CVS 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 CVS Corporation

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

All grants under the ICP are awarded at fair market value on the date of

grant. The fair value of stock options is estimated using the Black-Scholes

Option Pricing Model and compensation expense is recognized on a

straight-line basis over the requisite service period. Options granted prior

to 2004 generally become exercisable over a four-year period from the

grant date and expire ten years after the date of grant. Options granted

during and subsequent to fiscal 2004 generally become exercisable over

a three-year period from the grant date and expire seven years after the

date of grant. As of December 30, 2006, there were 18.0 million shares

available for future grants under the ICP.

SFAS No. 123(R) requires that the benefit of tax deductions in excess

of recognized compensation cost be reported as a financing cash flow,

rather than as an operating cash flow as required under prior guidance.

Excess tax benefits of $42.6 million were included in financing activities

in the accompanying consolidated statement of cash flow during 2006.

Cash received from stock options exercised, which includes the ESPP,

totaled $187.6 million and the related tax benefits realized were

$42.6 million during 2006. Cash received from stock options exercised

totaled $178.4 million and the related tax benefits realized were

$46.6 million during 2005.

The total intrinsic value of options exercised during 2006 was

$117.8 million, compared to $117.5 million and $51.9 million in

2005 and 2004, respectively. The fair value of options exercised

during 2006 was $257.1 million, compared to $263.3 million and

$156.8 million during 2005 and 2004, respectively.

The fair value of each stock option is estimated using the Black-Scholes

Option Pricing Model based on the following assumptions at the time

of grant:

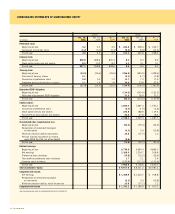

2006 2005 2004

Dividend yield (1) 0.50 % 0.56 % 0.65 %

Expected volatility (2) 24.58 % 34.00 % 30.50 %

Risk-free interest rate (3) 4.7 % 4.3 % 3.9 %

Expected life (in years) (4) 4.2 5.7 6.6

Weighted average

grant date fair value $ 8.46 $ 8.46 $ 6.47

(1) Dividend yield is based on annual dividends paid and the fair market value of the

Company’s stock at the period end date.

(2) Expected volatility is estimated utilizing the Company’s historical volatility over a

period equal to the expected life of each option grant after adjustments for infrequent

events such as stock splits.

(3) The risk-free interest rate was selected based on yields from U.S. Treasury zero-

coupon issues with a remaining term equal to the expected term of the options being

valued.

(4) Expected life represents the number of years that the options are expected to be

outstanding from grant date based on historical data of option holder exercise and

termination behavior.

As of December 30, 2006, unrecognized compensation expense related

to unvested options totaled $66.3 million, which the Company expects

to be recognized over a weighted average period of 1.4 years.

The Company’s 1997 Incentive Compensation Plan (the “ICP”) provides

for the granting of up to 85.8 million shares of common stock in the form

of stock options and other awards to selected officers, employees and

directors of the Company. The ICP allows for up to 7.2 million restricted

shares to be issued. The Company’s restricted awards are considered

nonvested share awards as defined under SFAS 123(R). The restricted

awards require no payment from the employee and compensation cost

is recorded based on the market price on the grant date, for which

compensation expense is recognized on a straight-line basis over the

requisite service period. The Company granted 5,000, 427,000 and

824,000 shares of restricted stock with a weighted average per share

grant date fair value of $28.71, $24.80 and $18.41, in 2006, 2005 and

2004, respectively. In addition, the Company granted 673,000 restricted

stock units with a weighted average fair value of $29.40 in 2006. The

fair value of the restricted shares and units are expensed over the period

during which the restrictions lapse. Compensation costs for restricted

shares and units totaled $9.2 million in 2006, $5.9 million in 2005 and

$2.4 million in 2004.

In 2004, an amendment to the Company’s ICP was approved by

shareholders, allowing non-employee directors to receive awards under

the ICP. Upon approval of this amendment to the ICP, all authority to

make future grants under the Company’s 1996 Directors Stock Plan

was terminated, although previously granted awards remain outstanding

in accordance with their terms and the terms of the 1996 Directors

Stock Plan.

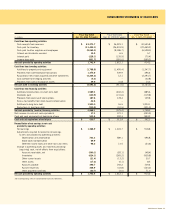

Following is a summary of the restricted share award activity under the

ICP as of December 30, 2006:

Weighted

Average Grant

Shares in thousands Shares Date Fair Value

Nonvested at December 31, 2005 501 $ 20.80

Granted 5 28.71

Vested (197) 18.94

Forfeited (3) 24.71

Nonvested at December 30, 2006 306 $ 22.08

Following is a summary of the restricted unit award activity under the

ICP as of December 30, 2006:

Weighted

Average Grant

Units in thousands Units Date Fair Value

Nonvested at December 31, 2005 1,377 $ 23.10

Granted 673 29.40

Vested (16) 33.80

Forfeited (25) 25.22

Nonvested at December 30, 2006 2,009 $ 25.22