CVS 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 13

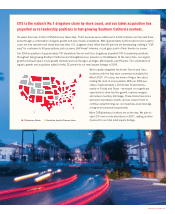

CVS is the nation’s No.1 drugstore chain by store count, and our latest acquisition has

propelled us to leadership positions in fast-growing Southern California markets.

It’s easier than ever to find a CVS/pharmacy these days. That’s because we’ve added some 2,000 locations over the past three

years through a combination of organic growth and well-chosen acquisitions. With approximately 6,200 locations from coast to

coast, we now operate more stores than any other U.S. drugstore chain. More than 60 percent are freestanding, making it “CVS

easy” for customers to fill prescriptions, pick up some LifeFitness® vitamins, or just grab a pint of their favorite ice cream.

Our 2006 acquisition of approximately 700 standalone Sav-on and Osco drugstores propelled CVS to leadership positions

throughout fast-growing Southern California and strengthened our presence in the Midwest. At the same time, our organic

growth continued apace in key growth markets such as Chicago, Las Vegas, Minneapolis, and Phoenix. The combination of

organic growth and acquisition added a hefty 23 percent to our retail square footage in 2006.

We’ve rapidly integrated the former Sav-on and Osco

locations, with the final store conversion scheduled for

March 2007. Of course, we know a thing or two about

making the most of an acquisition. With our 2004 pur-

chase of approximately 1,200 former Eckerd stores –

mainly in Florida and Texas – we seized on a significant

opportunity to drive top-line growth, improve margins,

and reduce inventory shrinkage. These stores have since

delivered impressive results, and we expect them to

continue outperforming our core business as we leverage

a long-term turnaround opportunity.

More CVS/pharmacy locations are on the way. We plan to

open 275 new or relocated stores in 2007, adding another

3 percent to our total retail square footage.

CVS/pharmacy Markets PharmaCare Specialty Pharmacy Stores