CVS 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 CVS Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Registration Statement on Form S-4 relating to the proposed merger

was declared effective by the Securities and Exchange Commission

(the “SEC”).

On February 13, 2007, Caremark and CVS announced that the special

one-time cash dividend payable to Caremark shareholders upon closing of

the transaction would be increased to $6 per share. A special meeting of

Caremark’s shareholders to approve the merger is to be held on March 16,

2007 and a special meeting of CVS’ shareholders for the same purpose

will be held on a date later in March. The proposed merger will be

accounted for using the purchase method of accounting under U.S.

GAAP. Under the purchase method of accounting, CVS will be consid-

ered the acquiror of Caremark for accounting purposes and the total

purchase price will be allocated to the assets acquired and liabilities

assumed from Caremark based on their fair values as of the date of the

completion of the merger and any excess of purchase price over those

fair values will be recorded as goodwill. Our reported financial condition

and results of operations issued after completion of the merger will

reflect Caremark’s balances and results after completion of the merger,

but will not be restated retroactively to reflect the historical financial

position or results of operations of Caremark. Following the completion

of the merger, our earnings will reflect purchase accounting adjustments,

including increased amortization expense for acquired intangible assets.

13 PROPOSED CAREMARK MERGER

On November 1, 2006, the Company entered into a definitive

agreement and plan of merger with Caremark Rx, Inc., (“Caremark”).

The agreement is structured as a merger of equals under which

Caremark shareholders will receive 1.670 shares of common stock,

par value $0.01 per share, of CVS for each share of common stock of

Caremark, par value $0.001 per share, issued and outstanding immediately

prior to the effective time of the merger. The closing of the transaction,

which is expected to occur during the first quarter of 2007, is subject

to approval by the shareholders of both CVS and Caremark, as well as

customary regulatory approvals, including review under the Hart-Scott-

Rodino Act. On December 20, 2006, the initial waiting period under

the Hart-Scott-Rodino Act expired without a request for additional

information from the U.S. Federal Trade Commission. On January 16,

2007, Caremark and CVS announced that Caremark shareholders would

receive a special one-time cash dividend of $2 per share upon closing of

the transaction. In addition, CVS and Caremark agreed that as promptly as

practicable after the closing of the merger, an accelerated share repurchase

transaction will be executed whereby 150 million of the outstanding

shares of the combined entity will be retired. On January 19, 2007, the

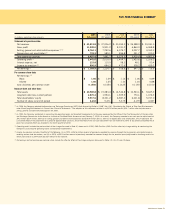

14 QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

Dollars in millions, except per share amounts First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

2006

Net revenues $ 9,979.2 $ 10,561.4 $ 11,206.9 $ 12,066.3 $ 43,813.8

Gross profit 2,649.0 2,844.4 3,080.3 3,365.3 11,939.0

Operating profit 560.5 595.0 536.8 749.3 2,441.6

Net earnings (1) 329.6 337.9 284.2 417.2 1,368.9

Net earnings per common share, basic (1) 0.40 0.41 0.34 0.50 1.65

Net earnings per common share, diluted (1) 0.39 0.40 0.33 0.49 1.60

Dividends per common share 0.03875 0.03875 0.03875 0.03875 0.15500

Stock price: (New York Stock Exchange)

High 30.98 31.89 36.14 32.26 36.14

Low 26.06 27.51 29.85 27.09 26.06

Registered shareholders at year-end 12,360

2005

Net revenues $ 9,182.2 $ 9,121.6 $ 8,970.4 $ 9,732.0 $ 37,006.2

Gross profit 2,380.8 2,417.4 2,401.0 2,702.0 9,901.2

Operating profit 499.8 477.7 438.9 603.1 2,019.5

Net earnings (2) 289.7 275.9 252.7 406.4 1,224.7

Net earnings per common share, basic (2) 0.35 0.34 0.31 0.49 1.49

Net earnings per common share, diluted (2) 0.34 0.33 0.30 0.48 1.45

Dividends per common share 0.03625 0.03625 0.03625 0.03625 0.14500

Stock price: (New York Stock Exchange)

High 26.89 29.68 31.60 29.30 31.60

Low 22.02 25.02 27.67 23.89 22.02

(1) Net earnings and net earnings per common share for the fourth quarter and fiscal year 2006 include the after-tax effect of $24.7 million as a result of the adoption of SAB No. 108

as discussed in Note 1 above.

(2) Net earnings and net earnings per common share for the fourth quarter and fiscal year 2005 include the after-tax effect of the reversal of $52.6 million of previously recorded tax

reserves as discussed in Note 10 above.