre-tax ($16.9 million after-tax)

as of December 30, 2006 and December 31, 2005, respectively.