CVS 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 35

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

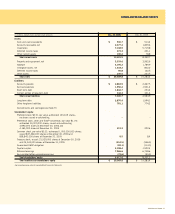

Property and Equipment

Property, equipment and improvements to leased premises are depreciated

using the straight-line method over the estimated useful lives of the assets,

or when applicable, the term of the lease, whichever is shorter. Estimated

useful lives generally range from 10 to 40 years for buildings, building

improvements and leasehold improvements and 5 to 10 years for fixtures

and equipment. Repair and maintenance costs are charged directly to

expense as incurred. Major renewals or replacements that substantially

extend the useful life of an asset are capitalized and depreciated.

Following are the components of property and equipment included in

the consolidated balance sheets as of the respective balance sheet dates:

Dec. 30, Dec. 31,

In millions 2006 2005

Land $ 601.3 $ 322.4

Building and improvements 801.9 631.0

Fixtures and equipment 4,347.4 3,484.1

Leasehold improvements 1,828.5 1,496.7

Capitalized software 219.1 198.6

Capital leases 229.3 1.3

8,027.5 6,134.1

Accumulated depreciation

and amortization (2,693.9) (2,181.5)

$ 5,333.6 $ 3,952.6

The Company capitalizes application development stage costs for significant

internally developed software projects. These costs are amortized over a

five-year period. Unamortized costs were $75.5 million as of December 30,

2006 and $84.3 million as of December 31, 2005.

Impairment of Long-Lived Assets

The Company accounts for the impairment of long-lived assets in accordance

with SFAS No. 144, “Accounting for Impairment or Disposal of Long-Lived

Assets.” As such, the Company groups and evaluates fixed and finite-lived

intangible assets excluding goodwill, for impairment at the individual store

level, which is the lowest level at which individual cash flows can be

identified. When evaluating assets for potential impairment, the Company

first compares the carrying amount of the asset group to the individual

store’s estimated future cash flows (undiscounted and without interest

charges). If the estimated future cash flows used in this analysis are less

than the carrying amount of the asset group, an impairment loss calculation

is prepared. The impairment loss calculation compares the carrying

amount of the asset group to the individual store’s estimated fair value

based on estimated future cash flows (discounted and with interest

charges). If the carrying amount exceeds the individual store’s estimated

future cash flows (discounted and with interest charges), the loss is

allocated to the long-lived assets of the group on a pro rata basis using

the relative carrying amounts of those assets.

Revenue Recognition

For all sales other than third party pharmacy sales, the Company

recognizes revenue from the sale of merchandise at the point of sale.

For third party pharmacy sales, revenue is recognized at the time the

prescription is filled, which is or approximates when the customer picks

up the prescription. Customer returns are immaterial. Service revenue

from the Company’s pharmacy benefit management segment, which is

recognized using the net method under Emerging Issues Task Force (“EITF”)

Issue No. 99-19, “Reporting Revenue Gross as a Principal Versus Net

as an Agent,” is recognized at the time the service is provided. Service

revenue totaled $194.5 million in 2006, $201.8 million in 2005 and

$129.3 million in 2004.

Premium revenue from the Company’s pharmacy benefit management

segment is accounted for under SFAS No. 113, “Accounting and

Reporting for Reinsurance of Short-Duration and Long-Duration Contracts,”

and is recognized over the period of the contract in proportion to the

amount of insurance coverage provided. Premiums collected in advance

are deferred. Premium revenue totaled $380.1 million in 2006 and

$91.6 million in 2005. There was no premium revenue in 2004.

Insurance

The Company is self-insured for certain losses related to general liability,

workers’ compensation and automobile liability. The Company obtains

third party insurance coverage to limit exposure from these claims. The

Company is also self-insured for certain losses related to health and

medical liabilities.

The Company’s self-insurance accruals, which include reported claims

and claims incurred but not reported, are calculated using standard

insurance industry actuarial assumptions and the Company’s historical

claims experience. During 2005, PharmaCare entered into certain risk-

based or reinsurance arrangements in connection with providing pharmacy

plan management services. Policies and contract claims include actual

claims reported but not paid and estimates of healthcare services

incurred but not reported. The estimated claims incurred but not

reported are calculated using standard insurance industry actuarial

assumptions based on historical data, current enrollment, health service

utilization statistics and other related information and are provided by

third party actuaries.

Vendor Allowances

The Company accounts for vendor allowances under the guidance provided

by EITF Issue No. 02-16, “Accounting by a Customer (Including a Reseller)

for Certain Consideration Received from a Vendor,” and EITF Issue

No. 03-10, “Application of EITF Issue No. 02-16 by Resellers to Sales

Incentives Offered to Consumers by Manufacturers.” Vendor allowances

reduce the carrying cost of inventory unless they are specifically identified

as a reimbursement for promotional programs and/or other services