CVS 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 45

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

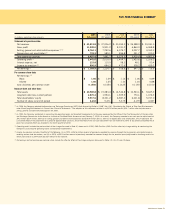

Following is a reconciliation of the benefit obligation, fair value of plan assets and funded status of the Company’s defined benefit and other

postretirement benefit plans as of the respective balance sheet dates:

Defined Benefit Plans Other Postretirement Benefits

In millions Dec. 30, 2006 Dec. 31, 2005 Dec. 30, 2006 Dec. 31, 2005

Change in benefit obligation:

Benefit obligation at beginning of year $ 421.2 $ 352.9 $ 10.7 $ 12.1

Service cost 1.7 0.7 – –

Interest cost 24.0 21.4 0.6 0.6

Actuarial (gain)/loss (8.5) 65.1 0.3 (0.7)

Benefits paid (19.4) (18.9) (1.4) (1.3)

Benefit obligation at end of year $ 419.0 $ 421.2 $ 10.2 $ 10.7

Change in plan assets:

Fair value at beginning of year $ 275.6 $ 255.2 $ – $ –

Actual return on plan assets 37.6 19.2 – –

Company contributions 19.8 20.1 1.5 1.3

Benefits paid (19.4) (18.9) (1.5) (1.3)

Fair value at end of year $ 313.6 $ 275.6 $ – $ –

Funded status:

Funded status $ (105.4) $ (145.6) $ (10.2) $ (10.7)

Unrecognized prior service cost N/A 0.3 N/A (0.3)

Unrecognized loss (gain) N/A 122.6 N/A (0.2)

Net liability recognized $ (105.4) $ (22.7) $ (10.2) $ (11.2)

Amounts recognized in the consolidated balance sheet:

Accrued benefit liability $ (105.4) $ (139.7) $ (10.2) $ (11.2)

Minimum pension liability – 117.0 – –

Net liability recognized $ (105.4) $ (22.7) $ (10.2) $ (11.2)

The changes in the balance sheet at December 30, 2006 arising from

the adoption of SFAS No. 158 are set out below:

Before After

Implementation Changes Implementation

of SFAS Due to SFAS of SFAS

In millions No. 158 No. 158 No. 158

Assets:

Non-current deferred

income taxes $ 87.6 $ 3.2 $ 90.8

Total Asset recognized $ 20,566.6 $ 3.2 $ 20,569.8

Liabilities and

Stockholders’ Equity:

Accrued expenses $ 1,949.9 $ 0.3 $ 1,950.2

Other long-term

liabilities 772.6 8.5 781.1

Accumulated other

comprehensive loss (67.0) (5.6) (72.6)

Total liabilities and

shareholders’ equity $ 20,566.6 $ 3.2 $ 20,569.8

The discount rate is determined by examining the current yields observed

on the measurement date of fixed-interest, high quality investments

expected to be available during the period to maturity of the related

benefits. The expected long-term rate of return is determined by using

the target allocation and historical returns for each asset class.

The Company utilized a measurement date of December 31 to determine

pension and other postretirement benefit measurements. The Company

included $3.5 million of accrued benefit liability in accrued expenses,

while the remaining benefit liability was recorded in other long-term

liabilities, as of December 30, 2006 and December 31, 2005. The

accumulated benefit obligation for the defined benefit pension plans

was $410.4 million and $415.3 million as of December 30, 2006

and December 31, 2005, respectively. The Company does not expect

to make a contribution to the pension plan during the upcoming year.

Estimated future benefit payments for the defined benefit plans and

other postretirement benefit plans, respectively, are $19.4 million

and $1.3 million in 2007, $20.4 million and $1.3 million in 2008,

$21.2 million and $1.2 million in 2009, $22.2 million and $1.2 million

in 2010, $23.0 million and $1.1 million in 2011 and $151.3 million and

$4.7 million in aggregate for the following five years.