CVS 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 47

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In December 2006, Laurence M. Silverstein filed a purported class

action lawsuit purportedly on behalf of Caremark stockholders relating

to the proposed merger between Caremark and CVS in the United States

District Court for the Middle District of Tennessee. The suit is brought

against Caremark, its directors, CVS and CVS’ chief executive officer.

The complaint alleges, among other things, that the Caremark directors

breached their fiduciary duties by entering into the proposed merger

with CVS and that the CVS defendants aided and abetted such breaches

of duty. The plaintiff seeks, among other things, preliminary and permanent

injunctive relief to prevent the proposed merger, to direct the defendants

to obtain a transaction that is in the best interests of Caremark, and to

impose a constructive trust upon any benefits improperly received by

the defendants. In January 2007, the plaintiff filed an amended class

action complaint and moved for expedited discovery and preliminary

injunctive relief. The amended class action complaint adds allegations

that the joint proxy statement/prospectus filed on December 19, 2006

omits certain material information. On January 8, 2007, the court stayed

the lawsuit. On January 10, 2007, the plaintiff moved to vacate the stay

order. On January 19, 2007, that motion was denied.

The Louisiana Municipal Police Employees’ Retirement System also

filed a purported class action lawsuit purportedly on behalf of Caremark

stockholders in the Delaware Court of Chancery against Caremark’s

directors and CVS. The complaint alleges, among other things, that

the directors breached their fiduciary duties by entering into the proposed

merger with CVS. The complaint also alleges that the joint proxy statement/

prospectus filed on December 19, 2006 omits certain material information.

The plaintiff seeks, among other things, preliminary and permanent

injunctive relief to prevent the proposed merger. The lawsuit was amended

in January 2007 to add the R.W. Grand Lodge of Free & Accepted Masons

of Pennsylvania as a plaintiff and to add Caremark as a defendant. On

February 12, 2007, Caremark filed a Form 8-K containing supplemental

disclosures concerning the proposed merger between Caremark and

CVS. That same day, plaintiffs moved to delay the Caremark shareholder

meeting, then scheduled for February 20, 2007. On February 13, 2007,

the court enjoined any shareholder vote concerning a merger between

Caremark and any other party until at least March 9, 2007 in order to

afford time for shareholders to fully consider the Caremark supplemental

disclosures. A hearing on the plaintiffs’ request for preliminary injunctive

relief was held on February 16, 2007. On February 23, 2007, the

Court denied plaintiff’s motion for a preliminary injunction enjoining

the planned merger between CVS and Caremark, but delayed the

Caremark shareholder vote on the CVS merger until twenty days after

Caremark makes supplemental disclosures regarding Caremark share-

holders’ right to seek appraisal and the structure of fees to be paid

by Caremark to its financial advisors. The supplemental disclosures

were mailed to Caremark shareholders on February 24, 2007.

In January 2007, Express Scripts, and Skadden, Arps, Slate, Meagher

& Flom LLP (“Skadden”), filed a lawsuit in the Delaware Court of

Chancery against Caremark, its directors, CVS and AdvancePCS. The

complaint alleges, among other things, that the directors breached their

fiduciary duties by entering into the proposed transaction with CVS. The

plaintiffs seek, among other things, declaratory relief and preliminary

and permanent injunctive relief to prevent the proposed merger. The

plaintiffs also seek declaratory relief holding that Skadden’s representa-

tion of Express Scripts does not violate Skadden’s professional, ethical

or contractual obligations. This lawsuit is proceeding on a coordinated

basis with the earlier filed lawsuit in the Delaware Court of Chancery as

described in the preceding paragraph.

In January 2007, Pirelli Armstrong Tire Corporation Retiree Medical

Benefits Trust filed a shareholder derivative action in United States

District Court for the Middle District of Tennessee on behalf of Caremark

against the Caremark board of directors and CVS. The complaint alleges

that the defendants disseminated misleading proxy materials and seeks

preliminary and permanent injunctive relief. In particular, plaintiff

seeks to enjoin the Caremark shareholder vote on the proposed merger

until such time as defendants’ failure to disclose material information is

remedied, and all material information regarding the proposed transaction

is made available to Caremark’s shareholders. On January 24, 2007,

plaintiff filed motions for a preliminary injunction and for expedited

discovery. On January 30, 2007 those motions were denied and the

case was stayed pending outcome of the Delaware litigation.

CVS believes the allegations pertaining to CVS in the shareholder lawsuits

described herein are void of merit and intends to defend them vigorously.

The Company is also a party to other litigation arising in the normal course

of its business, none of which is expected to be material to the Company.

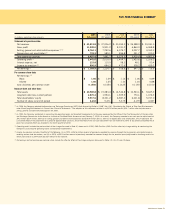

10 INCOME TAXES

The provision for income taxes consisted of the following for the

respective years:

In millions 2006 2005 2004

Current:

Federal $ 676.6 $ 632.8 $ 397.7

State 127.3 31.7 62.6

803.9 664.5 460.3

Deferred:

Federal 47.6 17.9 22.5

State 5.4 1.9 (5.2)

53.0 19.8 17.3

Total $ 856.9 $ 684.3 $ 477.6