Blackberry 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

ResearchInMotionLimited|IncorporatedUndertheLawsofOntario(UnitedStatesdollars,inthousandsexceptpersharedataorasotherwiseindicated)

51

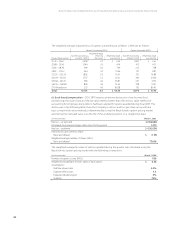

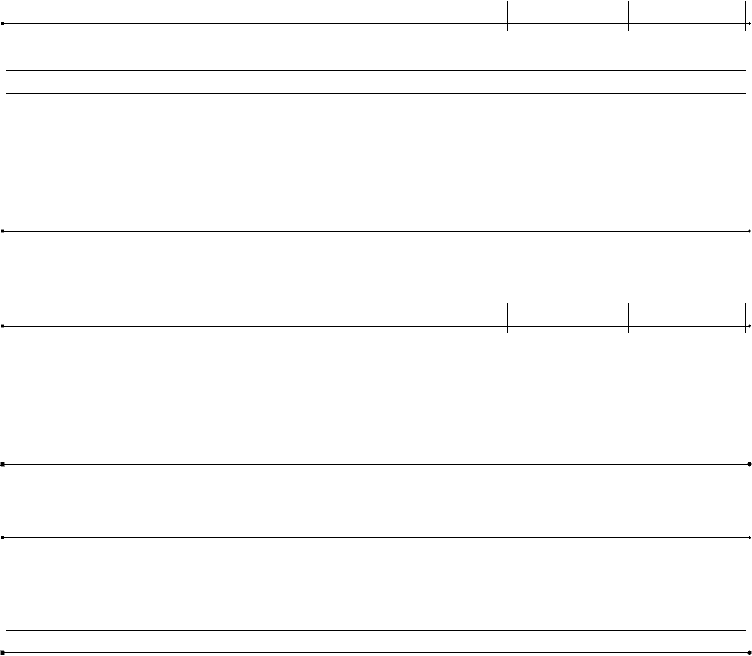

FortheyearsendedMarch1,2003,March2,2002andFebruary28,2001

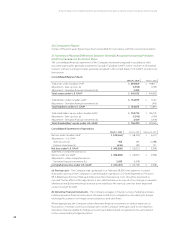

SFASNo.123,AccountingforStock-BasedCompensation,requiresproformadisclosuresofnetincomeand

earningspershare,asifthefairvaluebasedmethodasopposedtotheintrinsicvaluebasedmethod

ofaccountingforemployeestockoptionshadbeenapplied.Thedisclosuresinthefollowingtable

showthecompany’snetincomeandearningspershareonaproformabasisusingthefairvalue

methodasdeterminedbyusingtheBlack-Scholesoptionpricingmodelinclude:

Fortheyearended March1,2003 March2,2002 February28,2001

NetlossunderU.S.GAAP $(148,858) $ (28,321) $ (7,568)

Estimatedstock-basedcompensationcosts 20,296 19,773 11,115

NetlossunderU.S.GAAP $ (169,154) $ (48,094) $ (18,683)

Proformanetlosspercommonshare

Basic $ (2.18) $ (0.61) $ (0.25)

Diluted $ (2.18) $ (0.61) $ (0.25)

Weightedaveragenumberofshares(000’s)

Basic 77,636 78,467 73,555

Diluted 77,636 78,467 73,555

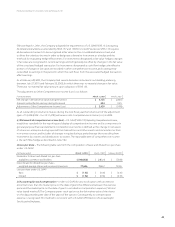

Theweightedaveragefairvalueofoptionsgrantedduringthefollowingperiodswerecalculatedas

followsusingtheBlack-Scholesoptionpricingmodelwiththefollowingassumptions:

Fortheyearended March1,2003 March2,2002 February28,2001

WeightedaverageBlack-Scholesvalueofoptions $ 8.58 $ 12.00 $ 34.82

Assumptions:

Riskfreeinterestrates 4.5% 4% 4%

Expectedlifeinyears 3.5 3.5 3.5

Expecteddividendyield 0% 0% 0%

Volatility 70% 75% 100%

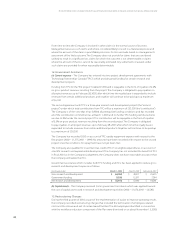

(f)ProductWarranty–ThechangeintheCompany’saccruedwarrantyobligationsfromMarch2,2002

toMarch1,2003wasasfollows:

AccruedwarrantyobligationsatMarch2,2002 $ 3,355

Actualwarrantyexperienceduring2003 (577)

2003warrantyprovision 5,465

Adjustmentforchangesinestimate (3,073)

AccruedwarrantyobligationsatMarch1,2003 $ 5,170

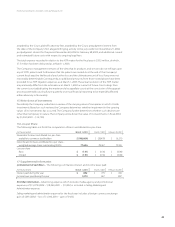

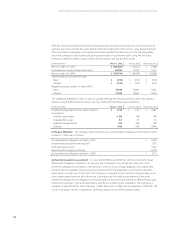

(g)Recentlyissuedpronouncements–InJune2001,FASBissuedSFASNo.143,“AccountingforAsset

RetirementObligations.”SFASNo.143requirestheCompanytorecordthefairvalueofanasset

retirementobligationasaliabilityintheperiodinwhichitincursalegalobligationassociatedwith

theretirementoftangiblelong-livedassetsthatresultfromtheacquisition,construction,develop-

mentand/ornormaluseoftheassets.TheCompanyisrequiredtoalsorecordacorrespondingasset

thatisdepreciatedoverthelifeoftheasset.Subsequenttotheinitialmeasurementoftheasset

retirementobligation,theobligationwillbeadjustedattheendofeachperiodtoreectthepassage

oftimeandchangesintheestimatedfuturecashowsunderlyingtheobligation.TheCompanyis

requiredtoadoptSFASNo.143onJanuary1,2003.TherewasnoeffectontheadoptionofSFASNo.143

ontheCompany’sresultsofoperationsandnancialpositionfor2003andprioryears.