CVS 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report 43

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

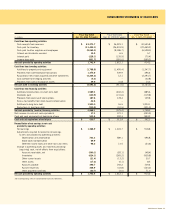

Following is a summary of the Company’s stock option activity as of December 30, 2006:

Weighted

Average

Weighted Remaining

Average Contractual Aggregate

Shares in thousands Shares Exercise Price Term Intrinsic Value

Outstanding at December 31, 2005 43,617 $ 18.82 – $ –

Granted 7,449 31.00 – –

Exercised (8,342) 16.69 – –

Forfeited (623) 21.55 – –

Expired (484) 21.68 – –

Outstanding at December 30, 2006 41,617 21.35 4.72 410,957,209

Exercisable at December 30, 2006 26,773 $ 19.57 4.16 $ 308,035,407

Following is a summary of the stock options outstanding and exercisable as of December 30, 2006:

Shares in thousands Options Outstanding Options Exercisable

Weighted Weighted Weighted

Number Average Average Number Average

Range of Exercise Prices Outstanding Remaining Life Exercise Price Exercisable Exercise Price

$ 11.50 to $ 14.96 12,644 5.49 $ 13.70 10,239 $ 13.96

14.97 to 18.66 8,378 3.02 17.50 6,707 17.47

18.67 to 25.00 7,598 4.17 22.21 4,073 22.04

25.01 to 30.26 11,047 5.17 30.14 5,753 30.25

30.27 to 33.95 49 7.51 32.34 – –

33.96 to 34.41 1,901 6.59 34.41 1 34.41

Total 41,617 4.72 $ 21.35 26,773 $ 19.57

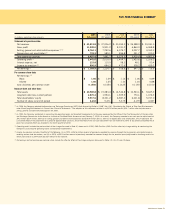

PENSION PLANS AND

8 OTHER POSTRETIREMENT BENEFITS

During 2006, the Company adopted SFAS No. 158, “Employer’s

Accounting for Defined Benefit Pension and Other Postretirement Plans –

an amendment of FASB Statements No. 87, 88, 106, and 132(R).”

SFAS No. 158 requires an employer to recognize in its statement of

financial position an asset for a plan’s overfunded status or a liability for

a plan’s underfunded status, measure a plan’s assets and its obligations

that determine its funded status as of the end of the employer’s fiscal

year, and recognize changes in the funded status of a defined benefit

postretirement plan in the year in which the changes occur. Those

changes will be reported in comprehensive income and in a separate

component of stockholder’s equity.

Defined Contribution Plans

The Company sponsors a voluntary 401(k) Savings Plan that covers

substantially all employees who meet plan eligibility requirements. The

Company makes matching contributions consistent with the provisions

of the plan. At the participant’s option, account balances, including the

Company’s matching contribution, can be moved without restriction

among various investment options, including the Company’s common

stock. The Company also maintains a nonqualified, unfunded Deferred

Compensation Plan for certain key employees. This plan provides

participants the opportunity to defer portions of their compensation and

receive matching contributions that they would have otherwise received

under the 401(k) Savings Plan if not for certain restrictions and limitations

under the Internal Revenue Code. The Company’s contributions under

the above defined contribution plans totaled $63.7 million in 2006,

$64.9 million in 2005 and $52.1 million in 2004. The Company also

sponsors an Employee Stock Ownership Plan. See Note 6 for further

information about this plan.

Other Postretirement Benefits

The Company provides postretirement healthcare and life insurance

benefits to certain retirees who meet eligibility requirements. The

Company’s funding policy is generally to pay covered expenses as they

are incurred. For retiree medical plan accounting, the Company reviews

external data and its own historical trends for healthcare costs to

determine the healthcare cost trend rates.

For measurement purposes, future healthcare costs are assumed to

increase at an annual rate of 10.0%, decreasing to an annual growth

rate of 5.0% in 2012 and thereafter. A one percent change in the

assumed healthcare cost trend rate would change the accumulated

postretirement benefit obligation by $0.6 million and the total service

and interest costs by $0.03 million.