CVS 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 41

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The ESOP Trust uses the dividends received and contributions from the

Company to repay the ESOP Notes. As the ESOP Notes are repaid, ESOP

Preference Stock is allocated to participants based on (i) the ratio of each

year’s debt service payment to total current and future debt service

payments multiplied by (ii) the number of unallocated shares of ESOP

Preference Stock in the plan.

As of December 30, 2006, 4.0 million shares of ESOP Preference Stock

were outstanding, of which 3.2 million shares were allocated to participants

and the remaining 0.8 million shares were held in the ESOP Trust for

future allocations.

Annual ESOP expense recognized is equal to (i) the interest incurred

on the ESOP Notes plus (ii) the higher of (a) the principal repayments

or (b) the cost of the shares allocated, less (iii) the dividends paid.

Similarly, the guaranteed ESOP obligation is reduced by the higher of

(i) the principal payments or (ii) the cost of shares allocated.

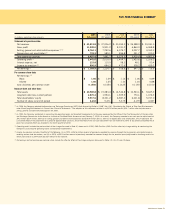

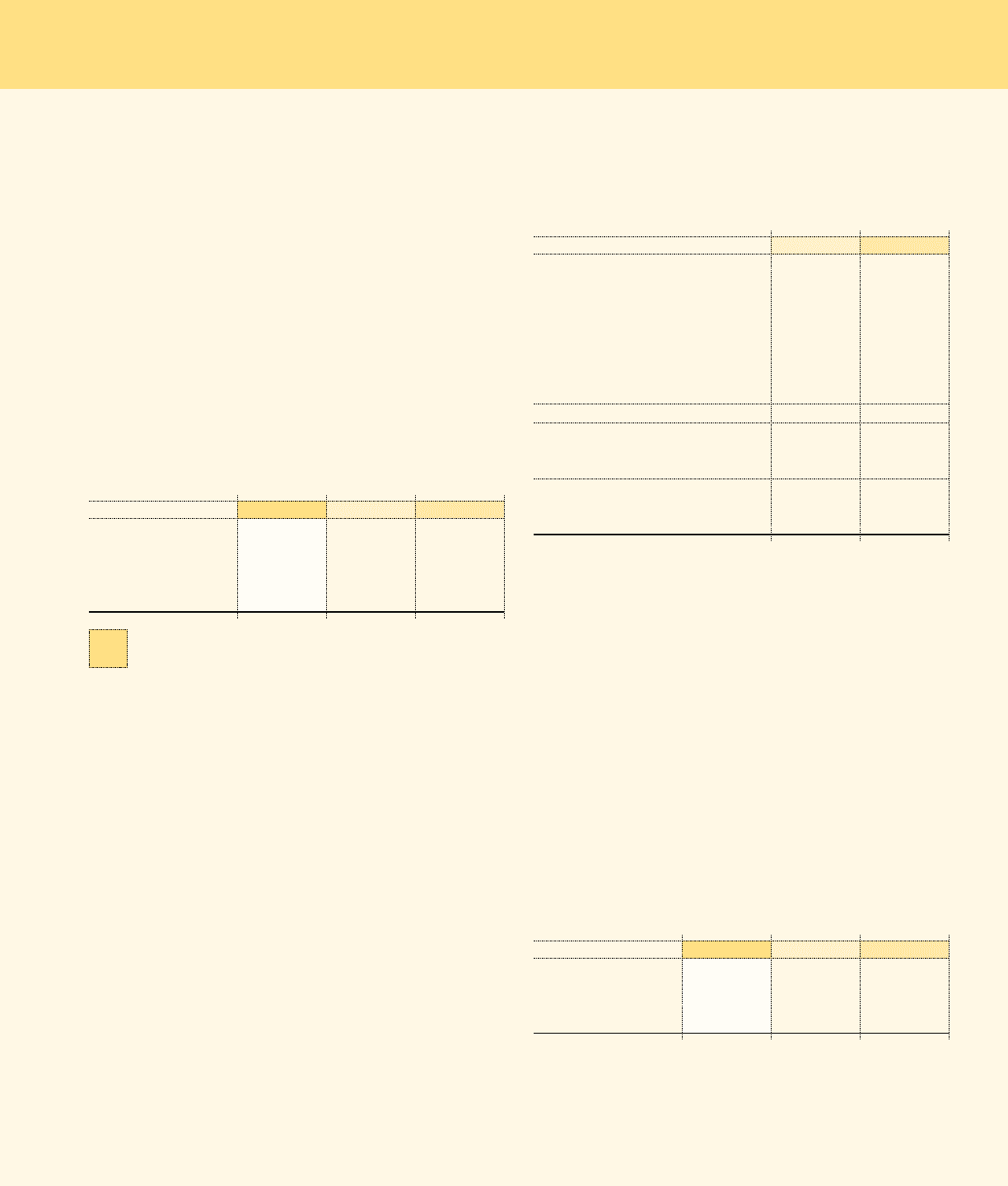

Following is a summary of the ESOP activity for the respective years:

