CVS 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 1

Tom Ryan, Chairman, President, and CEO

More good things ACROSS THE BOARD

I’m delighted to report on another year of significant accomplish-

ments for CVS Corporation, highlighted by record revenues and

earnings, substantial free cash flow generation, and continued

organic growth. In June, we acquired 700 standalone Sav-on

and Osco drugstores from Albertson’s, Inc., providing immediate

leadership in southern California, and we have made great

progress in rapidly integrating and converting the stores to the

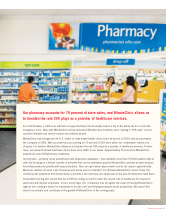

CVS/pharmacy® brand. We also acquired MinuteClinic®

, the

pioneer and largest provider of retail healthcare in the United

States, and have already nearly doubled the number of clinics

as we execute our aggressive rollout across the nation. At year

end, CVS operated 6,202 retail and specialty pharmacy stores,

more than any other U.S. pharmacy retailer.

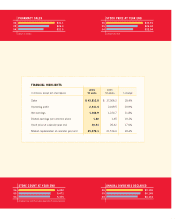

Total sales for 2006 rose 18.4 percent to a record $43.8 billion.

Meanwhile, net earnings per share climbed 10.3 percent to

$1.4 billion, or $1.60 per diluted share. Same store sales

increased 8.2 percent, rising 9.1 percent in the pharmacy and

6.2 percent in the front end. Gross margins also increased,

largely due to significant generic drug introductions, increased

private label penetration in the front of the store, and the use of

our ExtraCare® loyalty program to focus promotional spending.

CVS generated approximately $570 million in free cash flow.

That has allowed us, among other things, to announce a

26 percent dividend increase for 2007. Our 176,000 CVS

colleagues across the country helped us achieve these

excellent results. I want to thank them all for their hard work

in making things “CVS easy” for our customers.

Turning to our stock’s performance, the 17.6 percent total return

on CVS shares in 2006 outpaced that of both the S&P 500 Index

and the Dow Jones Industrial Average (DJIA). Over the past three

years, our shares returned 74 percent, significantly outperforming

the 28 percent and 19 percent returns of the S&P 500 and the

DJIA, respectively.

Successfully integrating our latest acquired stores

Even with all the positive news outlined above, more good

things are on the way in 2007 and beyond. We moved swiftly to

integrate the Sav-on and Osco stores, completing the systems

conversions in September 2006. The remodeling of the stores

will be complete in March 2007. We’ve made these stores

“CVS easy” by reducing shelf heights, resetting merchandise

layouts, installing our hallmark CVS carpet, enhancing the

lighting, and improving the signage.

To Our Shareholders: