CVS 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2006 Annual Report 23

In anticipation of the execution of the accelerated share repurchase

upon consummation of the proposed merger with Caremark, we expect

to enter into a $1.25 billion, five-year unsecured back-up credit facility,

in addition to a facility which will act as a bridge facility, with a value

of $5.0 billion. The bridge facility is expected to terminate upon the

placement of longer-term financing.

Our credit facilities and unsecured senior notes contain customary

restrictive financial and operating covenants. These covenants do not

include a requirement for the acceleration of our debt maturities in

the event of a downgrade in our credit rating. We do not believe that the

restrictions contained in these covenants materially affect our financial

or operating flexibility.

Our liquidity is based, in part, on maintaining investment-grade debt

ratings. As of December 30, 2006, our long-term debt was rated “Baa2”

by Moody’s and “BBB+” by Standard & Poor’s, and our commercial paper

program was rated “P-2” by Moody’s and “A-2” by Standard & Poor’s,

each on positive outlook. On February 13, 2007, Moody’s placed our

long-term debt and commercial paper program on stable outlook, while

Standard and Poor’s changed its outlook to developing. In assessing our

credit strength, we believe that both Moody’s and Standard & Poor’s

considered, among other things, our capital structure and financial policies

as well as our consolidated balance sheet, our acquisition of the Standalone

Drug Business, the entry into a definitive merger agreement with Caremark

and other financial information. Although we currently believe our long-term

debt ratings will remain investment grade, we cannot guarantee the

future actions of Moody’s and Standard & Poor’s. Our debt ratings have

a direct impact on our future borrowing costs, access to capital markets

and new store operating lease costs.

OFF-BALANCE SHEET ARRANGEMENTS

In connection with executing operating leases, we provide a guarantee

of the lease payments. We finance a portion of our new store development

through sale-leaseback transactions, which involve selling stores to

unrelated parties and then leasing the stores back under leases that

qualify and are accounted for as operating leases. We do not have any

retained or contingent interests in the stores, nor do we provide any

guarantees, other than a guarantee of the lease payments, in connection

with the transactions. In accordance with generally accepted accounting

principles, our operating leases are not reflected in our consolidated

balance sheet.

Between 1991 and 1997, we sold or spun off a number of subsidiaries,

including Bob’s Stores, Linens ‘n Things, Marshalls, Kay-Bee Toys, Wilsons,

This End Up and Footstar. In many cases, when a former subsidiary leased

a store, we provided a guarantee of the store’s lease obligations. When

the subsidiaries were disposed of, the guarantees remained in place,

although each initial purchaser agreed to indemnify us for any lease

obligations we were required to satisfy. If any of the purchasers were to

become insolvent and failed to make the required payments under a

store lease, we could be required to satisfy these obligations. Assuming

that each respective purchaser became insolvent, and we were required

to assume all of these lease obligations, we estimate that we could settle

the obligations for approximately $350 to $400 million as of December 30,

2006. As of December 30, 2006, we guaranteed approximately 240

such store leases, with the maximum remaining lease term extending

through 2022.

We currently believe that the ultimate disposition of any of the lease

guarantees will not have a material adverse effect on our consolidated

financial condition, results of operations or future cash flows.

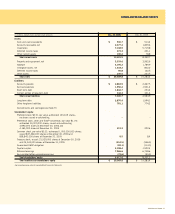

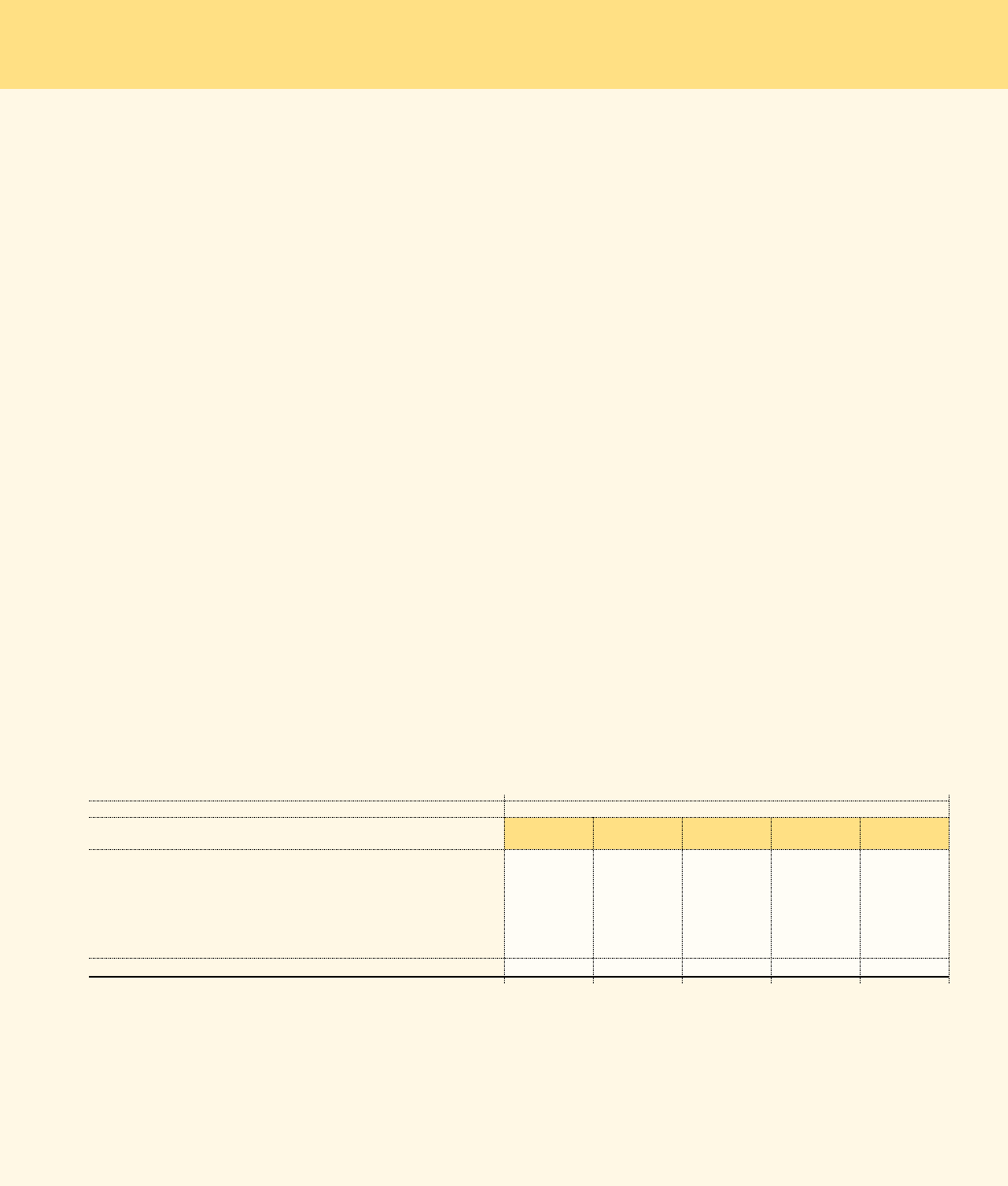

Following is a summary of our significant contractual obligations as of December 30, 2006:

Payments Due by Period

Within 1–3 3–5 After 5

In millions Total 1 Year Years Years Years

Operating leases $ 19,875.0 $ 1,445.7 $ 2,740.5 $ 2,674.0 $ 13,014.8

Long-term debt 3,093.8 342.1 696.6 802.7 1,252.4

Purchase obligations 0.4 0.4 – – –

Other long-term liabilities reflected

in our consolidated balance sheet 381.6 55.3 236.1 43.2 47.0

Capital lease obligations 120.9 2.3 5.4 6.8 106.4

$ 23,471.7 $ 1,845.8 $ 3,678.6 $ 3,526.7 $ 14,420.6