In millions 2006 2005 2004

ESOP expense recognized $ 26.0 $ 22.7 $ 19.5

Dividends paid 15.6 16.2 16.6

Cash contributions 26.0 22.7 19.5

Interest payments 9.7 12.0 13.9

ESOP shares allocated 0.4 0.3 0.3

7 STOCK INCENTIVE PLANS

On January 1, 2006, the Company adopted SFAS No. 123(R),

“Share-Based Payment,” using the modified prospective transition method.

Under this method, compensation expense is recognized for options

granted on or after January 1, 2006 as well as any unvested options on

the date of adoption. Compensation expense for unvested stock options

outstanding at January 1, 2006 is recognized over the requisite service

period based on the grant-date fair value of those options and awards as

previously calculated under the SFAS No. 123(R) pro forma disclosure

requirements. As allowed under the modified prospective transition method,

prior period financial statements have not been restated. Prior to

January 1, 2006, the Company accounted for its stock-based compensation

plans under the recognition and measurement principles of APB Opinion

No. 25, “Accounting for Stock Issued to Employees,” and related

interpretations. As such, no stock-based employee compensation costs

were reflected in net earnings for options granted under those plans since

they had an exercise price equal to the fair market value of the underlying

common stock on the date of grant.

Compensation expense related to stock options, which includes the

1999 Employee Stock Purchase Plan (“ESPP”) totaled $60.7 million

for 2006. The recognized tax benefit was $18.0 million for 2006.

Compensation expense related to restricted stock awards totaled

$9.2 million for 2006, compared to $5.9 million for 2005. Compensation

costs associated with the Company’s share-based payments are included

in selling, general and administrative expenses.

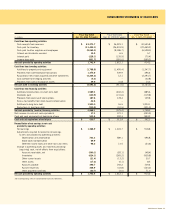

The following table includes the effect on net earnings and earnings

per share if stock compensation costs had been determined consistent

with the fair value recognition provisions of SFAS No. 123(R) for the

respective periods:

In millions, except per share amounts 2005 2004

Net earnings, as reported $ 1,224.7 $ 918.8

Add: Stock-based employee

compensation expense included

in reported net earnings, net of

related tax effects (1) 4.8 1.5

Deduct: Total stock-based employee

compensation expense determined

under fair value based method for

all awards, net of related tax effects 48.6 40.2

Pro forma net earnings $ 1,180.9 $ 880.1

Basic EPS:

As reported $ 1.49 $ 1.13

Pro forma 1.44 1.09

Diluted EPS:

As reported $ 1.45 $ 1.10

Pro forma 1.40 1.06

(1) Amounts represent the after-tax compensation costs for restricted stock grants and

expense related to the acceleration of vesting of stock options on certain terminated

employees.

The ESPP provides for the purchase of up to 14.8 million shares of

common stock. Under the ESPP, eligible employees may purchase common

stock at the end of each six-month offering period, at a purchase price

equal to 85% of the lower of the fair market value on the first day or the

last day of the offering period. During 2006, 2.1 million shares of common

stock were purchased at an average price of $22.54 per share. As of

December 30, 2006, 12.1 million shares of common stock have been

issued under the ESPP since its inception.

The fair value of stock compensation expense associated with the Company’s

ESPP is estimated on the date of grant (i.e., the beginning of the offering

period) using the Black-Scholes Option Pricing Model and is recorded

as a liability, which is adjusted to reflect the fair value of the award at

each reporting period until settlement date.

Following is a summary of the assumptions utilized in valuing the ESPP

awards for each of the respective periods:

2006 2005 2004

Dividend yield (1) 0.26 % 0.26 % 0.30 %

Expected volatility (2) 26.00 % 16.40 % 17.40 %

Risk-free interest rate (3) 5.08 % 3.35 % 2.50 %

Expected life (in years) (4) 0.5 0.5 0.5

(1) Dividend yield is calculated based on semi-annual dividends paid and the fair market

value of the Company’s stock at the period end date.

(2) Expected volatility is based on the historical volatility of the Company’s daily stock

market prices over the previous six month period.

(3) Based on the Treasury constant maturity interest rate whose term is consistent with

the expected term of ESPP options (six months).

(4) Based on semi-annual purchase period.