CVS 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

22 CVS Corporation

LIQUIDITY & CAPITAL RESOURCES

We anticipate that our cash flow from operations, supplemented by

commercial paper and long-term borrowings, will continue to fund the

future growth of our business.

Net cash provided by operating activities increased to $1.7 billion in 2006.

This compares to $1.6 billion in 2005 and $0.9 billion in 2004. The

increase in net cash provided by operations during 2006 primarily

resulted from an increase in cash receipts from revenues. Fiscal 2005

reflected increased revenues and improved inventory management.

Net cash used in investing activities increased to $4.6 billion in 2006.

This compares to $0.9 billion in 2005 and $3.2 billion in 2004. The

increase in net cash provided by investing activities was primarily due

to the acquisition of the Standalone Drug Business. The decrease in

net cash used in investing activities during 2005 related to a decrease

in acquisitions, as 2004 included the acquisition of the 2004 Acquired

Businesses. Gross capital expenditures totaled $1.8 billion during 2006,

compared to $1.5 billion in 2005 and $1.3 billion in 2004. During

2006, approximately 51% of our total capital expenditures were for

new store construction, 30% for store expansion and improvements

and 19% for technology and other corporate initiatives.

During 2007, we currently plan to invest over $1.7 billion in gross

capital expenditures, which will include spending for approximately

250–275 new or relocated stores.

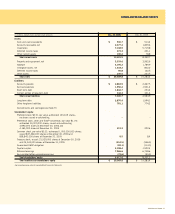

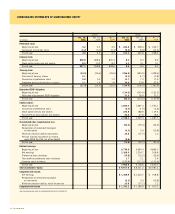

Following is a summary of our store development activity for the

respective years:

2006 2005 2004

Total stores

(beginning of year) 5,471 5,375 4,179

New and acquired stores 848 166 1,397

Closed stores (117) (70) (201)

Total stores (end of year) 6,202 5,471 5,375

Relocated stores (1) 118 131 96

(1) Relocated stores are not included in new or closed store totals.

Net cash provided by financing activities was $2.9 billion in 2006, compared

to net cash used in financing activities of $579.4 million in 2005 and

net cash provided by financing activities of $1.8 billion in 2004. The

increase in net cash provided by financing activities was primarily due

to the financing of the acquisition of the Standalone Drug Business,

including issuance of the Notes (defined below), during the third quarter

of 2006. This increase was offset partially by the repayment of the

$300 million, 5.625% unsecured senior notes, which matured during

the first quarter of 2006. Fiscal 2005 reflected a reduction in short-term

borrowings. During 2006, we paid common stock dividends totaling

$140.9 million, or $0.155 per common share. In January 2007, our

Board of Directors authorized a 26% increase in our annualized common

stock dividend to $0.195 per share for 2007.

We believe that our current cash on hand and cash provided by operations,

together with our ability to obtain additional short-term and long-term

financing, will be sufficient to cover our working capital needs, capital

expenditures, debt service requirements and dividend requirements for

at least the next twelve months and the foreseeable future.

We had $1.8 billion of commercial paper outstanding at a weighted

average interest rate of 5.3% as of December 30, 2006. In connection

with our commercial paper program, we maintain a $675 million, five-year

unsecured back-up credit facility, which expires on June 11, 2009 and

a $675 million five-year unsecured back-up credit facility, which expires

on June 2, 2010. In preparation for the consummation of the acquisition

of the Standalone Drug Business, we entered into a $1.4 billion, five-year

unsecured back-up credit facility, which expires on May 12, 2011. The

credit facilities allow for borrowings at various rates that are dependent

in part on our public debt rating. As of December 30, 2006, we had no

outstanding borrowings against the credit facilities.

On August 15, 2006, we issued $800 million of 5.75% unsecured senior

notes due August 15, 2011 and $700 million of 6.125% unsecured

senior notes due August 15, 2016 (collectively the “Notes”). The Notes

pay interest semi-annually and may be redeemed at any time, in whole

or in part at a defined redemption price plus accrued interest. Net proceeds

from the Notes were used to repay a portion of the outstanding commercial

paper issued to finance the Standalone Drug Business. To manage a

portion of the risk associated with potential changes in market interest

rates, during the second quarter of 2006, we entered into forward

starting pay fixed rate swaps (the “Swaps”), with a notional amount of

$750 million. The Swaps settled in conjunction with the placement of

the long-term financing. As of December 30, 2006, we had no

freestanding derivatives in place.